This Week’s Economic Calendar

In an expansion market profile, low-resistance, high-probability setups are expected—identified by large displacements that deliver targets with speed. We saw this play out last week across the indices, particularly on the NASDAQ, which delivered a range exceeding 1,000 points in a single day, clearing out fund-level stops below market price.

Institutional order flow remains heavily bearish going into the new week, with further downside targets expected to be delivered as part of a broader sell program, until proven otherwise. The best setups intra-day will continue to be those in alignment with the monthly, weekly, and daily institutional ordeflow and market structure.

Looking Ahead:

This week is data-heavy, with focus on:

–CPI numbers – Thursday, 8:30 AM EST

–PPI numbers – Friday, 8:30 AM EST

Expect heightened volatility all week long, especially around these news events, and be prepared to capitalize on high-probability opportunities that emerge at time of day within a higher time-frame draw.

Please note that this is not financial advice.

Monday:

Given that its the first trading day following a large range week, which delivered several downside targets on the indices , and a Monday, patience and managed expectations are key. With no significant economic news driver expected to inject volatility into the markets;I recommend looking for opportunities pre-market, if the market structure suggests its high-probability, or during the Opening Range (9:30-10:00 AM)—focusing on identifying the most probable higher-timeframe draw on liquidity and capitalizing on the volatility near the 9:30 opening bell, if a setup presents itself.

Tuesday:

With no significant economic news driver expected to inject volatility—expectations are being managed accordingly into an anticipated difficult AM session given the lack of high impact news drivers. Much like Monday, I recommend looking for opportunities pre-market if the market structure suggests its high-probability, or during the Opening Range (9:30–10:00 AM)—focusing on identifying the most probable higher-timeframe draw on liquidity and capitalizing on the volatility near the 9:30 opening bell for higher-probability trades, if a setup presents itself.

Wednesday:

Heightened volatility is expected in the PM session due to the FOMC meeting minutes release at 2:00 PM, with likely consolidation leading up to the event. With CPI data scheduled for tomorrow, managing expectations today is key. Focus should be on either the pre-market session (7:00–8:00 AM), macro time windows, and the opening range (9:30–10:00 AM) for low risk setups on a day we expect the AM to be more difficult. The PM session is best avoided to protect capital, as price is likely to deliver lower-probability, high-resistance ahead of Wednesday’s CPI release.

Thursday:

This day brings the anticipation of the CPI numbers at 8:30 AM, which is expected to inject significant volatility into the market following the news release. While its advised to avoid trading ahead of high-impact news driver, the post-news release reveals liquidity and inefficiencies that can be capitalized on as a draw. Focus on the AM Session beginning at 9:30 and the PM session for higher probability trade setups.

Friday:

Expect heightened volatility in the AM session due to multiple key high-impact news drivers scheduled at 8:30 AM into 10:00 AM. Focus on identifying the most probable higher-timeframe draw on liquidity post-news release, or alternatively, wait for the 10 AM Silver Bullet window to frame low-risk, high-probability setups. If you’ve already met your profit objectives for the week, its best to either scale risk down or step aside entirely to preserve capital heading into the weekend.

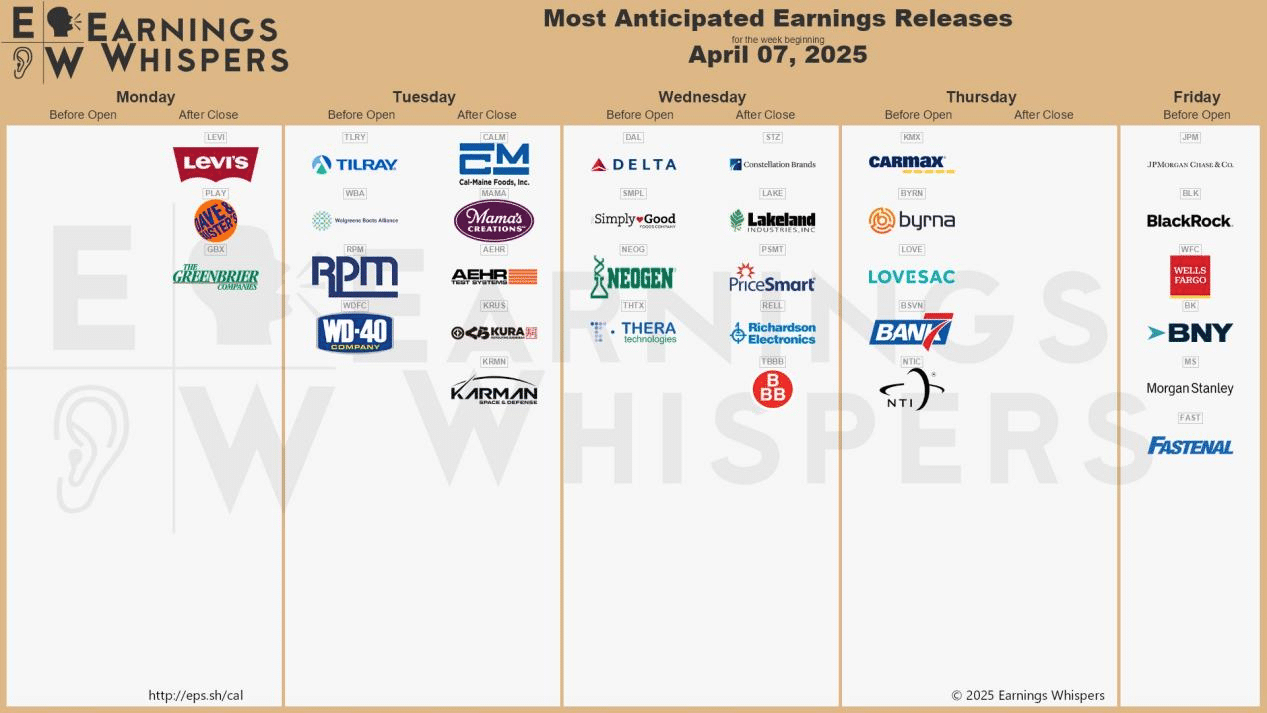

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports from several major large-cap institutions, with key releases to watch including:

- JPMorgan Chase & Co. (JPM)

- Wells Fargo & Co. (WFC)

- BlackRock Inc. (BLK)

- Delta Air Lines Inc. (DAL)

- Levi Strauss & Co. (LEVI)

- Constellation Brands Inc. (STZ)

- CarMax Inc. (KMX)

These reports are expected to inject significant volatility into the market, with a high likelihood of consolidation leading up to the announcements—particularly given the diverse range of sectors represented.

The Cot Report For The US Dollar

The Previous Week in Review

As expected, the weekly FVG—highlighted in last week’s analysis—served as a key PD array, used by smart money to drive price lower. The previous week delivered a massive range, which aligns with the current expansion market profile we’re trading within. Coupled with key fundamentals—interest rate dynamics, seasonal tendencies, and COT positioning—there’s a strong case for continued weakness in the dollar until proven otherwise. Bias remains bearish into the new week.

On the other hand, commercials have flipped net long and continue to hedge long into the new week. This comes after a clear short squeeze and capital transfer, signaling a potential reversal may be forming in the US dollar. However, as we always emphasize, this information is meaningless without institutional order flow confirmation. The discrepancies between the technical structure and macro positioning hint at smart money accumulation—something we’ll be monitoring closely moving forward.

What Does This Signify for Us as Traders?

As discussed in recent editions of this newsletter, discount targets should now be closely watched, as they may constitute a smart money reversal in line with commercial positioning. This does not mean we are calling a bottom in a clearly bearish market—but rather anticipating the possibility of a shift within market structure which is to be confirmed by institutional order flow.

Until then, we remain heavily bearish, with price targets below 100 still in focus for the US dollar—unless proven otherwise.

Seasonal Tendencies

The US Dollar

Back in March, we observed an intermediate-term high priced in, right in line with seasonal tendency data. This then set the stage for a market maker sell model within a sell program—seen with the weakness throughout April so far and is expected to continue into the later weeks of the month.

Looking ahead into the new week, the bearish bias remains intact, supported by both seasonal data and institutional flow, which continue to align to the downside.

Unless we see a clear break in market structure to the upside into the new week .

WE ARE BEARSIH

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team