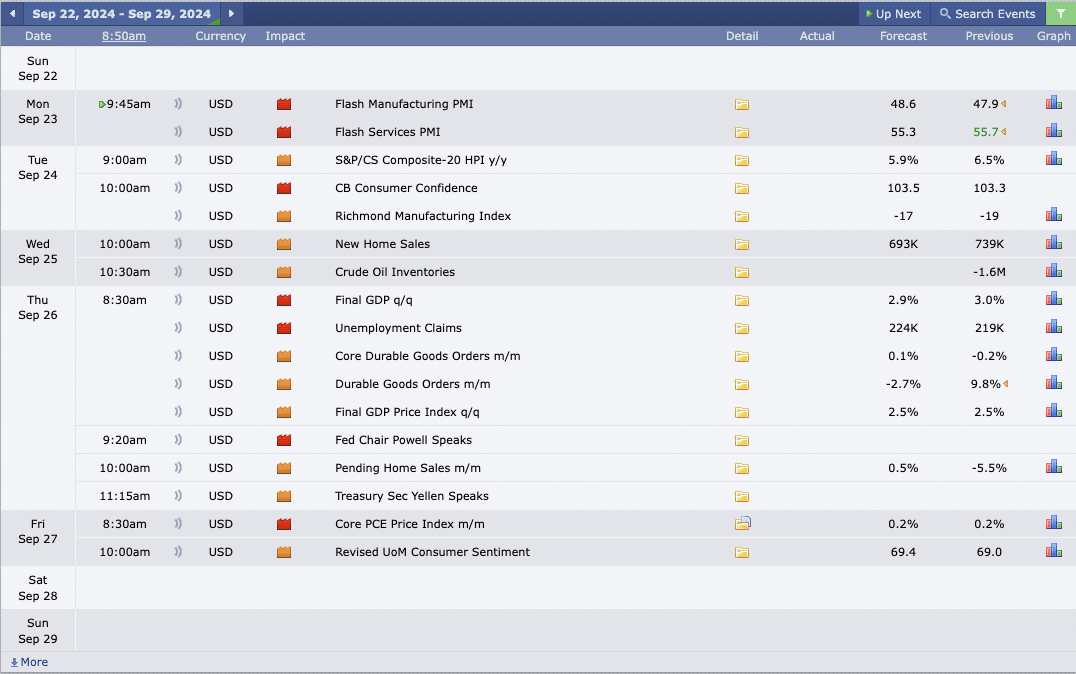

This Week’s Economic Calendar

The Federal Reserve’s decision to cut interest rates by 50bps for the first time in four years is expected to bring significant relief and signal an end to inflation concerns, driving the economy back to the preferred 2% inflation target. Lower interest rates—particularly on the 5, 10, and 30-year interest rates triads —translate into a weaker US dollar in the near term. With premium levels still resisting price and institutional order flow confirming this outlook, we remain bearish, anticipating a fast repricing toward discount targets. This bias holds until a significant break in structure is observed within institutional order flow.

Looking ahead, the upcoming week brings key data releases, with the final GDP q/q and unemployment claims, scheduled for Thursday at 8:30 AM, being the highlight. While market ranges remain open, we expect significant price swings, the priority remains effective risk management as we continue navigating market oportunities moving forward.

Please note that this is not financial advice.*

Monday:

Given that it’s the first day of the trading week after a weekend, the last week of the month, and a Monday, it’s crucial to exercise patience and manage expectations. Red-folder news drivers at 9:45 AM are expected to inject volatility, providing price runs to algorithmic reference points at this time. The recommendation is to wait for the opening range and then focus on identifying the most probable higher time-frame draw on liquidity during the 10:00 AM silver bullet.

Tuesday:

Medium and red folder news drivers are scheduled for 9 AM and 10 AM, respectively, coinciding with the Silver Bullet hour. This is expected to inject volatility into the markets, presenting optimal trading opportunities. Traders are advised to focus on the 10 AM Silver Bullet and the PM session for higher probability trade.

Wednesday:

Expect heightened market volatility between 10:00 AM and 10:30 AM due to the impact of medium-impact scheduled news drivers. Anticipate optimal trading opportunities throughout the day, especially in the crude oil market, spanning both the AM and PM sessions.

Thursday:

The release of red and medium-folder news drivers is expected to impact the market throughout the AM session, starting as early as 8:30 AM and transitioning into the Silver Bullet distribution hour, which will likely inject further volatility. However, it’s important to note that Fed Chair Powell will be speaking at 9:20 AM, potentially causing consolidations leading up to his speech. During his address, increased volatility and erratic whipsaws may occur. Traders are advised to manage their expectations and optimize trading opportunities by either focusing on the 7-8 AM Silver Bullet or the PM session instead.

Friday:

Red and medium-impact news drivers are scheduled for 8:30 AM and 10 AM, respectively, coinciding with the Silver Bullet distribution hour. If you haven’t met your weekly profit objectives, shift your focus to identifying the most probable higher time frame draw on liquidity during the 10 AM Silver Bullet window or the PM session, should a suitable setup present itself.

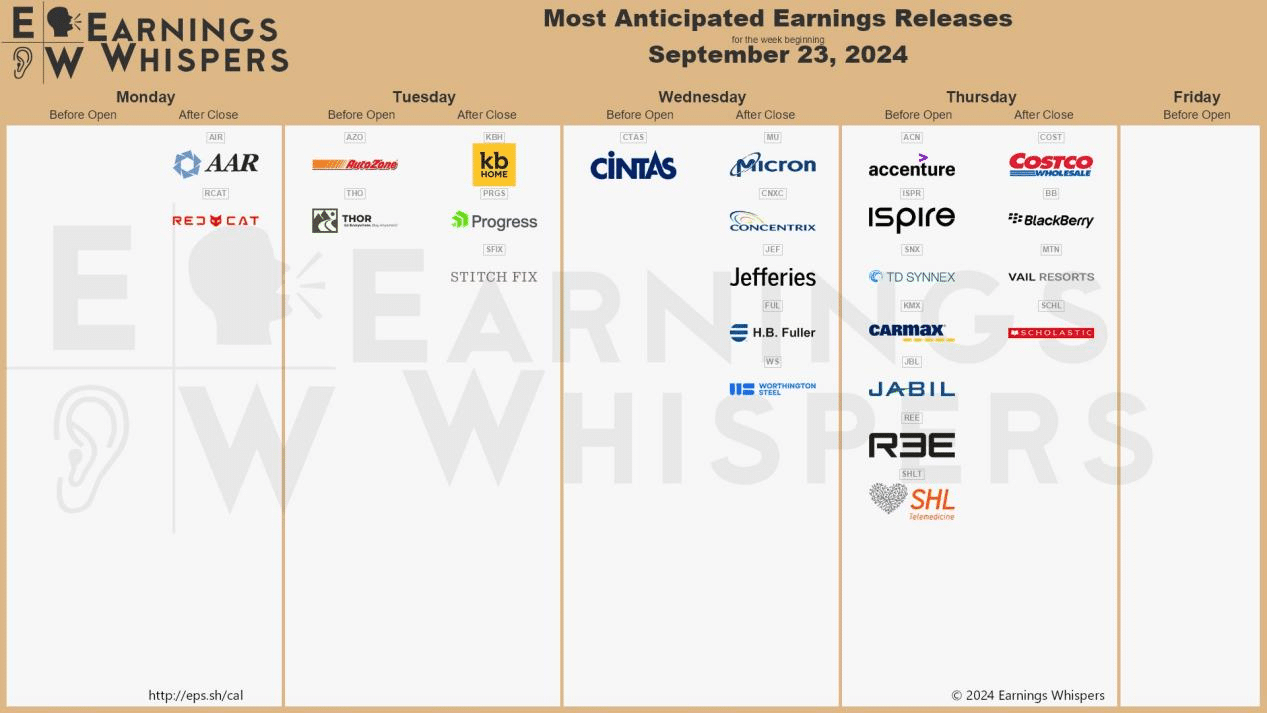

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week will be dominated by earnings reports from major large-cap institutions, including KB Home, Cintas Corp, Micron Technologies Inc., CarMax, and Costco. Traders should brace for heightened volatility and potential consolidation leading up to these announcements.

The Cot Report For The US Dollar

The US dollar once again closed heavily at 100.73, delivering into key targets below 100 with speed, as anticipated. This marks yet another bearish weekly close in a series of successive down-close candles, aligning with both fundamental and technical analysis.

The latest Commitments of Traders (COT) report reveals a notable shift in commercial hedging activities. Previously dominant short positions are now transitioning into long hedges. Friday’s data confirms that commercial entities, including institutions and hedgers, have started accumulating long positions as we transition into the remainder of September and October. This shift indicates early signs of smart money accumulation.

What does this signify for us as traders? The commercials, whose activities we closely monitor, have begun to hedge long positions. This shift, shown by increased open interest, suggests they anticipate a bullish U.S. dollar in the near term. While this is a valuable insight for long-term macro analysis, we will continue to monitor technical analysis and institutional order flow on the lower time frames to validate or negate this data.The U.S. dollar remains bearish until until the prevailing price action indicates otherwise, confirmed by a break of structure.

Although we avoid calling a bottom, it’s essential to pay attention to discount targets moving forward. New lows created could constitute a potential smart money reversal in line with this data.

Seasonal Tendencies

The US Dollar

As discussed in previous editions of this newsletter, seasonal tendencies suggest a steep decline in the early weeks of the month of September, followed by a sharp recovery that creates an intermediate-term low to close the month. If institutional order flow remains bullish, this could extend through to the end of the year. Early signs of this are already surfacing, as both the COT data and interest rate trends are showing initial strength, confirming this outlook.

Fundamentally, a rally is also expected leading into the U.S. presidential election, supported by historical data from past election years. While the fundamentals are pointing towards a stronger U.S. dollar, the prevailing institutional order flow and higher time frame bias remain intact until technicals confirm this data. As mentioned earlier, expect big ranges—they are coming!

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team