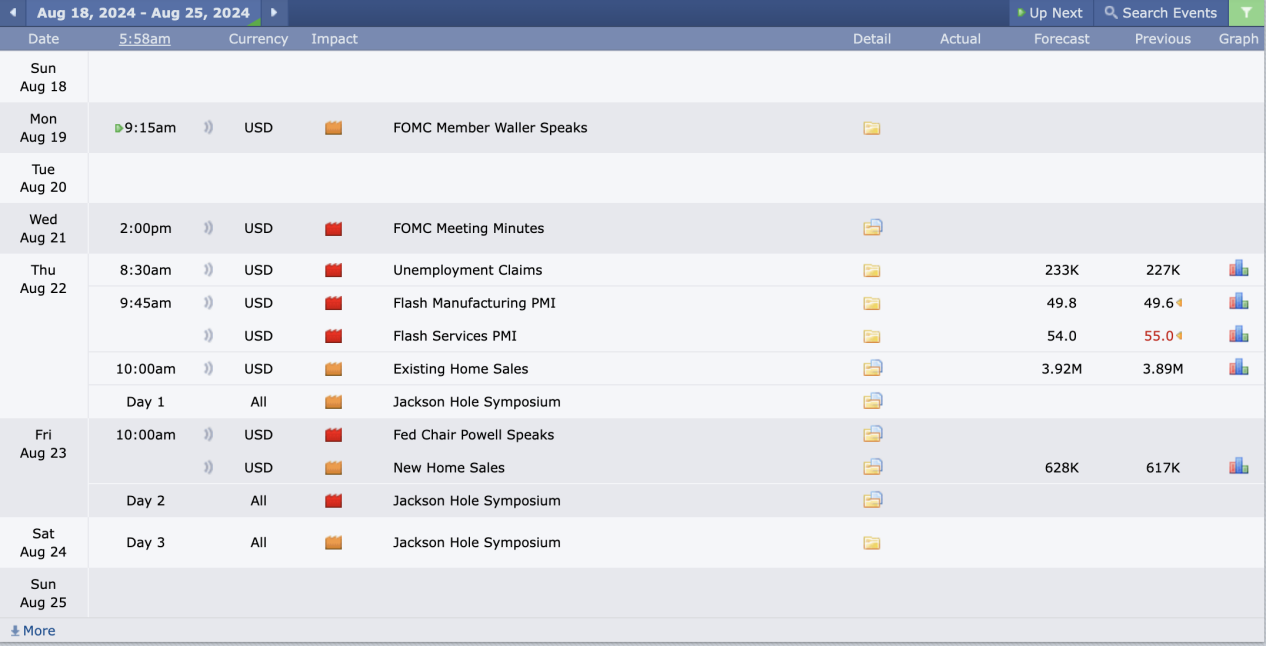

This Week’s Economic Calendar

Given the recent volatility and open ranges facilitating fast repricing into targets, the just-concluded week closed bullish, marked by yet another consecutive upclose weekly candle following a reversal from the daily rejection block in a discount of the dealing range, particularly on the NASDAQ and S&P. This serves as a continuous reminder to focus on buy models in a buy program until a significant break in structure is observed moving forward.

Seasonality continues to indicate a bearish month for the U.S. dollar, with upward repricing expected in the early part of August, followed by a steep decline for the remainder of the month. This outlook is supported by prevailing institutional order flow and heavy interest rate triads. We’ll continue to trust institutional order flow on the technical charts to confirm or negate this data and expectation, adjusting and refining our approach as necessary.

The new week brings important reports, with Fed Chair Powell speaking on Friday, taking the spotlight. This emphasizes the need for meticulous trading and tight risk management.

Please note that this is not financial advice.*

Monday:

Today brings significant medium-impact news drivers, following Friday’s expansion on the US dollar, which was confirmed across all major assets. The FOMC member’s speech at 9:15 AM is expected to inject volatility into the markets. We expect consolidation leading up to his speech, followed by potential volatility and erratic price swings during his speech making taking on any risk extremely low probability. Traders are advised to manage their expectations carefully and shift their focus to the PM session for Higher probability opportunities.

Tuesday:

This day lacks any significant news drivers expected to inject volatility into the marketplace. As traders, we rely on these volatility injections for smoother trades, making it crucial to exercise patience and manage expectations. The recommendation is to wait for the 9:30 AM opening, then focus on identifying the most probable higher timeframe draw on liquidity around the 10 AM silver bullet.

Wednesday:

Today brings forth the FOMC Meeting Minutes release at 2:00 PM, which is expected to inject volatility into the marketplace. While these minutes are generally less impactful than the main FOMC decisions, traders are advised to prioritize the last hour of trading for higher probability opportunities.

Thursday:

Red and medium-folder news drivers are expected to flood the market throughout the AM session, starting as early as 8:30 AM and continuing into the Silver Bullet distribution hour. Traders should anticipate volatility injections that could facilitate smoother trades and present high-probability low resistance trading conditions. To optimize trading opportunities, focus on the 7-8 AM ‘Silver Bullet,’ the 10 AM ‘Silver Bullet,’ or the PM session.

Friday:

Fed Chair Powell speaks at 10 AM, coinciding with the Silver Bullet hour. Be aware that his speech could lead to consolidation leading up to the event. During the speech, expect increased excitement, volatility, and erratic whipsaws. If your weekly profit objectives haven’t been met, traders are advised to manage their expectations carefully and consider focusing on the PM session instead.

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week is centered around earnings reports, with several large-cap institutions set to release theirs. Notably, Medtronic, SQM, Target, Zoom, TJX, TD Bank, Ross Stores, Analog Devices, and Intuit are in focus. Traders should expect volatility and potential consolidation in the lead-up to these reports.

The Cot Report For The US Dollar

The previous week for the US dollar saw a swift repricing from the 103.7 premium, effectively delivering into discount targets. This aligns with our objectives as the data, seasonality,Technical analysis and interest rate triads all continue to indicate and support a weaker US dollar. The week closed heavily bearish at 102.42.

Analyzing the COT report, especially focusing on commercials engaged in hedging activities, reveals that commercials continue to hold more short positions than longs. This stance confirms their anticipation of lower prices for the US dollar in the near future, consistent with the series of bearish closing weeks we’ve observed in continuous succession.

What does this signify for us as traders? The US dollar remains heavily bearish, and the focus is on discount targets of 102.17, 102.10, and 101.78 going into the new week. Given the ongoing monthly and weekly consolidation ranges, these levels will be critical if the dollar continues its decline. The overall outlook remains firmly bearish.

Seasonal Tendencies

The US Dollar

As we move into the third week of August, contrary to existing data in seasonal tendencies, the US dollar hasn’t remained range-bound for the month. Instead of the expected delivery into intermediate-term targets and immediately reverting to the range consolidating, we’ve witnessed an expansion into discount targets. This reaffirms the dynamic and unique market environment we are trading in this year—one that is proving to be different, marked by heightened volatility and open ranges.

Fundamentals will continue to play a crucial role in price delivery, serving as a rationale for deep pockets and central banks to strategically inject liquidity, taking advantage of the current volatility rapidly repricing into set targets.

The US dollar remains bearish in my analysis, supported by both technicals and fundamentals. As we move into the new week, I anticipate a delivery below 101.89, while also managing expectations for intermediate-term targets. This view holds until we see evidence to the contrary, especially considering the tight weekly range of 99.5-107.38 that we are currently trading within.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team