This Week’s Economic Calendar

The previous week on the indices saw a small-range week, which was expected after a series of large-range weeks delivering discount targets. Following a small-range week, a large-range week can be expected, identified by a displacement out of the hourly consolidation ranges—marked by a breakaway gap being left open as we leave the range, presenting low-risk, high-probability intra-day trade setups.

Looking Ahead:

This week is data-heavy, with the spotlight on the Flash Manufacturing and Services PMI scheduled for Monday at 9:45 AM.

Expect heightened volatility all week long, especially around these news events, and be prepared to capitalize on high-probability opportunities that emerge at time of day within a higher timeframe draw.

Please note that this is not financial advice.

Monday:

Today, being the beginning of the last trading week of the month and Monday following a weekend, it’s crucial to exercise patience and manage expectations. Red-folder news drivers at 9:45 AM are expected to inject volatility into the market, providing price runs to algorithmic reference points at this time. The recommendation is to observe the opening range and then focus on identifying the most probable higher time-frame draw on liquidity during the 10:00 AM Silver Bullet and into the PM session for high-probability trades.

Tuesday:

Volatility injections are anticipated in the AM session between 9 and 10 AM—coinciding with the Silver Bullet distribution hour, facilitated by multiple medium-folder news drivers expected to inject volatility. This will likely provide easy price runs into higher time frame algorithmic reference points, presenting optimal trading opportunities. Traders are advised to focus on the AM session beginning at 9:30 and the PM session for higher probability trade setups.

Wednesday:

Medium folder news drivers are expected to hit the markets at 8:30 AM, injecting volatility. As a result, today is expected to present optimal trading opportunities. I recommend focusing on identifying the most probable higher time-frame draw on liquidity during the Opening Range (9:30-10:00 AM) and 10:00 AM Silver Bullet capitalizing on the volatility near the 9:30 opening bell.

Thursday:

Expect heightened market volatility between 8:30 AM and 10 AM due to the impact of Red and medium-folder news drivers expected to flood the market in the AM session. Traders are advised to focus on identifying the most probable higher time-frame draw on liquidity post-news release or alternatively, the AM Session beginning at 9:30 and the PM session is likely to offer high-probability trade setups.

Friday:

Medium and High-impact news drivers scheduled between 8:30 and 10:00 AM are expected to inject volatility into the marketplace.If you haven’t met your weekly profit objectives, focus on the AM session starting at 9:30, leading into the Silver Bullet hour, and the PM session for higher-probability trade setups.

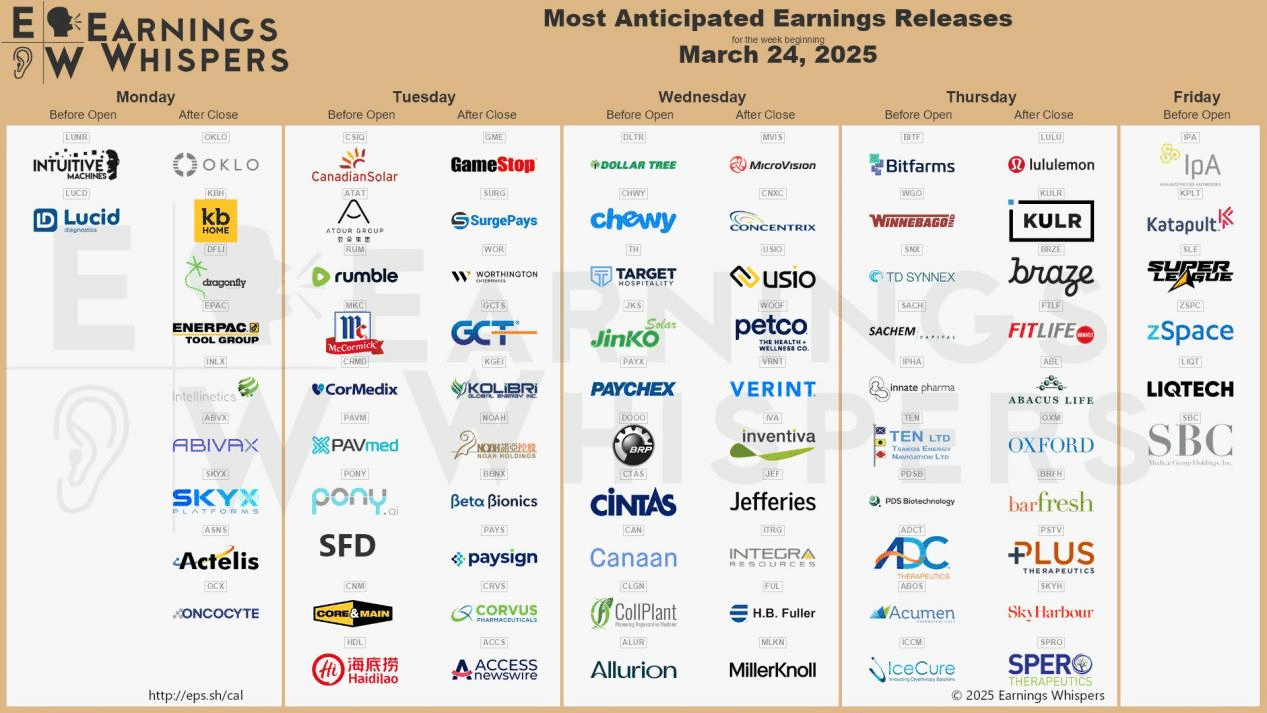

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports from several major large-cap institutions. Key releases to watch include:

- McCormick (MKC)

- HDollar Tree (DLTR)

- Chewy (CHWY)

- Paychex (PAYX)

- Cintas (CTAS)

- Lululemon (LULU)

- TD SYNNEX (SNX)

- Jefferies (JEF)

These reports are expected to inject significant market volatility, with a likelihood of consolidation leading up to the announcements—especially given the diverse range of sectors represented.

The Cot Report For The US Dollar

The Previous Week in Review

The US dollar has had an uneventful week, with a retracement back into a premium inefficiency closing the previous week. This has offered smart money fair value to load up new positions and the algo the opportunity to re-balance the inefficiently-delivered range to the downside, providing both sell-side and buy-side delivery.

Heading into the new week, the Monday, March 3, 2025 weekly FVG remains a key PD array for reading institutional order flow. Ideally, we should see the market remain in the lower quadrant of the FVG, confirming algorithmic weakness.

On the other side, the commercials have provided fresh insights. They’ve shifted from their formerly short hedges into long positions based on the data received on Friday when the week closed. This isn’t a cause for alarm; rather, it indicates potential smart money accumulation underway, reflecting discrepancies between fundamentals and technicals that need to be monitored.

What does this signify for us as traders?

Top-down, we remain heavily bearish on the US dollar with an expectation of discount targets being delivered moving forward. However, given the data presented and the shift in commercial positioning, attention should be paid to new lows discount lows created moving forward. If these are followed by a break in structure, it could signal a transition from a sell program to a buy program.

Seasonal Tendencies

The US Dollar

For yet another week, we remain bearish on the US dollar. Barring any shifts within institutional order flow, our top-down analysis continues to point lower, with discount targets serving as the draw. This aligns with the seasonal tendencies for March and into April—which is fast approaching and still expected to remain heavy.

Although the commercials have shown their cards, shifting from short to long hedges, macro data takes time to maneuver within the charts, and these adjustments could take as much as weeks to months to get priced in. Barring any significant shifts, we remain bearish into the new week.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team