This Week’s Economic Calendar

The just-concluded week witnessed the indexes accelerating toward their respective discount targets as outlined to the community, ultimately closing on a bullish note to end the week. Higher time frame order flow remains bullish as discount PD arrays continue to provide support for price. At all-time highs, buy models will continue to be trusted until proven otherwise. Although counter-trend trades can be taken on the lower time frames to target intraday liquidity, A+ setups will manifest when trading in line with the higher time frame weekly and daily order flow.

The new week brings forth important reports, with the Non-Farm Payrolls (NFP) Report on Friday taking the spotlight, emphasizing the need for meticulous trading and tight risk management.

Please note that this is not financial advice.*

Monday:

Given that it’s the first day of the NFP (Non-Farm Payrolls) week, combined with the start of a new month and a Monday, it’s crucial to exercise patience and manage expectations. Red and medium folder news drivers at 9:45 and 10 am are expected to inject volatility. The recommendation is to wait for the opening range and then focus on identifying the most probable higher time-frame draw on liquidity around the 10 am silver bullet.

Tuesday:

A red folder driver is scheduled for 10 am, coinciding with the silver bullet hour, which is expected to inject volatility into the markets. Consequently, the day is anticipated to present optimal trading opportunities. It will be ideal for traders to consider the 10-11 am Silver Bullet session and the PM session for higher probability trades.

Wednesday:

Red and medium folder news drivers are expected to flood the market in the AM session, starting as early as 8:15 AM until 10 am, coinciding with the silver bullet hour. Traders should anticipate volatility injections that could facilitate smoother trades. Traders are encouraged to prioritize either the 7-8 am Silver bullet, the 10 am Silver bullet, and have your positions covered by the lunch hour.

Thursday:

Highlighted as the day before the Non-Farm Payrolls (NFP) report, it tends to exhibit high resistance and low probability. Traders are advised to exercise caution, particularly if they lack experience. On this day, there is a red folder news driver scheduled for 8:30 AM, which is expected to inject volatility into the marketplace. If traders opt to participate on this day, they should recognize that it’s a lower probability trading day.

Friday:

Marked by the anticipation of the Non-Farm Payrolls (NFP) numbers, there is an expectation of heightened volatility in the markets following the release of this high-impact news, potentially offering optimal trading opportunities. However, it’s important to note that trading ahead of such high-impact news is not recommended due to increased uncertainty and risk. Instead, traders are advised to wait and observe the liquidity and inefficiencies that unfold after the news release. For higher probability setups, consideration can be given to trading during the 10-11 AM Silver Bullet or the PM session.

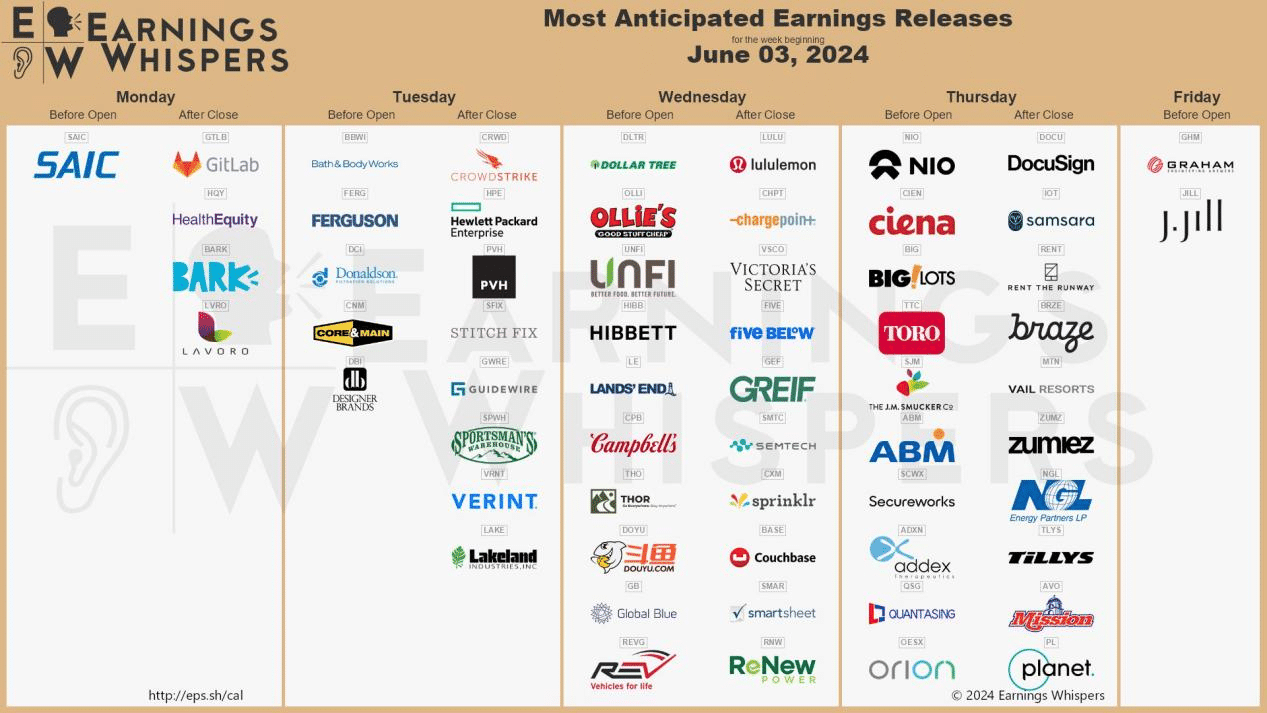

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders to anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports, with several large-cap institutions scheduled to release theirs. Traders should expect volatility and potential consolidation ahead of these reports.

The Cot Report For The US Dollar

In the just concluded week, the US dollar closed indecisive, experiencing a lack of sufficient institutional sponsorship, taking out liquidity on both sides. The US dollar remains at the equilibrium of the weekly trading range, stuck in consolidation until we break out of this range. Consolidation can be expected moving forward until we displace.

Analysis of the Commitments of Traders (COT) report, focusing on commercials engaged in hedging activities, reveals that commercials maintain a net long position. The data released on Friday reaffirms that commercial entities, including institutions and hedgers, continue to hold more long than short positions in the market, indicating anticipation of higher prices in the longer term.

What does this signify for us as traders? We are currently at equilibrium on the weekly dealing range while also finding support at the weekly breaker. Interest yields are also still bullish, trading into their respective discounts in the previous week. Order flow will continue to be relied on until correlation returns between the technicals and commercials. We will continue to pay attention to technical analysis and order flow on the lower time frames, with a gentle reminder that discount targets moving forward can constitute a reversal in line with the commercial data.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wiseley

Happy Trading!

Adora Trading Team