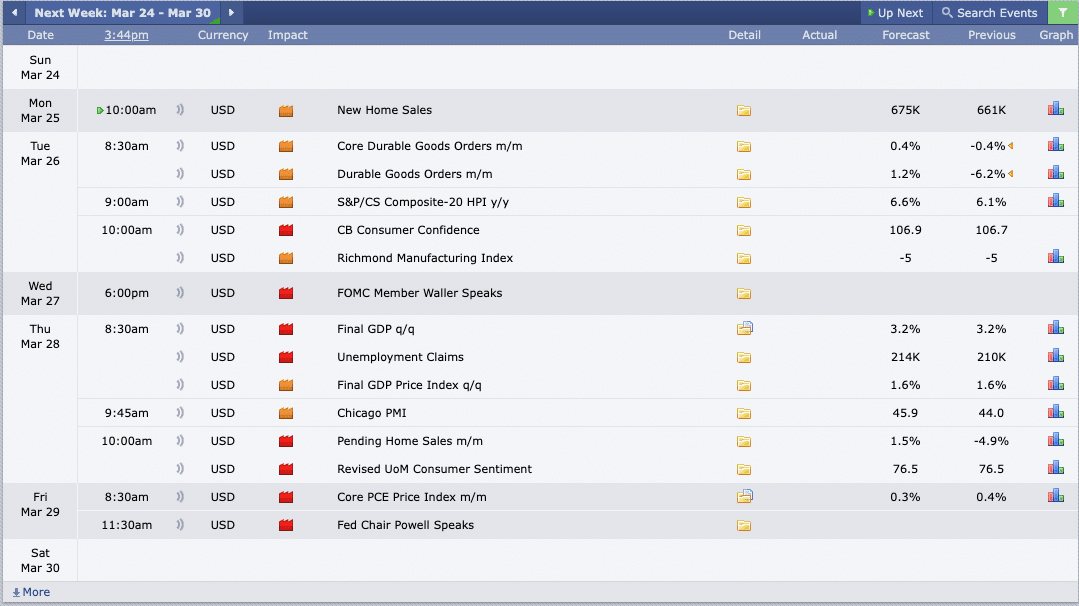

This Week’s Economic Calendar

The recently concluded week in the DXY has provided clean price action, providing clean Low-resistance liquidity runs to clear 1 side objectives. This was characterized by a rally, with the dollar resuming its upward bullish momentum and the indices market breaking free of its consolidation, reaching all-time highs. This signifies that the peak is yet to come and serves as a reminder of the strict reliance on buy models at all-time highs until they prove ineffective.

The new week brings forth important reports, with Fed Chair Powell speaking later in the week in the spotlight.

Please note that this is not financial advice.*

Monday:

Considering the medium folder news driver scheduled for 10 am and the recent significant price run on the indexes, resulting in new all-time highs closing the just concluded weekly candle bullish, coupled with today being Monday, it’s crucial to exercise patience and manage expectations. The recommendation is to wait for the 9:30 opening and then focus on identifying the most probable higher time frame draw on liquidity around the 10 am silver bullet.

Tuesday:

Expect heightened market volatility between 8:30 AM and 10 AM due to the influence of multiple scheduled news drivers. Anticipate optimal trading opportunities throughout the day, encompassing both the AM and PM sessions.

Wednesday:

A red folder news driver scheduled for 6 PM after the market close can still impact the day’s trading. Traders should exercise extra caution on this day as the market might potentially be held within a range in anticipation of the speech. However, trades can be considered during the AM session, particularly the 10 AM silver bullet, if the price action provides a clear and evident draw on liquidity.

Thursday:

With multiple news drivers scheduled between the hours of 8:30 and 10 AM, expect increased volatility in the market, which could potentially lead to smoother trades due to the heightened volatility. For higher probability trades, consider focusing on the 10-11 AM Silver Bullet timeframe or the PM session.

Friday:

On this day, there are two red folder news drivers scheduled for 8:30 AM and 11:30 AM, with greater significance placed on Fed Chair Powell’s speech at 11:30 AM. This event is expected to inject volatility into the marketplace. If traders choose to participate on this day, they should understand it’s lower probability trading the AM session; rather focus should be shifted to the PM session for higher probability trades.

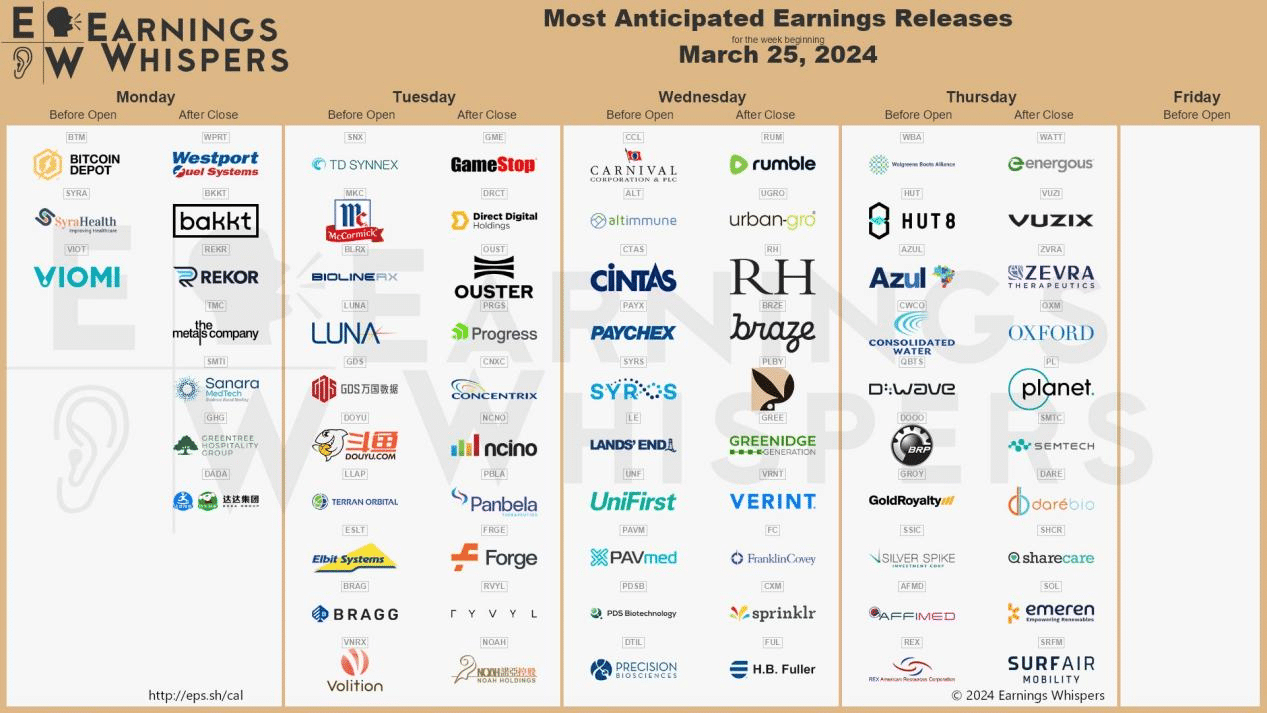

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

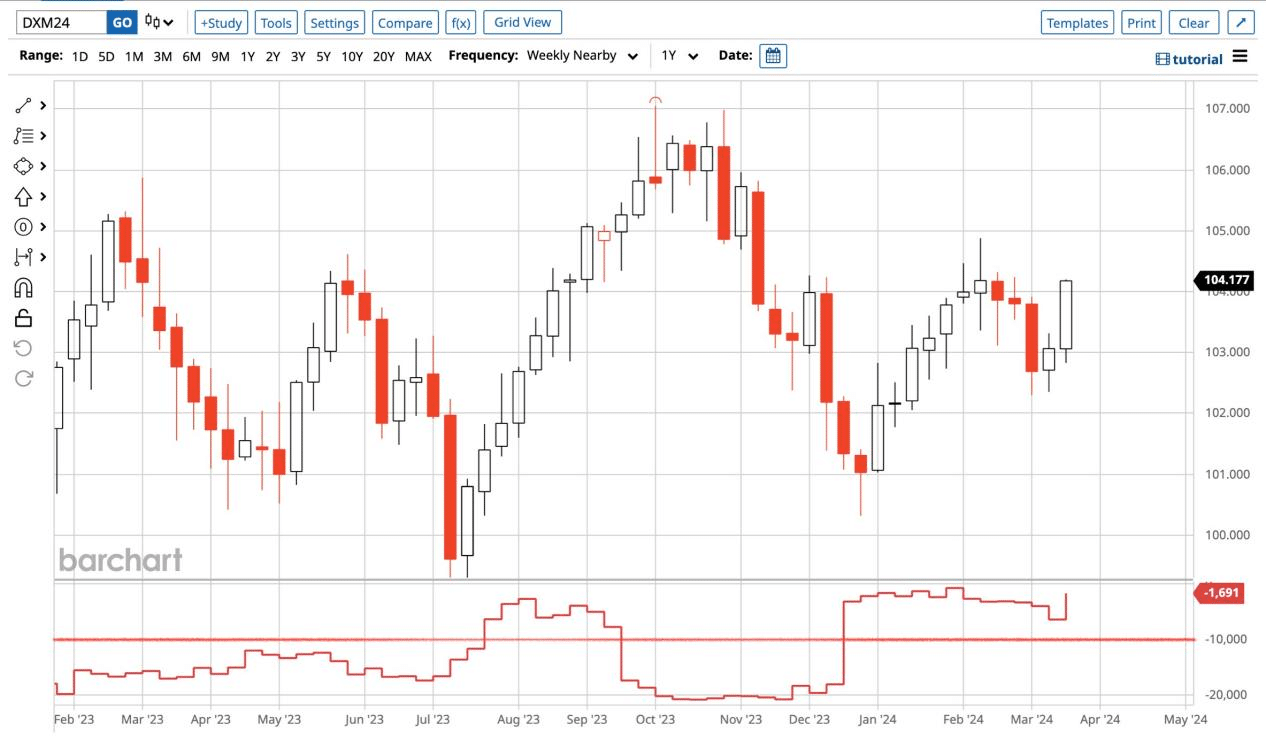

The Cot Report For The US Dollar

At first glance, it is evident that the US dollar remains strongly bullish, as confirmed by both technical analysis and fundamental factors. There has been a recent expansion from a discount of the weekly range, accompanied by an accumulation of new long orders by commercial entities. This accumulation is reflected in a significant increase in open interest, as observed in the provided image. Analysis of the Commitments of Traders (COT) report, with a specific focus on commercials engaged in hedging activities, reveals that commercials are holding more long positions than shorts. This indicates their anticipation of higher prices for the US dollar in the near future.

What does this signify for us as traders? We left off the previous week awaiting confirmation from commercials regarding the accumulation of new long positions following the significant reduction in open interest observed the week before. This week’s report has indeed confirmed that commercials remain strongly bullish. As a result, we can anticipate higher prices for the dollar following the accumulation by smart money a few weeks back. Therefore, the US dollar maintains its bullish outlook going into the near future, as indicated by this report.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team