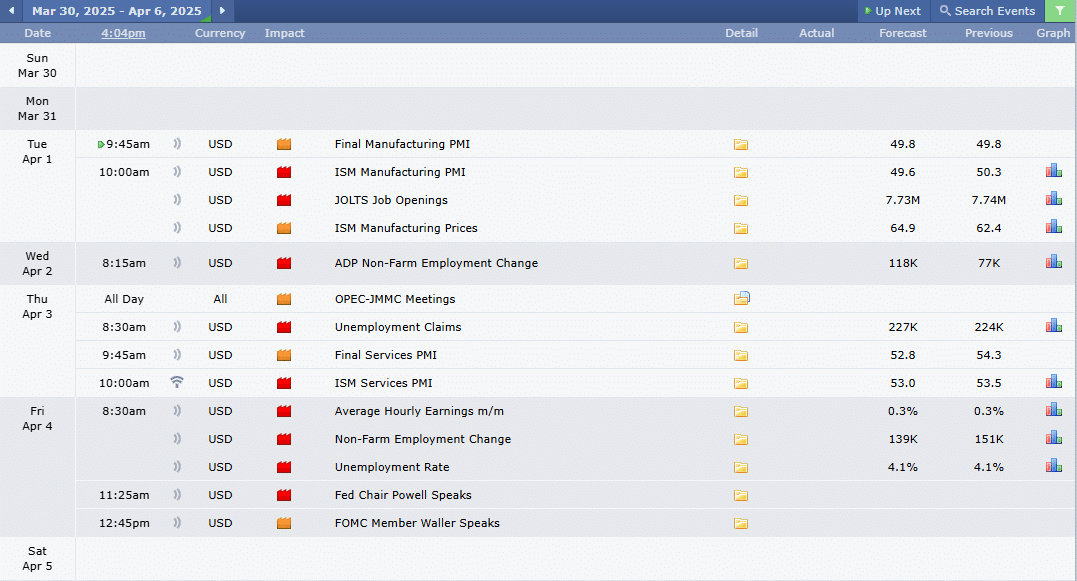

This Week’s Economic Calendar

For yet another week, the indices extended their losses—wiping out over $1.25 trillion off the US stock market.

Layered fund-level sell stops were taken out below market price within a discount, aligning with expectations for a large range week following the prior week’s consolidation and small range.

We saw a breakaway gap, confirming the exit from the consolidation range, and the indices remains heavy heading into the new week—with further discount targets expected to be delivered. This creates intraday low-risk, high-probability setups in line with the higher timeframe draw.

While counter-trend intraday trades are possible, the highest probability setups will always be those aligned with the weekly, daily, and hourly order flow.

Looking Ahead:

This week is data-heavy, with key focus on:

–Non-Farm Payrolls – Friday, 8:30 AM

–Fed Chair Powell speaks – Friday, 11:25 AM

Expect heightened volatility all week long, especially around these news events, and be prepared to capitalize on high-probability opportunities that emerge at time of day within a higher time-frame draw.

Please note that this is not financial advice.

Monday:

Given that it’s the first day of NFP (Non-Farm Payrolls) week, and a Monday, patience and managed expectations are key. With no significant economic news driver expected to inject volatility into the markets;I recommend looking for opportunities pre-market, if the market structure suggests its high-probability, or during the Opening Range (9:30-10:00 AM)—focusing on identifying the most probable higher-timeframe draw on liquidity and capitalizing on the volatility near the 9:30 opening bell, if a setup presents itself.

Tuesday:

Expect heightened volatility in the AM session due to key high impact news drivers scheduled between 9:45 and 10 AM, coinciding with the silver bullet hour. This marks the second most probable trading day pre-NFP. Both the AM and PM sessions should offer low-risk, high-probability opportunities.

Wednesday:

Volatility injections are anticipated in the AM session at 8:15 AM, facilitated by a red folder news driver. This will likely provide easy price runs to algorithmic reference points, presenting optimal trading opportunities. Traders are advised to focus on the AM session beginning at 9:30 AM and look to conclude their trading day by 12 noon to protect capital, as price delivery beyond that point may shift into lower-probability, high-resistance conditions ahead of Friday’s NFP release.

Thursday:

Highlighted as the day before the Non-Farm Payrolls (NFP) report, where we can expect price to deliver within the context of high resistance and low probability trading conditions. Traders are advised to exercise caution and recognize that it’s a lower probability trading day, particularly if they lack experience.

Friday:

Marked by the anticipation of the Non-Farm Payrolls (NFP) numbers, there is an expectation of heightened volatility in the markets following the release of this high-impact news driver; However, with Powell scheduled to speak at 11:25 AM, a consolidation profile leading up to his speech is likely. During his address, increased volatility and erratic whipsaws may occur.

For those experienced enough to handle increased volatility, consideration can be given to looking for opportunities during the Opening Range (9:30-10:00 AM), focusing on identifying the most probable higher-time frame draw on liquidity if a setup presents itself given the NFP volatility, or instead focus on the PM session.

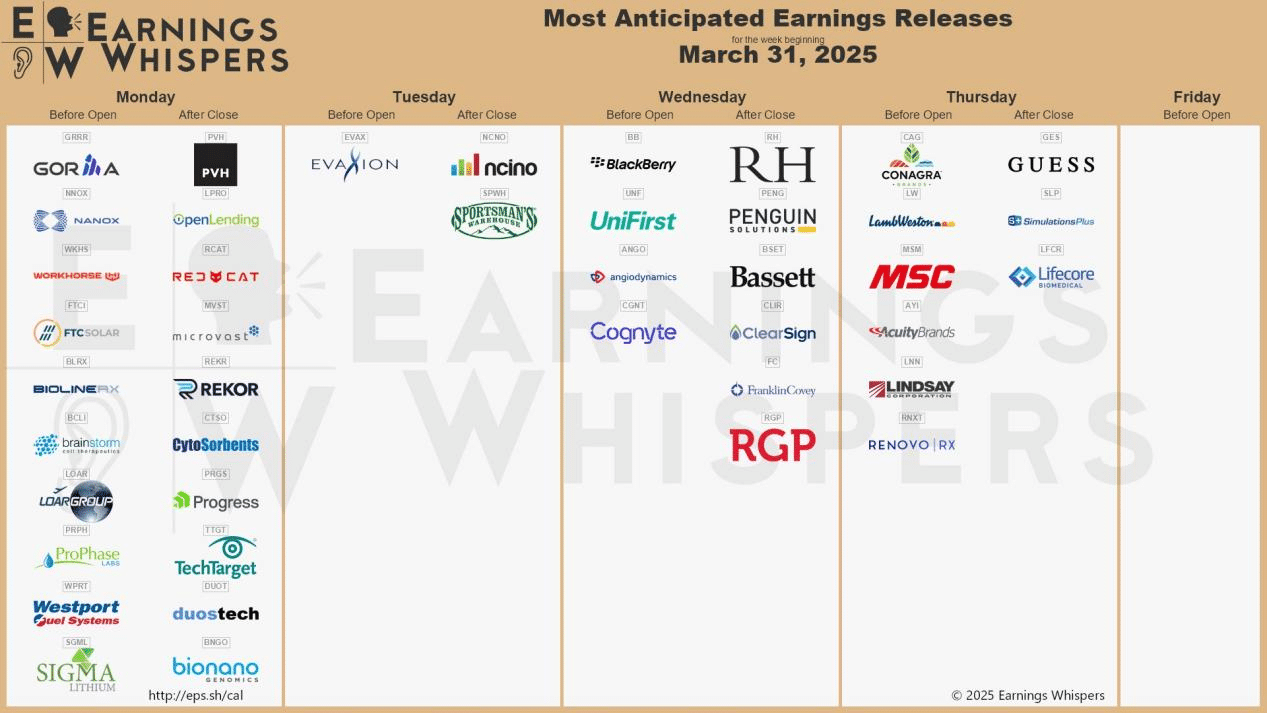

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports from several major large-cap institutions, with key releases to watch including:

- Acuity Brands

- MSC Industrial

- Lamb Weston

- Conagra Brands

- RH

- PVH

These reports are expected to inject significant volatility into the market, with a high likelihood of consolidation leading up to the announcements—particularly given the diverse range of sectors represented.

The Cot Report For The US Dollar

The Previous Week in Review

The U.S. dollar retraced into the weekly fair value gap, remaining inside its lower quadrant—a key signature indicating early signs of algorithmic weakness.

Heading into the new week, nothing has structurally changed. The expectation remains that the dollar will continue to trade lower, with discount targets below market price acting as the next draw.

Commercial Data Insight

A short squeeze is currently underway. Deep-pocketed players are aggressively closing short hedges while increasing their long exposure.

This type of reallocation—de-leveraging shorts and gradually building long exposure—points to smart money accumulation. The growing divergence between technical weakness and underlying commercial activity must be monitored closely moving forward.

What Does This Signify for Us as Traders?

Top-down, the Top-down, the U.S. dollar remains heavily bearish. Until we see alignment between technicals and fundamentals, institutional order flow remains the most actionable guide for clarity and insights.

For the upcoming week, we remain bearish, expecting a large-range week to deliver 103.11 and below as downside targets.

Seasonal Tendencies

The US Dollar

Seasonal tendencies for the month of April continue to anticipate weakness in the U.S. dollar, which aligns with what we’ve seen so far.

Having priced in an intermediate-term high earlier in March, the dollar has been on a steady decline—supported by institutional order flow within a clear sell program.

Into the new week, the bearish bias remains intact, as both seasonal data and institutional order flow confirm downside momentum.

Barring any shift within institutional order flow to the upside , we maintain a bearish outlook into the new week.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team