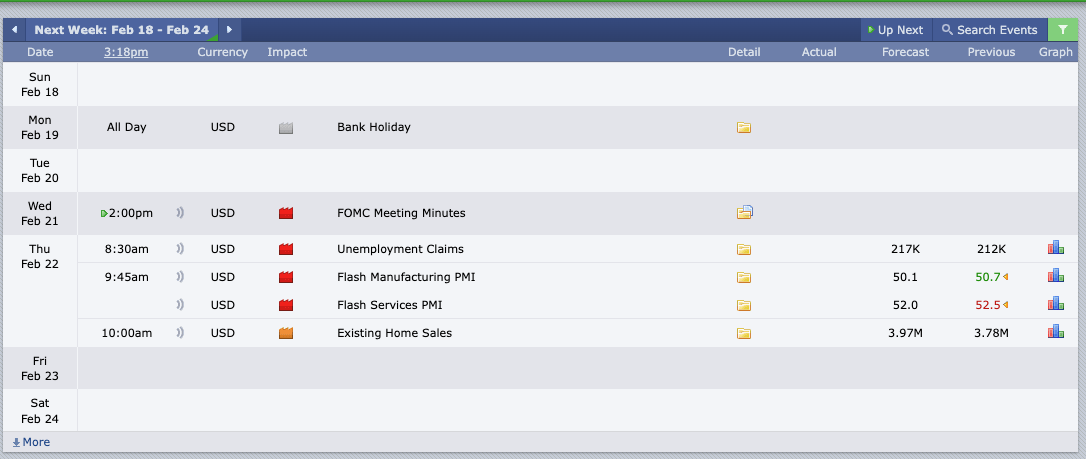

This Week’s Economic Calendar

In the previous week, we remained inside of a range on the higher timeframe Weekly and Daily charts on the Dollar (DXY) and Stock Futures. February is typically a month of expansion according to seasonalities, and we are waiting for higher time frame range expansions. However, until we get that, we’ll continue to scalp on the lower time frames into the most obvious draw on liquidity moving forward.

Please note that this is not financial advice.*

Monday:

Bank holiday – Low volatility, avoid trading.

Tuesday:

Days following a bank holiday can be challenging. This day doesn’t present any significant news drivers. On days like this, we wait for the opening range and then direct our attention to identifying the most probable higher time frame draw on liquidity in the 10 am silver bullet and PM Session.

Wednesday:

FOMC Meeting Minutes at 2 pm. FOMC Minutes are less impactful than the main FOMC decisions. Prioritize either the 10 am Silver Bullet or the last hour of trading.

Thursday:

Multiple news drivers between 8:30 am and 10 am will inject volatility into the markets, likely presenting optimal trading opportunities throughout the day. For higher probability trades, consider 7-8:30 am, 10-11 am Silver Bullet and the pm session.

Friday:

In the absence of significant news drivers on this particular day, it is best to prioritize either the 7-8 am Silver bullet, the 10 am Silver bullet, or the PM Session.

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder for fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often provides strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The entire week’s earnings reports are highlighted, with several large-cap institutions scheduled to release their reports. Specifically, NVIDIA is in the spotlight this week and traders should be prepared for substantial volatility and potential consolidation leading up to the report.

The Cot Report For The US Dollar

The COT report we closely monitor reveals a significant shift in the behavior of commercials, primarily engaged in hedging activities. In recent weeks, these entities transitioned from hedging shorts to establishing long positions. The most recent report, released on Friday, reinforces this sentiment, and bullish up-close candles on the weekly chart have been evident in price delivery.

What does this signify for us as traders? The week that just concluded finished bullish, albeit with a lot of consolidation and high resistance. The market remains bullish until we receive further confirmation suggesting otherwise. Commercials are also net long, reinforcing this sentiment. While the Higher timeframe is bullish, the institutional order flow on the lower timeframes must be closely monitored to confirm or negate this bias as shared in our Pre-market outlook on Youtube.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team