This Week’s Economic Calendar

The past week has seen a dollar that continues to consolidate while indexes expand, resulting in new all-time highs for consecutive weeks. American indexes closed notably bullish, indicating promising future prospects as discussed in the latest newsletter. Trading at all-time highs requires a focus on buy models until they prove ineffective, with attention remaining on the US dollar, we await institutional sponsorship to emerge and break the consolidation, providing long-term projections. The new week brings forth important reports, among other significant news drivers, prompting adjustments in risk management practices and meticulousness in trades.

Please note that this is not financial advice.*

Monday:

Given that it’s the first day of the NFP (Non-Farm Payrolls) week and the most recent significant price run on the indexes led to new all-time highs on the last trading day of the previous week, coupled with it being a Monday, it’s crucial to exercise patience and manage expectations. The recommendation is to wait for the 9:30 opening and then focus on identifying the most probable higher timeframe draw on liquidity around the 10 am silver bullet.

Tuesday:

Red folder drivers scheduled for 10 am, which is expected to serve as volatility injections into the markets. Consequently, the day is anticipated to present optimal trading opportunities. It will be ideal for traders to consider the 10-11 am Silver Bullet for higher probability.

Wednesday:

Red folder news, drivers are expected to flood the market in the AM session, starting as early as 8:15 AM. These news events will likely serve as volatility injections into the markets. However, it’s important to note that Fed Chair Powell will be speaking by 10 AM, likely leading to consolidations up to his speech. During his speech, there may be times of volatility and whipsaws in the market. Traders are advised to heavily manage their expectations on this day and focus on the 7-8 AM kill zone or the PM session if you have the experience to navigate this day professionally.

Thursday:

Highlighted as the day before the Non-Farm Payrolls (NFP) report, it tends to exhibit high resistance and low probability. It’s advised that traders exercise caution, especially if they are not experienced. On this day, there are medium and red folder news drivers scheduled between 8:30 AM and 11:30 AM, including Fed Chair Powell’s testimony, which is expected to inject volatility into the marketplace. If traders choose to participate on this day, they should understand it’s a lower probability trading day.

Friday:

Marked by the anticipation of the Non-Farm Payrolls (NFP) numbers, after the release of this high-impact news, there is expected to be a volatility injection into the markets, potentially offering optimal trading opportunities. It’s noted that trading ahead of such high-impact news is not recommended. Instead, traders are advised to wait and observe the liquidity and inefficiencies that unfold post-news. For higher probability setups, consideration can be given to the 10-11 AM Silver Bullet or the PM session.

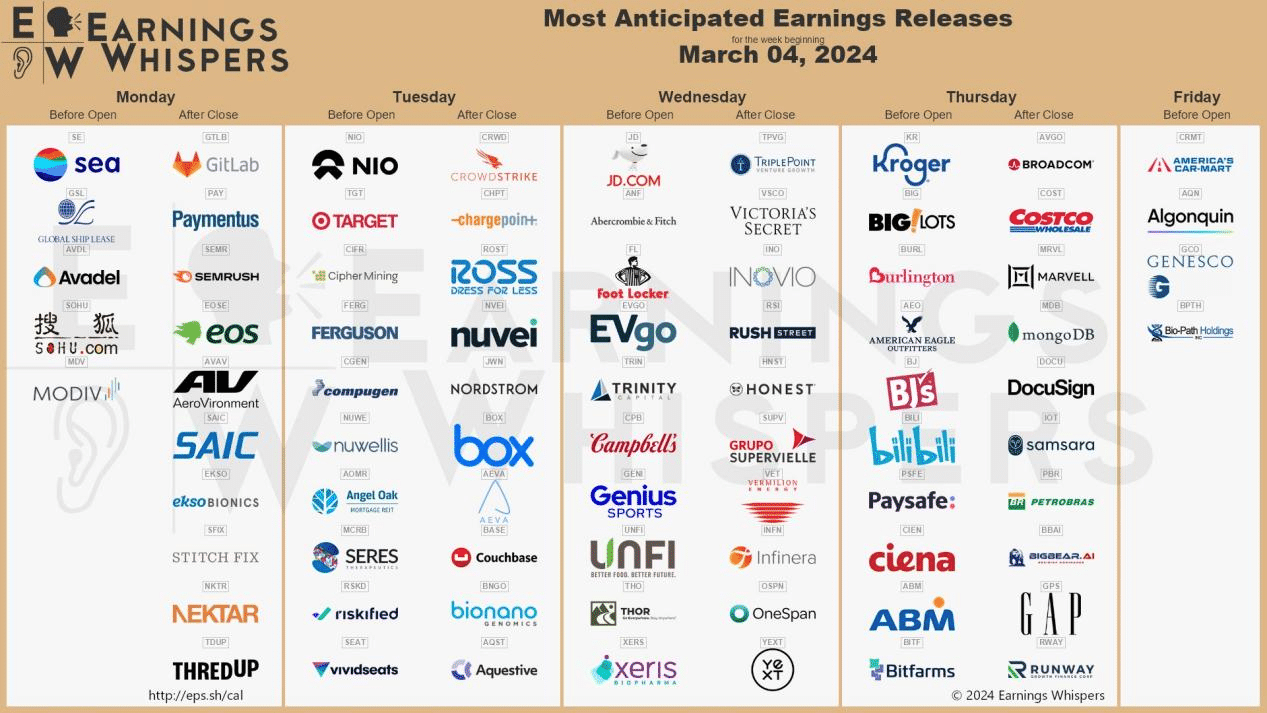

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports, with several large-cap institutions scheduled to release theirs. Specifically, SEA, MARVELL, and COSTCO are in focus this week, and traders should expect notable volatility and potential consolidation in the lead-up to these reports.

The Cot Report For The US Dollar

As discussed in the previous week, the US dollar is currently undergoing a temporary consolidation phase on the daily time frame, characterized by a lack of institutional sponsorship and global economic uncertainty. Analysis of the Commitments of Traders (COT) report, with a particular emphasis on commercials involved in hedging activities, indicates that commercials maintain a net long position. This data reaffirms that commercial entities, including institutions and hedgers, continue to hold more long positions than short positions in the market, with no significant changes observed.

Traders frequently utilize COT reports to glean insights into the positioning of various market participants, enabling them to make informed decisions regarding market trends and potential trading opportunities.

What does this signify for us as traders? The commercials, whose positions we measure to anticipate market directions accurately, are still holding onto their long positions as of the latest data released on Friday. Considering the consolidation on the daily time frame, we will allow for the market to expand on the daily chart before having a long-term projection. As discussed on the Sunday LiveStream we are short-term bearish based on the technicals, for the complete analysis be sure to refer to our Weekly Forecast Livestream.

Happy Trading!

Adora Trading Team