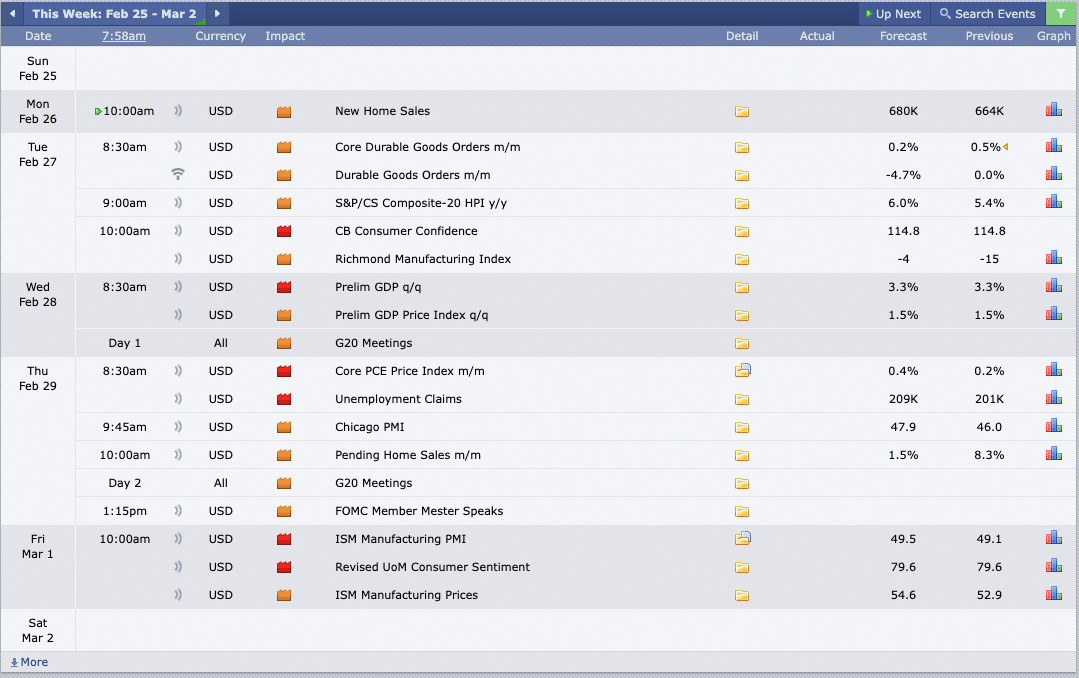

This Week’s Economic Calendar

The past week witnessed a consolidating dollar and expanding indexes, resulting in new all-time highs as the week concluded. American indexes closed on a notably bullish note, indicating promising future prospects. Trading at all-time highs necessitates a focus on buy models until they prove ineffective. Attention remains on the US dollar, awaiting institutional sponsorship to emerge and break the consolidation, providing long-term projections. Exciting weeks lie ahead, prompting adjustments in risk management practices.

Please note that this is not financial advice.*

Monday:

Given the medium folder news driver at 10 am and the recent significant price run on the indexes leading to new all-time highs on the last trading day of the previous week, coupled with it being a Monday, it’s crucial to exercise patience and manage expectations. The recommendation is to wait for the 9:30 opening and then focus on identifying the most probable higher time frame draw on liquidity around the 10 am silver bullet.

Tuesday:

Expect increased market volatility between 8:30 AM and 10 AM due to multiple scheduled news drivers. Anticipate optimal trading opportunities throughout the day, both in the AM and PM sessions.

Wednesday:

Release of the red folder news, expected by 8:30 am, is poised to inject volatility into the markets shortly thereafter. Identifying the most probable higher time frame draw on liquidity post-news release, or alternatively awaiting the 10 am silver bullet, is likely to present optimal trading opportunities.

Thursday:

This brings forth medium and red folder news drivers, starting as early as 8:30 AM and spanning until 1:15 PM, injecting volatility into the marketplace. Similar to the preceding day, this presents potential opportunities in both the AM and PM sessions.

Friday:

Introduces red folder news drivers at 10 AM, coinciding with the Silver Bullet hour. If your weekly profit objectives haven’t been met, redirect your focus to identifying the most probable higher time frame draw on liquidity during the 10 to 11 AM silver bullet window.

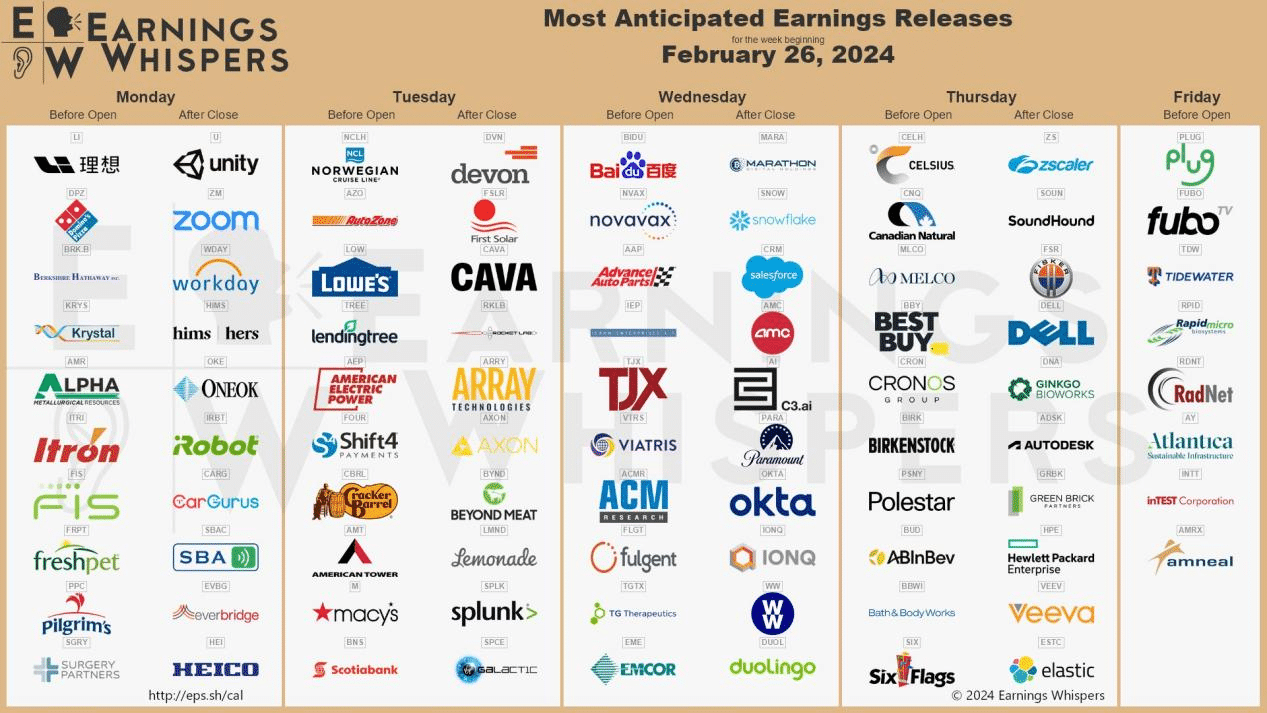

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports, with several large-cap institutions scheduled to release theirs. Specifically, DELL & ZOOM are in focus this week, and traders should expect notable volatility and potential consolidation in the lead-up to these reports.

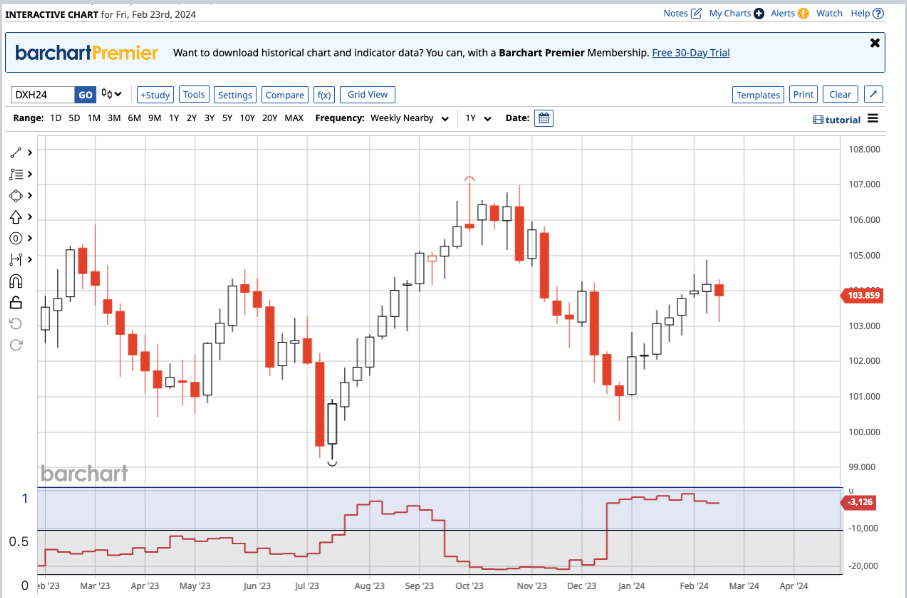

The Cot Report For The US Dollar

Currently, the US dollar is undergoing a temporary consolidation phase on the daily time frame. Analysis of the Commitments of Traders (COT) report, with a particular emphasis on commercials involved in hedging activities, indicates that commercials maintain a net long position. This data reaffirms that commercial entities, including institutions and hedgers, continue to hold more long positions than short positions in the market, with no significant changes observed.

Traders frequently utilize COT reports to glean insights into the positioning of various market participants, enabling them to make informed decisions regarding market trends.

What does this signify for us as traders? The commercials, whose positions we measure to anticipate market directions accurately, are still holding onto their long positions as of the latest data released on Friday. Despite being in a premium fvg on the weekly and consolidation on the daily time frames, to maintain a bullish outlook, we need to break out of the consolidation and continue expanding higher. Based on this data and the current market structure, we will continue to rely on our buy models until order flow indicates otherwise, which would contradict this bias. Overall, our outlook remains bullish.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team