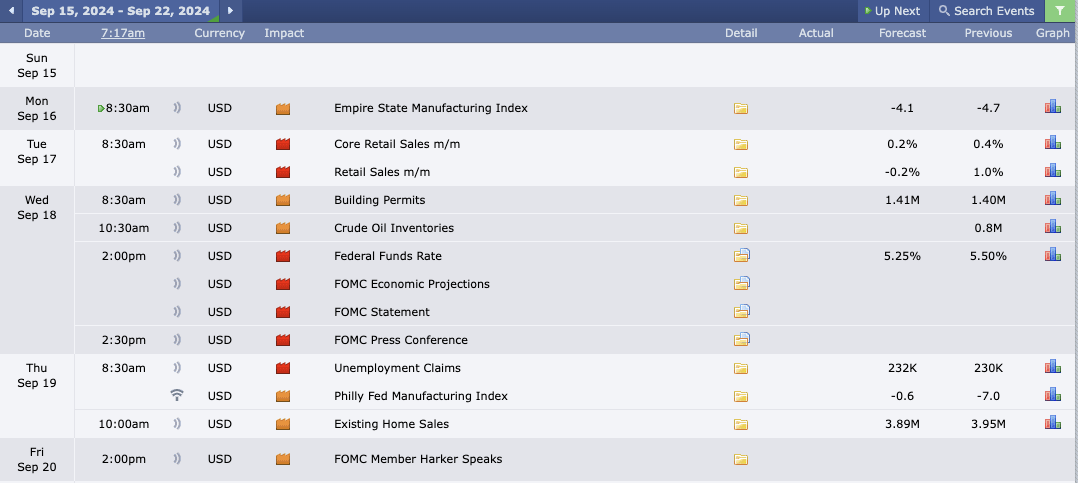

This Week’s Economic Calendar

With US inflation currently at 2.5% and expected to fall even further, we could anticipate lower interest rates, as seen by the weakening 5- and 10-year short-term interest rates in recent weeks. This shift translates into the dollar, with premium levels resisting price, accelerating us towards discount targets. This confirms the correlation between technicals and fundamentals.

As smart money sells buy stops at a premium on higher timeframes, the focus remains on sell models. A sell program will continue until there’s a significant break in structure within institutional order flow, maintaining a bearish outlook for the near term.

Looking ahead, the upcoming week brings key data releases, with the FOMC rate decision and press conference at 2 PM on Wednesday being the highlight. While market ranges remain open,where can expect significant swings, the focus should always remain on managing risk effectively as we navigate forward.

Please note that this is not financial advice.*

Monday:

Given that it’s the first day following a large range weekly candle on the indices, characterized by a significant repricing into premium targets, and considering it’s a Monday, patience and managed expectations are key. Medium-folder news driver at 8:30 AM is expected to inject volatility into the market, offering price runs to algorithmic reference points at this time. The recommended approach is to wait for the opening range and then focus on identifying the most probable higher timeframe draw on liquidity during the 10:00 AM Silver Bullet window.

Tuesday:

Red folder drivers are expected to hit the markets at 8:30 AM, injecting volatility. As a result, today is expected to present optimal trading opportunities. Focus on identifying the most probable higher timeframe draw on liquidity post-news release or, alternatively, wait for the 10 AM Silver Bullet window to frame low risk,high probability setups.

Wednesday:

Red and medium-folder news drivers are expected to flood the market in the AM session, starting as early as 8:30AM. These news events will likely serve as volatility injections into the markets. However, it’s important to note that the FOMC rates and press conference are scheduled for later in the day, likely leading to consolidation leading up to this event. During the event, there may be periods of heightened volatility and whipsaws in the market.

Traders, especially those with less experience, should manage expectations carefully. The recommended focus should be on the 7-8 AM Silver Bullet window, or, for those experienced enough to handle increased volatility, consider setups post-2:30 PM after the FOMC event.

Thursday:

Red and medium-folder news drivers are expected to flood the market throughout the AM session, starting as early as 8:30 AM and transitioning into the Silver Bullet distribution hour. Traders should anticipate volatility injections that could facilitate smoother trades and present high-probability, low-resistance trading conditions. To optimize trading opportunities, focus on the 7-8 AM Silver Bullet, the 10 AM Silver Bullet, or the PM session.

Friday:

No volatility injections are anticipated in the AM session between 8:30 and 10 AM, given the lack of significant news drivers until the PM session, when a Fed speaker is scheduled. If you haven’t met your weekly profit objectives yet, shift your focus to identifying the most probable higher timeframe draw on liquidity during the 10 AM Silver Bullet window or in the PM session, provided a high-probability setup can be justified. Stay patient and disciplined.

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week will focus on key earnings reports from large-cap institutions such as FedEx, RH, FactSet, and General Mills. Traders should prepare for increased volatility and possible consolidation ahead of these release.

The Cot Report For The US Dollar

The US dollar closed heavily at 101.11, providing room for indices to rally into premium targets with ease. This marks another bearish down-close weekly candle, with fundamentals remaining heavy at this time of year, supported by seasonal tendencies and confirmed by technical analysis. The downside targets 100.12 & 99.00 are still expected to be delivered in the near future.

The latest COT report shows that commercials continue to hold more short positions than longs, indicating their expectations of further downside prices for the dollar. Friday’s data reaffirmed this sentiment, with no significant shifts in positioning. Both technicals and fundamentals are pointing in the same direction—lower. This reinforces the bearish outlook as the week closes with evident signs of weakness.

What does this signify for us as traders? The commercials remain relatively bearish on the US dollar, maintaining this stance for another week. Leading macro indicators 5,10, and 30-year interest rates, are also bearish, repricing below their discount targets in previous weeks. This fundamentally signals continued market weakness, with further discount targets expected. In my view, the US dollar remains firmly bearish heading into the new week until we observe a significant break in structure.

Seasonal Tendencies

The US Dollar

Seasonal tendencies continue to anticipate a steep decline in the US dollar during the early weeks of September. This is particularly significant as the 3 averages—5, 15, and 30-year seasonal tendencies—align, reinforcing the expectation for lower prices. With August behind us, large funds are more inclined to take on new risk heading into the final quarter, creating new liquidty to be capitalized on. This predictable cycle gives us precision, indicating the potential for massive repricing, with economic catalysts(NEWS DRIVERS) driving these price runs.

As we’ve anticipated in previous newsletters, further declines are expected, with potential for larger, more volatile moves. This provides an opportunity for traders to capitalize on clear, low-risk, high-probability runs into targets, once confirmed by technical analysis in the new week.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team