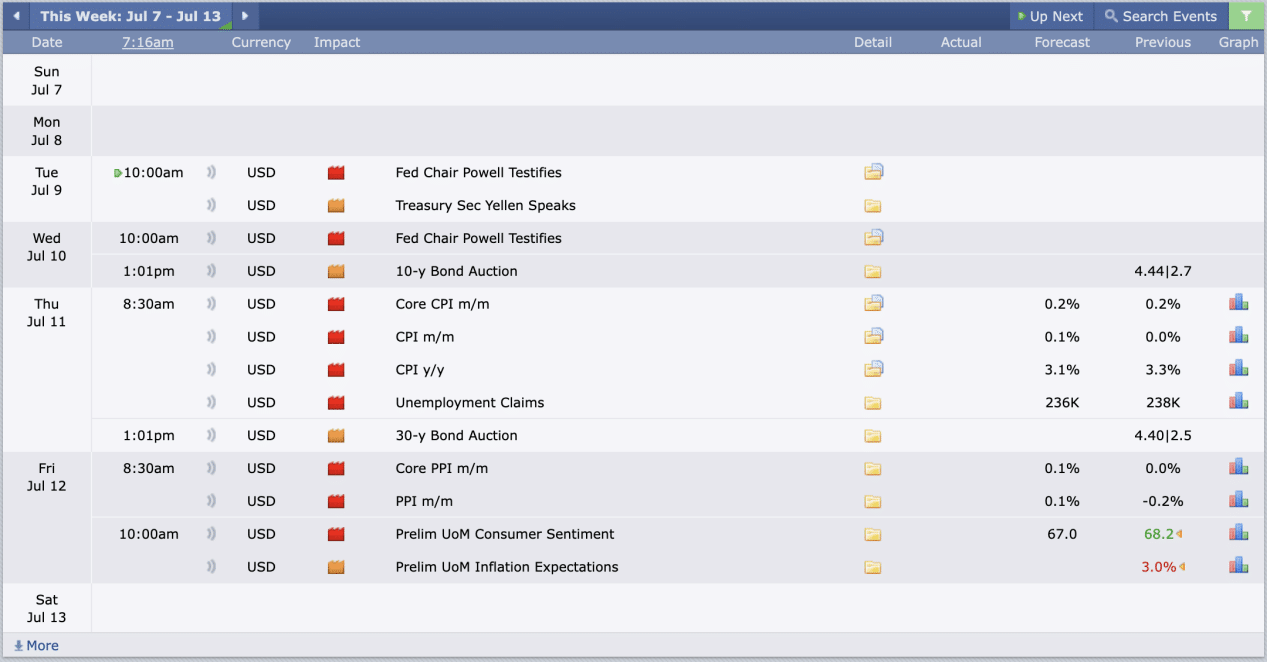

This Week’s Economic Calendar

The just-concluded week was characterized by an expansion out of consolidation ranges, seeing a change in the state of delivery, resulting in new all-time highs on the indexes, particularly the NASDAQ and S&P. These indexes closed the weekly candle bullish for yet another week in succession. This serves as a continuous reminder to focus on buy models at all-time highs until a significant break in structure is observed.

Seasonality indicates a bearish month for the U.S. dollar, with upward repricing expected in the early part of July, followed by a steep decline for the remainder of the month. This outlook is confirmed by prevailing institutional order flow and interest rate triads. We will continue to trust institutional order flow on the technical charts to confirm or negate this data and expectation moving forward, adjusting and refining as necessary.

The new week brings forth important reports, with the CPI numbers release on Thursday taking the spotlight, emphasizing the need for meticulous trading and tight risk management.

Please note that this is not financial advice.*

Monday:

Today, there are no significant news drivers following Friday’s expansion of the indexes into new all-time highs. Given that it’s Monday, exercising patience and managing expectations is crucial. The recommendation is to wait for the 9:30 opening and then focus on identifying the most probable higher timeframe draw on liquidity around the 10 AM silver bullet.

Tuesday:

Fed Chair Powell will be speaking at 10 AM, coinciding with the silver bullet distribution hour. This is likely to lead to consolidations up to his speech. During his address, there may be periods of volatility and whipsaws in the market. Traders are advised to manage their expectations carefully on this day and focus on the 7-8 AM kill zone or the PM session for higher probability setups.

Wednesday:

Highlighted as a day before the CPI release,where we typically experience high resistance runs and lower probability setups. Additionally, with Fed Chair Powell testifying, another layer of caution is required due to the risk of volatile repricing and manual intervention using his speech as a catalyst. It is important to note that if traders choose to participate on this day ahead of the CPI, they should only engage if they have the experience to navigate the this day professionally.

Thursday:

This day brings the anticipation of CPI numbers. Following the news release, we expect a surge in market volatility, potentially offering favorable trading opportunities. While we typically avoid trading before high-impact news events, we can assess liquidity and inefficiencies afterward, which present themselves as a draw. Consider focusing on the 10-11 AM Silver Bullet or the PM session for higher probability trades.

Friday:

Today, we have multiple red and medium folder news drivers being introduced at 8:30 and 10 AM consecutively. If your weekly profit objectives haven’t been met, redirect your focus to identifying the most probable higher time frame draw on liquidity during the 10 AM Silver Bullet and the PM session. This strategic approach will help in navigating the day’s volatility and capitalizing on high-probability setups.

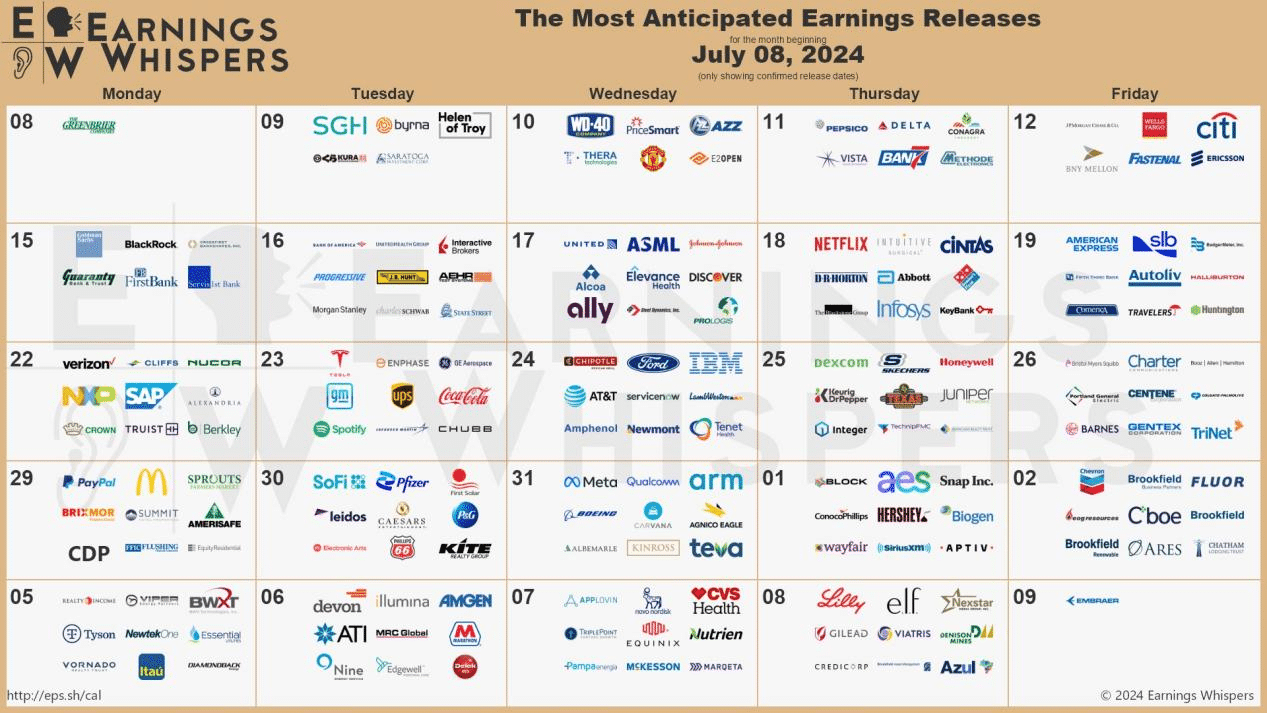

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders, anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports, with several large-cap institutions scheduled to release theirs. Specifically, Delta, Wells fargo, JP Morgan Chase and Citibank are in focus this week. Traders should expect volatility and potential consolidation in the lead-up to these reports.

The Cot Report For The US Dollar

Update will be provided on Monday, since the COT report was not published last Friday as we were observing a bank holiday the previous day.

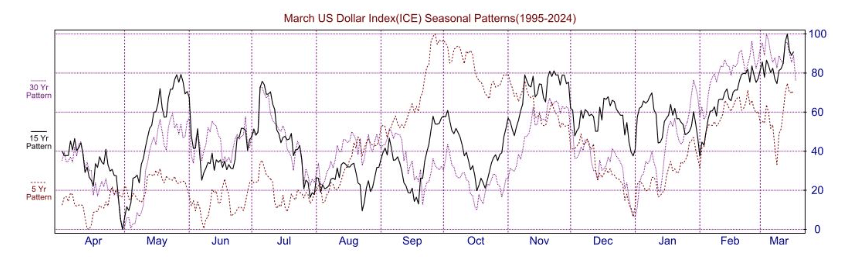

Seasonal Tendencies

Seasonal tendencies refer to the recurring patterns observed in market prices or movements at certain times of the year. These patterns are based on historical data and can provide insights into the potential behavior of prices or market conditions, offering future long-term macro projections.

The US Dollar

Seasonal tendencies for the U.S. dollar indicate a rapid repricing into discount targets following a sharp rally in July at a key higher timeframe institutional reference point. This was observed with the U.S. dollar closing the previous weekly candle bearish. Going into the new week, institutional order flow will either confirm or negate this particular data. As we trade at higher timeframe key PD arrays, more clarity will be provided moving forward. The data suggests a bearish month for the U.S. dollar.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wiseley

Happy Trading!

Adora Trading Team