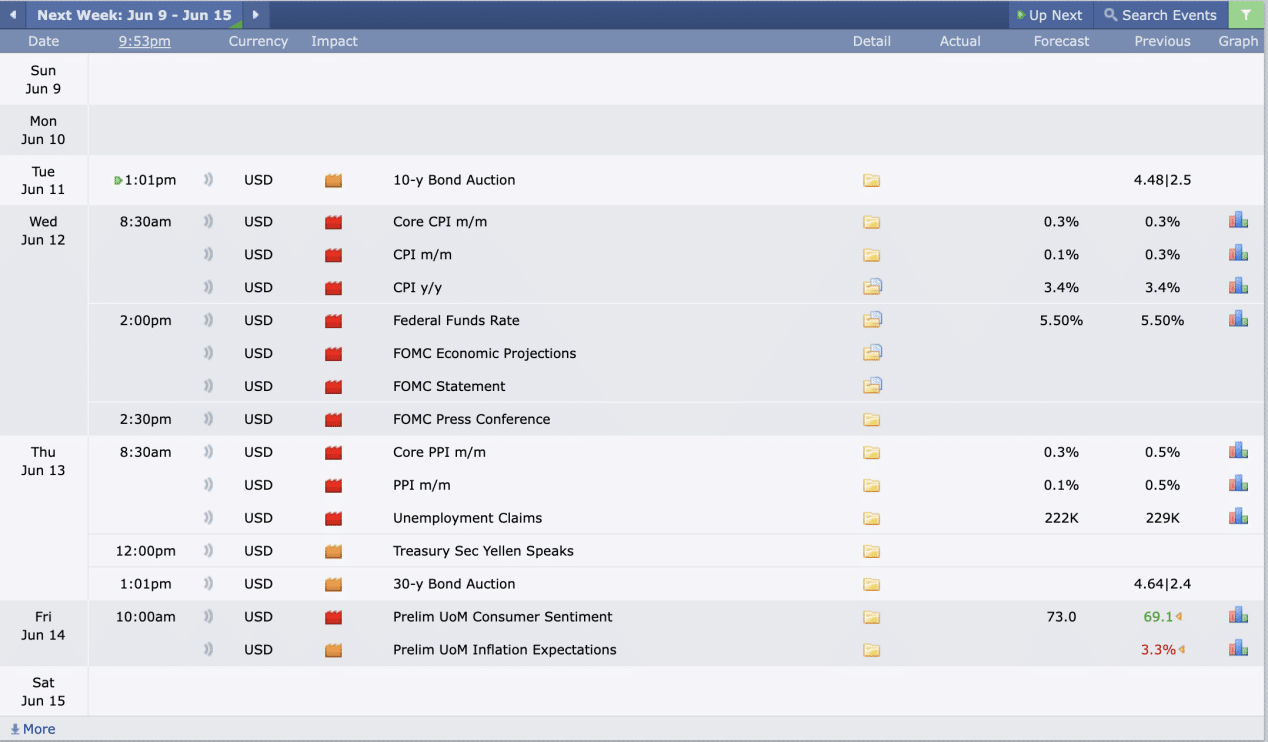

This Week’s Economic Calendar

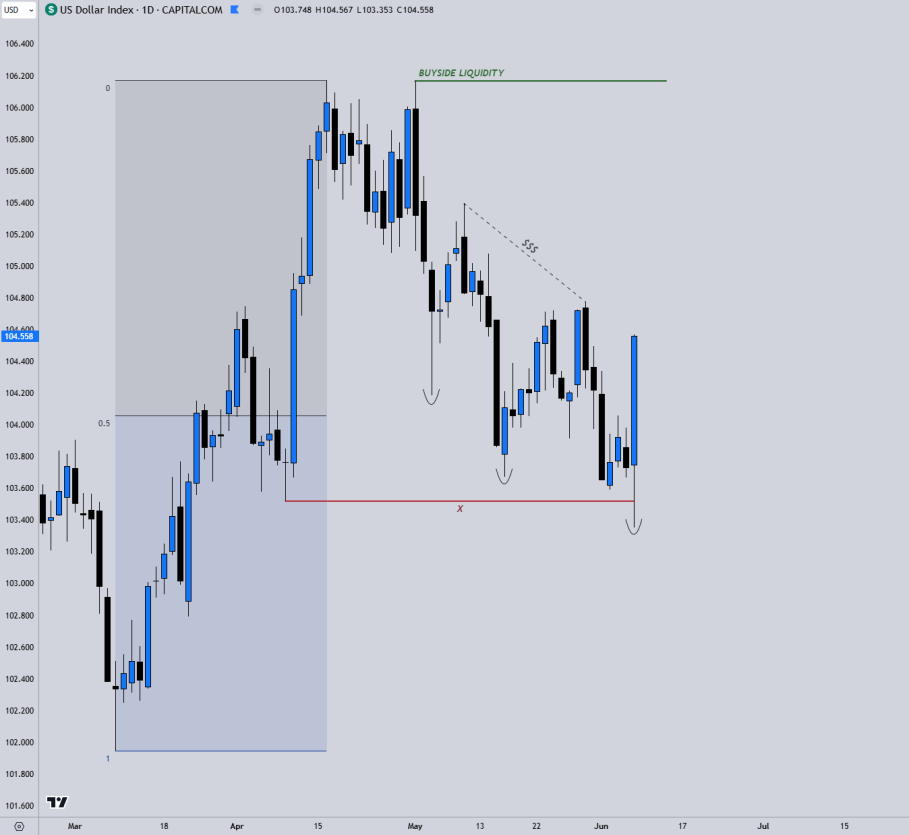

The just concluded week was characterized by the expansion into new all-time highs on the indexes, particularly the NASDAQ and S&P, closing the weekly candle bullish. This serves as a continuous reminder of the focus on buy models at all-time highs until a significant break in structure is observed. The US dollar, on the other hand, closed on a rather bullish note after sell stops were bought by smart money at a discount on the daily time-frame, breaking out of the weekly consolidation it had been in. Further displacement to the upside, confirmed by discount PD arrays providing support for price, will confirm the resumption of a bullish momentum and anticipation of a bullish month according to seasonal tendencies moving forward.

The new week brings forth important reports, with CPI numbers and FOMC rates announcement on Wednesday taking the spotlight, emphasizing the need for meticulous trading and tight risk management.

Please note that this is not financial advice.*

Monday:

Today, there are no significant news drivers following Friday’s expansion on the indexes into new all-time highs. Given that it’s Monday, exercising patience and managing expectations is crucial. The recommendation is to wait for the 9:30 opening and then focus on identifying the most probable higher time-frame draw on liquidity around the 10-11 am silver bullet

Tuesday:

With no news drivers in the AM session and medium-folder news in the PM session on a day preceding both CPI and FOMC, traders are advised to heavily manage their expectations. The day is likely to be one where we tend to experience high resistance runs and lower probability set-ups, building liquidity in anticipation of the events following the next day.

Wednesday:

Marked by the anticipation of the CPI numbers at 8:30 am and the FOMC rate announcement and press conference in the PM session, traders, especially those who are less experienced, are advised to manage their expectations heavily on this day. It’s recommended to focus on the 7-8 am ‘Silver bullet’ or after 2:30 if you have the experience to navigate the heightened volatility.

Thursday:

Expect heightened market volatility between 8:30 AM and 1:01 PM due to the influence of multiple scheduled news drivers. Anticipate optimal trading opportunities throughout the day, encompassing both the AM and PM sessions.

Friday:

Red and medium-tier news drivers are scheduled for 10 AM, coinciding with the Silver Bullet hour. If your weekly profit objectives haven’t been met, redirect your focus to identifying the most probable higher time frame liquidity draw during the 10 to 11 AM Silver Bullet window, or in the PM session if you find your set-up.

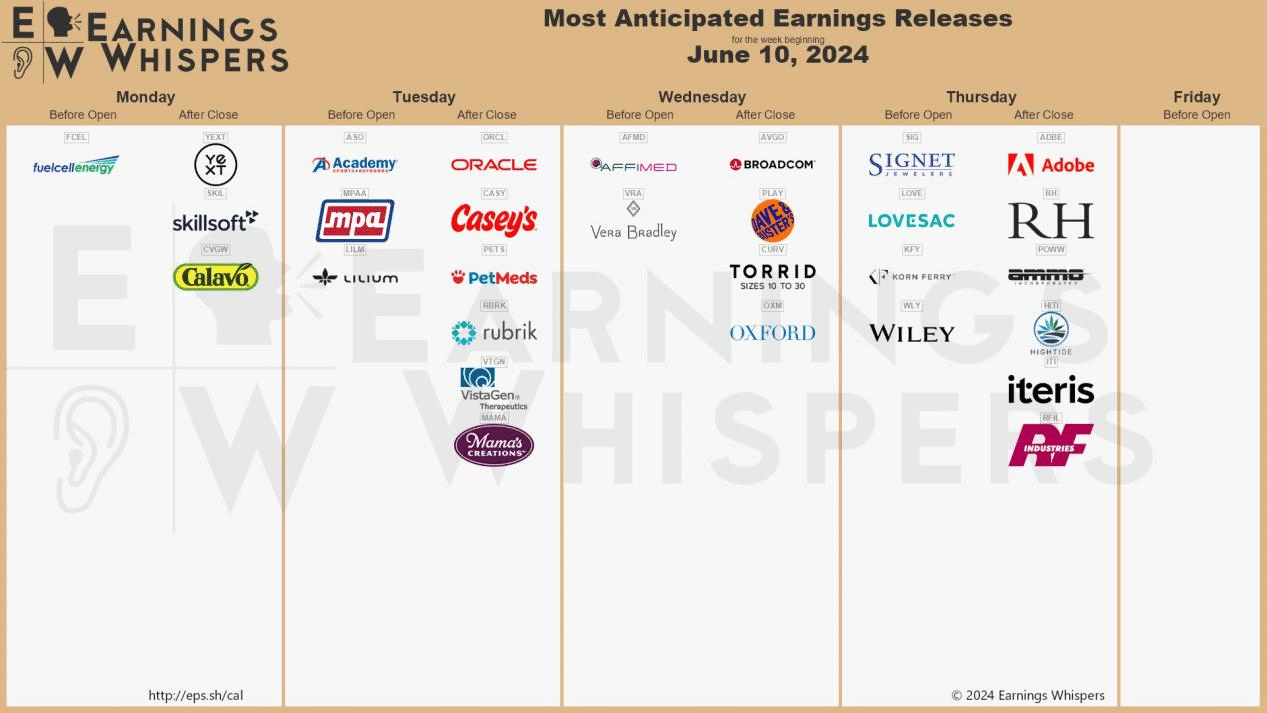

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports, with several large-cap institutions scheduled to release theirs. Specifically, ORACLE & ADOBE are in focus this week, and traders should expect notable volatility and potential consolidation in the lead-up to these reports.

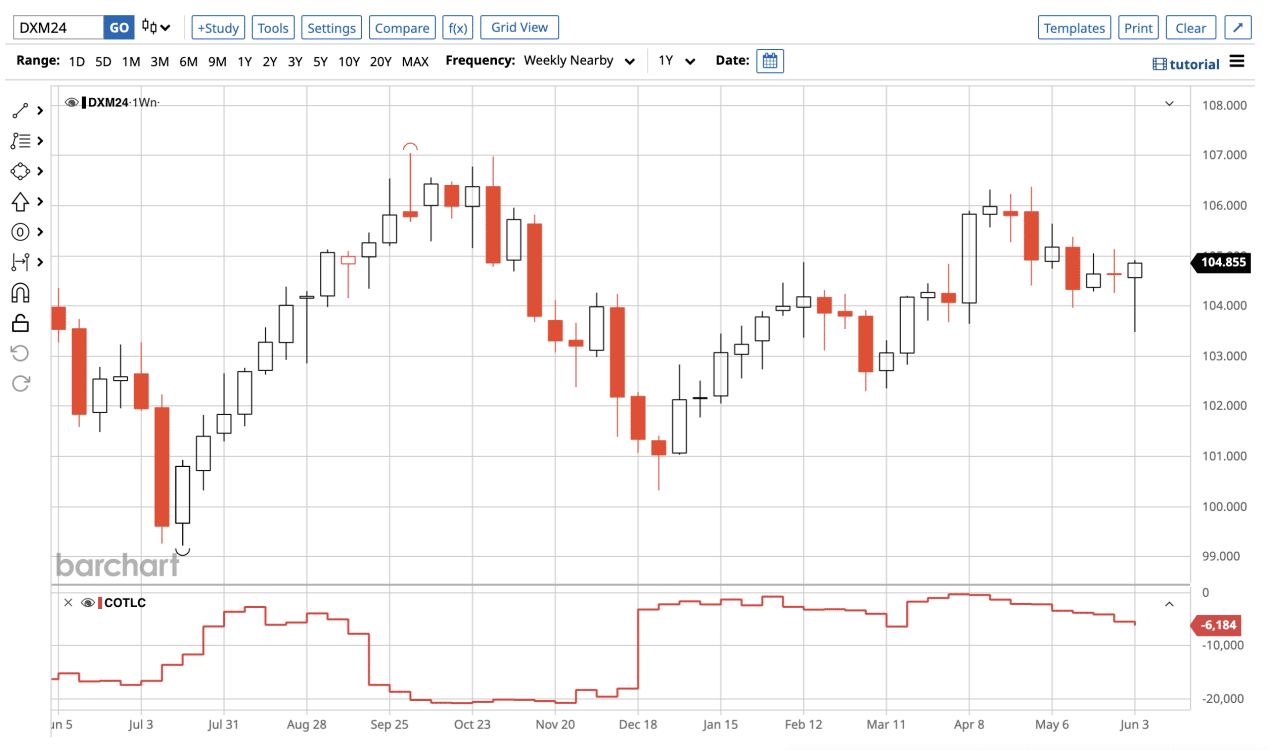

The Cot Report For The US Dollar

In the just concluded week, the US dollar closed on a rather strong bullish note, wiping out the earlier losses of the week. The US dollar also displaced away from the equilibrium of the weekly trading range it had been stuck in for a while. Further displacement to the upside, supported by key discount PD arrays, will mean a bullish dollar in the longer term.

Analysis of the Commitments of Traders (COT) report, focusing on commercials engaged in hedging activities, reveals that commercials maintain a net long position. The data released on Friday reaffirms that commercial entities, including institutions and hedgers, continue to hold more long than short positions in the market, indicating anticipation of higher prices in the longer term.

What does this signify for us as traders? The US dollar, in line with the commercial data on Friday, traded into its respective discount where inter-bank traders and smart money bought after taking out sell-side liquidity of uninformed money. Attention was also drawn last week to the commercial data indicating that discount targets moving forward can signal a reversal, which was seen on Friday. Moving forward, in line with confirmations from prevailing order flow, we will expect continued displacement to the upside, if we are to remain bullish.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wiseley

Happy Trading!

Adora Trading Team