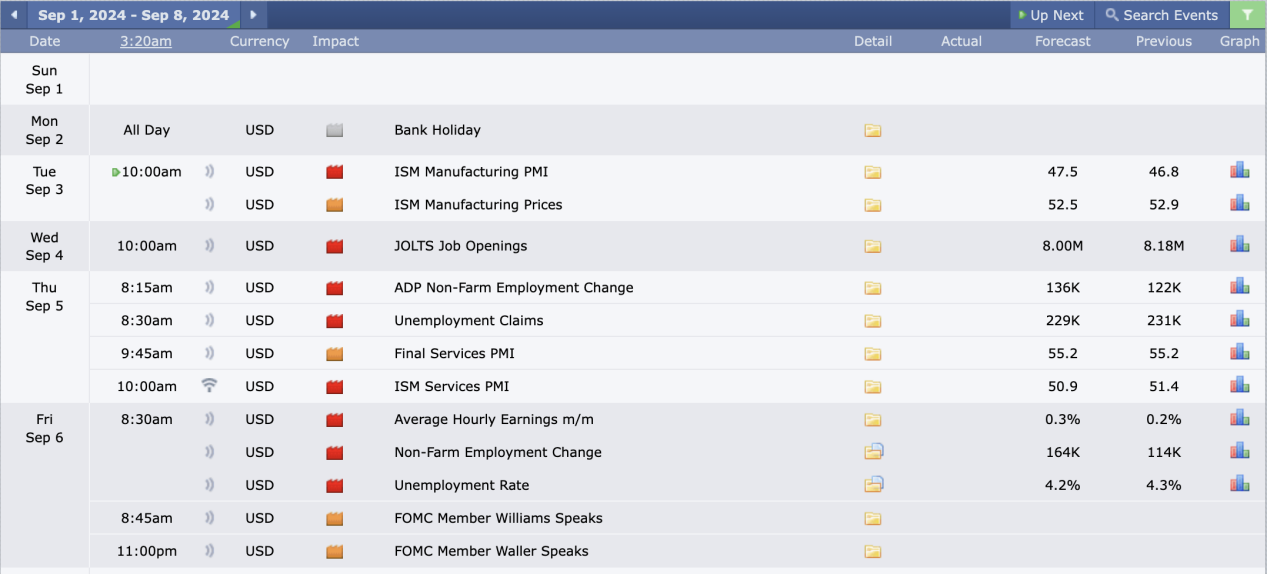

This Week’s Economic Calendar

The indices have been bullish as seen in the price action with bullish weekly candles over the past weeks, repricing into premium targets and delivering within the context of low resistance, high probability price runs. This delivery has effectively re-balanced inefficiencies and targeted liquidity pools of fund-level traders. With seasonal tendencies indicating a strong month for the NASDAQ, this serves as a gentle reminder of the reliance on buy models in a buy program until a significant break in structure is observed.

As we enter the new week, key reports will come into focus, with the Non-Farm Payroll (NFP) announcement on Friday being particularly significant. The emphasis remains on meticulous trading and tight risk management to navigate the evolving markets effectively.

Please note that this is not financial advice.*

Monday:

Bank holiday – Low volatility, avoid trading.

Tuesday:

The AM session following a bank holiday can be challenging, often characterized by potential consolidations and high resistance runs into liquidity and inefficiencies. Given that it’s the first trading day of the NFP (Non-Farm Payrolls) week and the start of a new month following a bank holiday, it’s crucial to exercise patience and manage expectations.

This day presents medium and red folder news drivers at 10 AM, coinciding with the silver bullet hour. Traders are advised to approach the day as a typical Monday, waiting for the opening range before focusing on identifying the most probable higher time frame draw on liquidity during the 10-11 am Silver bullet hour and the PM Session.

Wednesday:

Volatility injections are anticipated in the AM session at 10 AM, coinciding with the Silver Bullet distribution hour, facilitated by a red folder news driver expected to inject volatility. This will likely provide price runs to algorithmic reference points at this time, presenting optimal trading opportunities. Traders are advised to focus on the 10 AM Silver Bullet and conclude their trading day by 12 noon, staying ahead and protecting capital against volatile repricings and price swings in anticipation of the NFP numbers on Friday.

Thursday:

Red and medium-folder news drivers are expected to flood the market throughout the AM session, starting as early as 8:30 AM and transitioning into the Silver Bullet distribution hour. Highlighted as the day before the Non-Farm Payrolls (NFP) report, we can expect price to deliver within the context of high resistance and low probability trading conditions. Traders are advised to exercise caution and recognize that it’s a lower probability trading day, particularly if they lack experience.

Friday:

Marked by the anticipation of the Non-Farm Payrolls (NFP) numbers, there is an expectation of heightened volatility in the markets following the release of this high-impact news, potentially offering optimal trading opportunities. However, it’s important to note that trading ahead of such high-impact news is not recommended due to increased uncertainty and risk. Instead, traders are advised to wait and observe the liquidity and inefficiencies that unfold after the news release. For higher probability setups, consideration can be given to trading during the 10-11 AM Silver Bullet and the PM session.

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week will center around earnings reports, with several large-cap institutions scheduled to release theirs. Specifically, DocuSign, Dick’s Sporting Goods, Dollar Tree, Casey’s, Copart, and Broadcom are in focus. Traders should anticipate volatility and potential consolidation in the lead-up to these reports.

The Cot Report For The US Dollar

The just-concluded week was characterized by an upward repricing, closing the weekly candle bullish at 101.72. Given the protracted expansion over the last few weeks, a short term retracement back into the range after delivering into key targets is reasonable. This retracement offers smart money the opportunity to accumulate new positions inside a premium, setting the stage for the next price leg in the market delivery.

Analyzing the COT report, particularly focusing on commercials engaged in hedging activities, reveals that commercials continue to hold more short positions than longs. This positioning confirms their anticipation of lower prices for the US dollar in the near future, as indicated by the latest data releases on Friday, with no significant changes observed. This creates a discrepancy between the technicals and fundamentals, highlighting a potential smart money accumulation that traders should pay attention to moving forward.

What does this signify for us as traders? The commercials we track in the Commitment of Traders report still maintain a net short hedging position, despite order flow on the technicals suggesting otherwise, with a bullish close on the just-concluded week. This discrepancy serves as an early indication of potential smart money accumulation. If we are to remain bearish, as the commercials have made their position known, this should also be confirmed on the technical charts, with premium PD arrays resisting price moving forward. We will continue to rely on institutional order flow and price action until the correlation between fundamentals and technicals returns.

Seasonal Tendencies

The US Dollar

We bid August farewell and welcome September, driving us closer to the U.S. presidential elections amidst rising tensions among global powers and an impending recession in view, with the Federal Reserve stepping in to implement policies aimed at containing the obvious threat to the economy ahead. This chaos, in turn, translates into the markets by strategically feeding on the fear, excitement, and uncertainty of uninformed money, with smart money capitalizing on the liquidity of the losing counterparty.

The seasonal tendencies of September forecast a large dump on the U.S. dollar, characterized by a massive repricing toward discount targets expected to deliver into longer-term objectives. If confirmed by the technical charts, this could translate to likely directional long-term price runs as we expand out of the 99-107 weekly range, producing low-risk, high-probability setups and potential swing trading opportunities.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team