This Week’s Economic Calendar

For yet another week, the indices extended their gains—adding over $2.25 trillion in value across the U.S. stock market.

Layered fund-level buy stops above market price were taken out inside of a premium, aligning with expectations for a large-range week within an expansion market profile, marked by aggressive displacements that delivered targets rapidly.

Further upside targets as a draw remain in play as part of the ongoing buy program, until proven otherwise by a break in structure.

While counter-trend intraday trades may present themselves, the highest-probability setups will continue to be those that align with the weekly, daily, and hourly institutional order flow.

Looking Ahead: Key Events This Week

This is a data-heavy week, with volatility expected around major macroeconomic releases:

- ISM Services PMI – Monday, 10:00 AM EST

- FOMC Rate Announcement – Wednesday, 2:30 PM EST

Traders should stay alert and prepared to capitalize on high-probability opportunities, especially when they align with:

- Time-of-day and macro windows

- A clear higher-timeframe draw on liquidity

Please note that this is not financial advice.

Monday:

Today, being the first trading day after a range week and a Monday, it’s crucial to exercise patience and manage expectations. A Red-folder news driver at 10:00 AM is expected to inject volatility into the market, providing price runs to algorithmic reference points at this time. The recommendation is to observe the opening range and then focus on identifying the most probable higher time-frame draw on liquidity during the 10:00 AM Silver Bullet and into the PM session for high-probability trades.

Tuesday:

With no significant economic news driver expected to inject volatility pre-FOMC rate release—a high-impact news event—expectations are being managed accordingly into an anticipated difficult AM session. I recommend looking for opportunities pre-market if the market structure suggests it’s high-probability, or during the Opening Range (9:30–10:00 AM)—focusing on identifying the most probable higher-timeframe draw on liquidity and capitalizing on the volatility near the 9:30 opening bell for higher-probability trades, if a setup presents itself.

Wednesday:

Heightened market volatility is expected in the PM session, driven by the FOMC rates and press conference scheduled between 2-2:30 PM, likely leading to consolidation ahead of the event. During the event, there may be periods of heightened volatility and whipsaws in the market. Traders, especially those with less experience, should manage expectations carefully. The recommended focus should be on looking for opportunities pre-market if the market structure suggests it is high-probability, or, for those experienced enough to handle increased volatility, consider setups post-2:30 PM after the FOMC event.

Thursday:

Expect heightened market volatility at 8:30 AM due to the impact of a Red folder news driver expected to inject volatility into the market in the AM session. Traders are advised to focus on the AM Session beginning at 9:30 and the PM session for high-probability trade setups.

Friday:

Today presents no significant news drivers expected to inject volatility into the markets. If you haven’t met your weekly profit objectives, focus on the premarket trading hours or allow the opening range (9:30-10:00 AM) to develop, then focus on identifying the most probable higher time frame draw on liquidity during the 10 AM Silver Bullet or the PM session, should a suitable setup present itself.

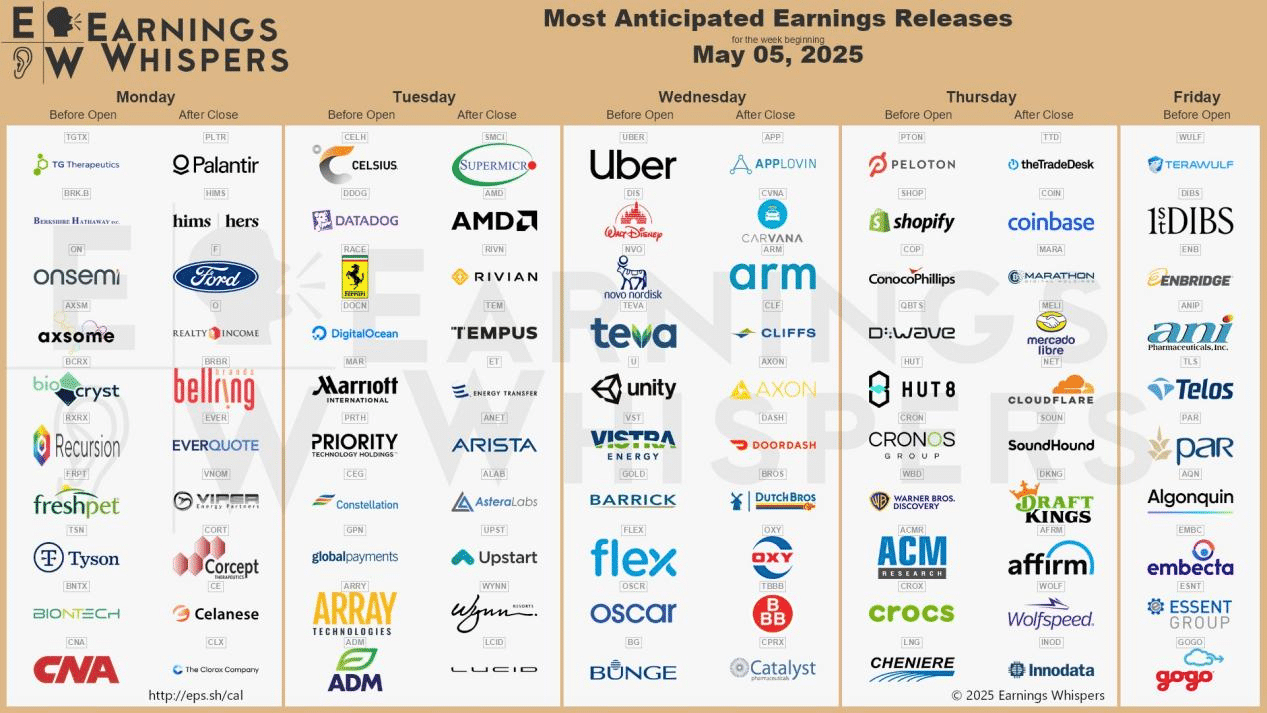

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports from several major large-cap institutions, with key releases to watch including:

- Advanced Micro Devices

- Shopify

- ConocoPhillips

- Altria Group

- Enbridge

- Archer-Daniels-Midland

- Uber Technologies

- Marriott International

- Ford Motor Company

- Arista Networks

These reports are expected to inject significant volatility into the market, with a high likelihood of consolidation leading up to the announcements—particularly given the diverse range of sectors represented.

The Cot Report For The US Dollar

The Previous Week in Review

After targets are met in an expansion market profile, we expect to see a retracement into inefficiencies and gaps for smart money accumulation inside of a short-term premium or discount before the next expansion leg.

Last week on the U.S. dollar, that played out perfectly: we retraced into the weekly FVG following a downward repricing into sell-side liquidity. How price trades within this inefficiency moving forward will set the stage for either a smart-money reversal or a continuation.

For yet another week, commercials remain heavily long—aggressively loading long hedge positions, as confirmed by Friday’s COT releases and a surge in open interest. While fundamentals and macro drivers support this bullish bias, real confirmation must come from institutional order flow to trust bullish intra-day setups.

What Does This Signify for Us as Traders?

Now that the market has repriced into the weekly FVG, we are to watch how it trades inside that gap: If the weekly FVG is repriced through and acts as an inversion, it signals an intermediate-term low priced in and a smart-money reversal in motion—we look for higher prices. If the market, however fails to trade above the FVG, beginning to rotate lower, it indicates the absence of bullish order flow, and lower prices remain high-probability. This will be something to closely monitor moving forward into the new week.

Seasonal Tendencies

The US Dollar

As we turn the page into May, seasonal data historically points to a bullish month for the U.S. dollar, setting the backdrop for continued upside into the latter half of 2025. Confluent factors add weight to this expectation; Rising yields across the 5-, 10-, and 30-year Treasuries—a leading indicator for dollar strength, The tentative intermediate-term low already being priced in; this level remaining protected will be key.

True conviction comes when institutional order flow aligns with the seasonals. Watch for PD arrays on the left side of the curve (e.g. order blocks, FVGs) that were used to send price lower to begin to lend a support for price. Seeing this confirms a shift from bearish to bullish flow.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team