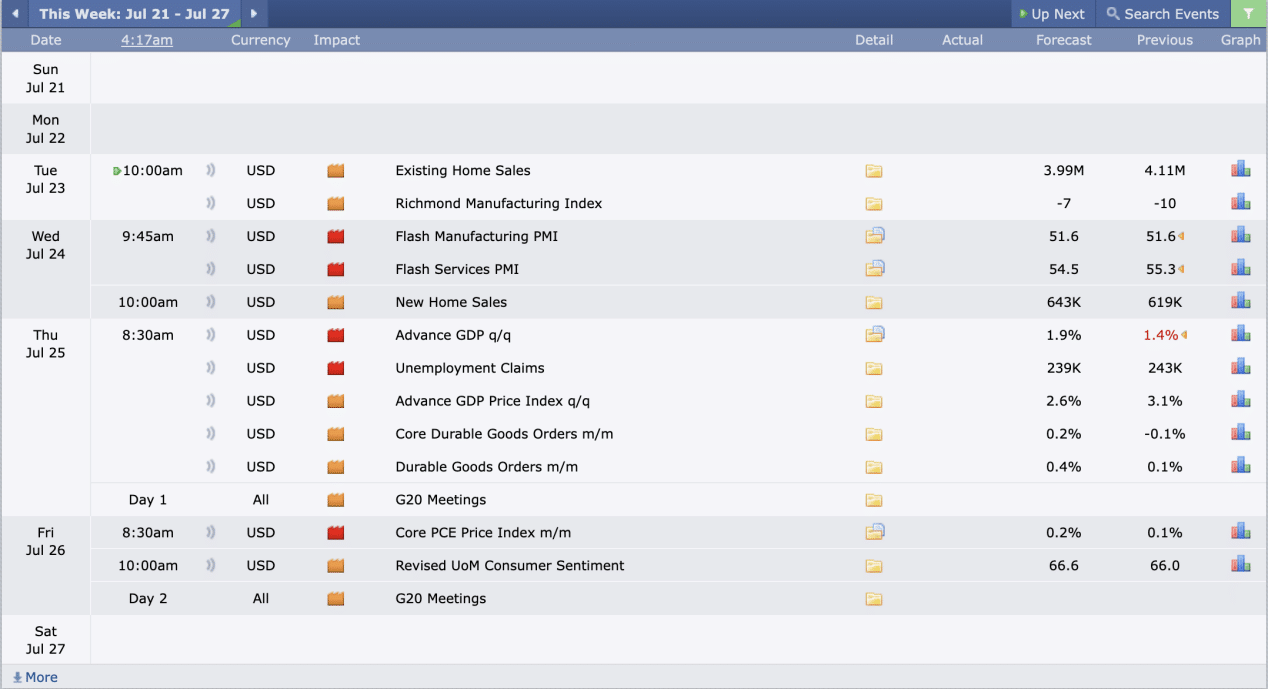

This Week’s Economic Calendar

For Index Futures the previous week was characterized by a bearish weekly candle, which repriced into discount targets, rebalancing inefficiencies and targeting liquidity pools of fund level traders by smart money. Although seasonal tendencies indicate a bullish solid month for the Nasdaq, we will continue to monitor the current institutional order flow and market structure across the indices to confirm if this is the much-awaited market structure break going into the new week.

The new week brings forth light reports, with unemployment claims on Thursday taking the spotlight. While this is a relatively light week regarding news drivers, the emphasis remains on the need for meticulous trading and tight risk management.

Please note that this is not financial advice.*

Monday:

Today, there are no significant news drivers following Friday’s expansion of the indices into their discount targets. Given that it’s Monday, exercising patience and managing expectations is crucial. The recommendation is to wait for the 9:30 opening and then focus on identifying the most probable higher timeframe draw on liquidity around the 10 AM silver bullet.

Tuesday:

Medium folder drivers are scheduled for 10 AM, coinciding with the silver bullet hour. This is expected to inject volatility into the markets, presenting optimal trading opportunities. Traders should focus on the 10 AM silver bullet distribution hour and the PM session for higher probability trades.

Wednesday:

Expect heightened market volatility between 9:45 AM and 10:00 AM due to the influence of multiple scheduled news drivers. Anticipate optimal trading opportunities throughout the day, encompassing the AM and PM sessions.

Thursday:

With red and medium folder news expected to flood the market at 8:30 AM, traders should anticipate volatility injections that could facilitate smoother trades. Traders are encouraged to identify the most probable higher time frame draw on liquidity post-news release or alternatively await the 10 AM Silver Bullet for low-risk, higher probability trades.

Friday:

Red and medium-tier news drivers are scheduled for 8:30 and 10 AM respectively, coinciding with the Silver Bullet hour. If your weekly profit objectives haven’t been met, redirect your focus to identifying the most probable higher time frame draw on liquidity during the 10 AM Silver Bullet window, or in the PM session if you find your setup.

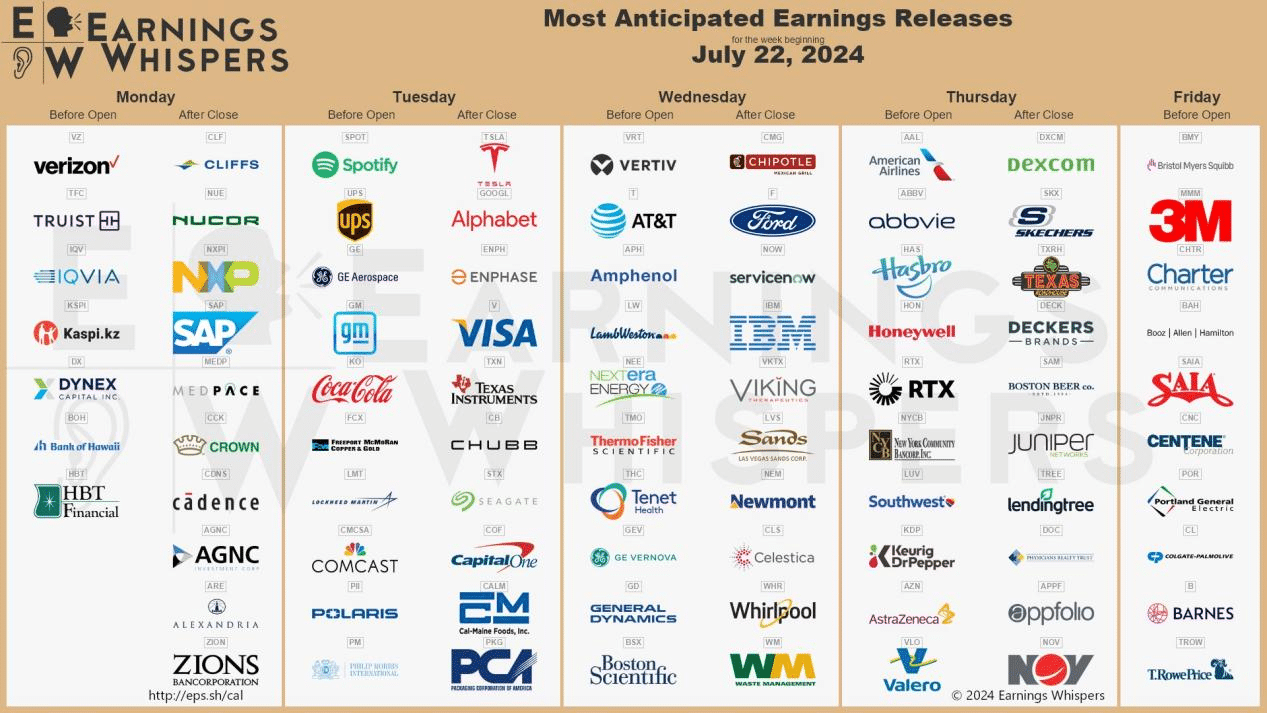

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports, with several large-cap institutions scheduled to release theirs. Specifically, Spotify, Tesla, Alphabet, Coca-Cola, IBM, AT&T, Visa, UPS, and 3M are in focus this week. Traders should expect volatility and potential consolidation in the lead-up to these reports.

The Cot Report For The US Dollar

The previous week for the US Dollar was characterized by a repricing into 104, 103.89, and 103.7, as anticipated, followed by an expansion into 104.365, closing out the week. Seasonal tendencies and the Commitments of Traders (COT) report continue to expect lower prices for the Dollar Index in the long term. How we trade at premium targets of 104.60 will either confirm or negate this data.

Analysis of the COT report, focusing on commercials engaged in hedging activities, reveals that commercials continue to hold more short positions than longs. This confirms their anticipation of lower prices for the US Dollar in the near future from a fundamental standpoint.

What does this signify for us as traders? As we enter the new week, the US dollar remains bearish, as confirmed by fundamental factors. However, this outlook is subject to institutional order flow and market structure. We will be watching if premium PD arrays continue to resist price, followed by acceleration into discount targets or if we see a transition to bullish orderflow on the daily chart. This week will be used to gather further Intel based on these factors.

Seasonal Tendencies

The US Dollar

Seasonal tendencies for the U.S. dollar highlight the likelihood of rapid repricing into discount targets for July at key higher timeframe institutional reference points. This has been observed with the U.S. dollar through consecutive bearish closes on the weekly candle in recent weeks. We will monitor how we trade at premium levels moving forward, looking to see if there is a rejection followed by a repricing into discount targets. With us still being in consolidation on the weekly timeframe, technical analysis will continue to be heavily relied on for precise calling of targets as we will not be seeing directional long-term price runs until we expand out of the 99.5-107.38 current range likely waiting the U.S. Elections. The action plan for now is to rely on intermediate term price targets within the current range we are trading in.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wiseley

Happy Trading!

Adora Trading Team