This Week’s Economic Calendar

August began on a volatile note with a rapid repricing seen across all assets, using the NFP and FOMC as catalysts to move the markets significantly by the market makers. World events and global economic fears could translate into the markets, where a month expected to be silent and uneventful could see some excitement and volatile swings in price delivery this particular year.

The US dollar remains weak, confirmed by both technical and fundamental factors. Most importantly, interest rates, a critical macro indicator, remain relatively weak, confirming the dollar’s weakness. Given the higher timeframe consolidation range, expectations remain managed until we leave that particular range we are currently trading in.

The new week brings forth light reports, with unemployment claims on Thursday taking the spotlight. While this is a relatively light week regarding news drivers, the emphasis remains on the need for meticulous trading and tight risk management.

Please note that this is not financial advice.*

Monday:

Given that it’s the first day post-NFP (Non-Farm Payrolls) Friday, combined with the start of a new month and a Monday, it’s crucial to exercise patience and manage expectations. Red and medium-folder news drivers at 9:45 and 10:00 AM are expected to inject volatility. The recommendation is to wait for the opening range and then focus on identifying the most probable higher time-frame draw on liquidity around the 10:00 AM silver bullet.

Tuesday:

This is a day with no significant news drivers present. We continue to follow the protocols outlined on Monday, which involve waiting for the opening range and then directing our attention to identifying the most probable higher time frame draw on liquidity in the 10 AM Silver Bullet and PM Session for higher probability trades.

Wednesday:

This day introduces a medium-folder news driver in the PM session, with no news driver in the AM session, making for a relatively easy trading session. Prioritize the 10 AM, 2 PM Silver Bullet distribution hour, or the last hour of trading for higher probability trades.

Thursday:

Expect heightened market volatility between 8:30 AM and 1:01 PM due to the influence of scheduled red and medium-folder news drivers. Anticipate optimal trading opportunities throughout the day, encompassing both the AM and PM sessions.

Friday:

Relatively light week in terms of news drivers expected to inject volatility into the marketplace. With no news drivers scheduled for the day, if your weekly profit objectives have not been met, it’s advisable to redirect your focus toward identifying the most probable higher timeframe draw on liquidity post-9:30 equities opening into the 10 AM Silver Bullet hour and the PM session.

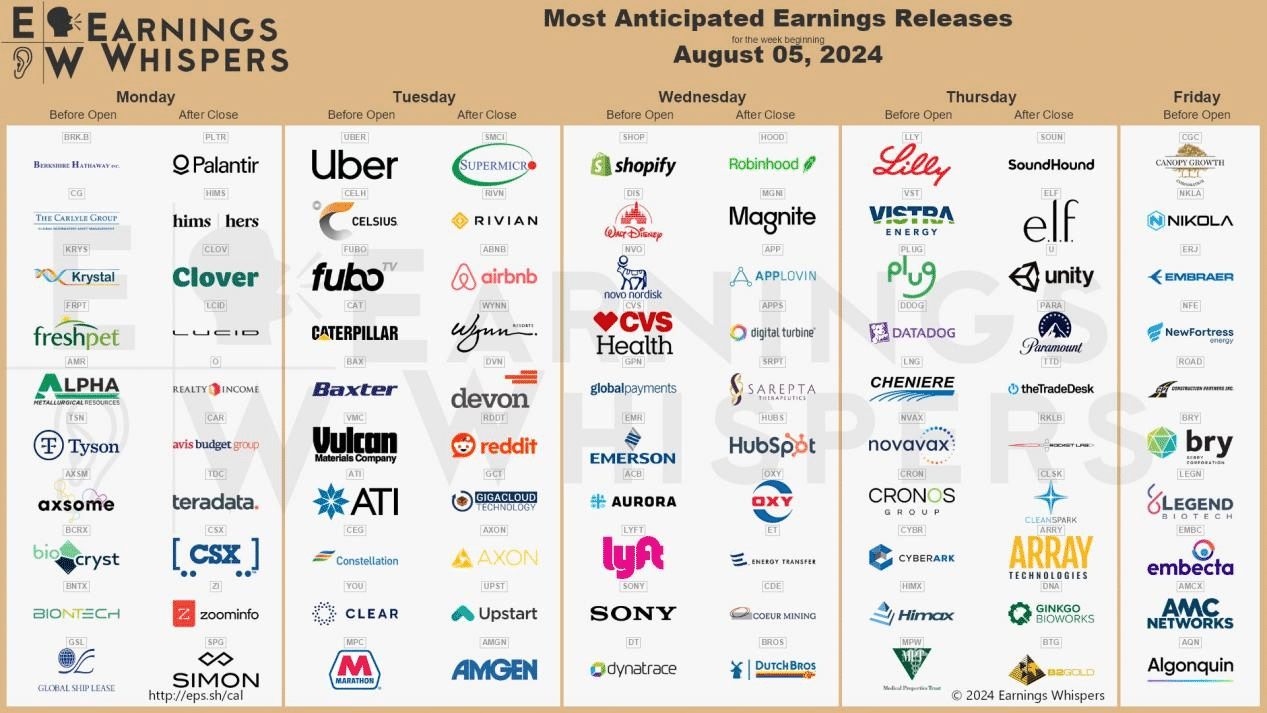

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports, with several large-cap institutions scheduled to release theirs. Specifically, Uber, Airbnb, Reddit, Sony, Shopify, Walt Disney, Global Payments, Embraer, Nikola, and AMC Networks are in focus this week. Traders should expect volatility and potential consolidation in the lead-up to these reports.

The Cot Report For The US Dollar

The previous week was characterized by a swift repricing from the premium 104.6 levels we were monitoring and expecting a reaction from, into discount targets, breaking out of the ranges the US dollar has been in and achieving downside targets below 103.1. The week closed at 103.22 on a strong bearish note. Continued weakness in the interest rate triads of the US bonds will place a strain on the US dollar, where we can expect further repricing to the downside towards 102.68 and 102.32 moving forward.

Analysis of the COT report, focusing on commercials engaged in hedging activities, reveals that commercials continue to hold more short positions than longs. This confirms their anticipation of lower prices for the US dollar in the near future, as seen in the delivery of price in the previous week.

What does this signify for us as traders? The data from the fundamentals have been confirmed by the technicals, creating a beautiful 1-1 correlation. The US dollar remains weak all around, coupled with a recession inbound and pressure from interest rates and expensive bond prices. This makes the market currently not enticing for large institutions to invest in. The US dollar remains bearish going into the new week, with discount targets below 102.68 expected to be delivered. Managed expectations remain emphasized as we are still in a higher timeframe range, which should be taken into account.

Seasonal Tendencies

The US Dollar

Seasonal tendencies for the U.S. dollar highlight the likelihood of a consolidation, range-bound market in August, characterized by an initial protraction higher followed by a massive slump at institutional reference points, and then a rally to close out the month. This can be attributed to the fact that August is a summer month when central banks and institutions with deep pockets are less willing to take on new risks.

However, given the global events and the imminent presidential election, August may be a rather different month in terms of volatility this year compared to previous years. The tight weekly range of 99.5-107.38 continues to emphasize one course of action: managing expectations and looking for delivery into intermediate-term price targets moving forward until proven otherwise.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wiseley

Happy Trading!

Adora Trading Team