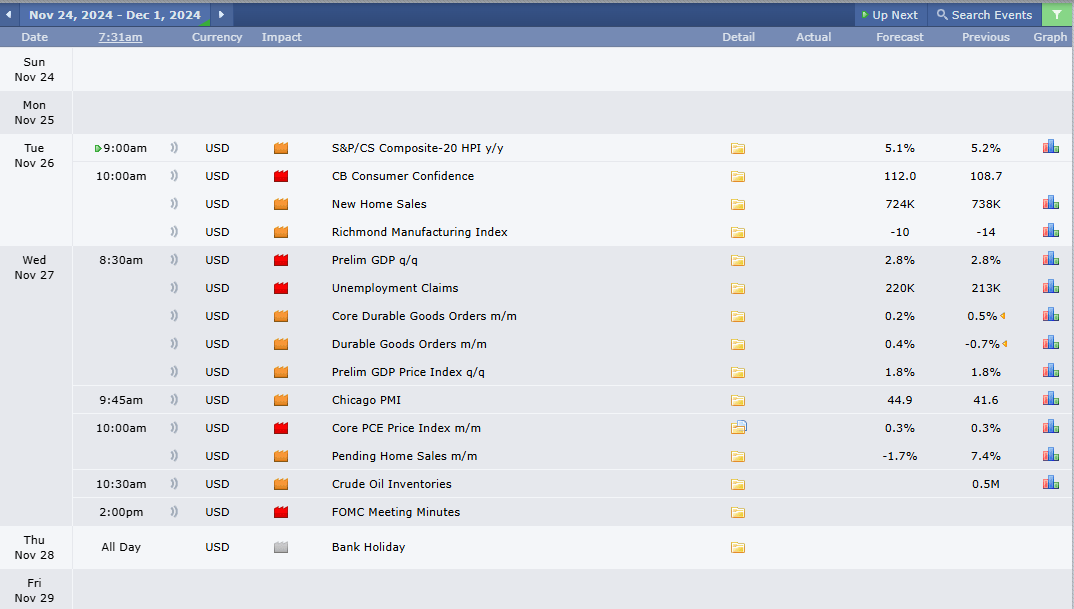

This Week’s Economic Calendar

The just-concluded week delivered yet another bullish close on the U.S. Dollar, marking the ninth consecutive weekly up-closing candles into fund-level stops. The strength in the U.S. Dollar was also reflected across correlated assets, particularly currencies, making new lows. Our focus remains on buy models in a buy program until a significant break in structure is observed within institutional order flow, avoiding premature calls for a market top.

On the other hand, the indices remain range-bound, necessitating managed expectations. We will continue framing price runs into intra-day liquidity that presents themselves as a draw until we leave the range transitioning into an expansionary price delivery profile. Emphasis remains on capital preservation and disciplined risk management, particularly in these conditions, to avoid unnecessary losses or emotional trading tilt.

Looking Ahead:

The upcoming week is data-heavy, with unemployment claims and the FOMC meeting minutes on Wednesday being key highlights. These events are likely to inject significant volatility, and while significant price swings are expected, traders must remain meticulous. Tight risk management remain essential for navigating these evolving market effectively.

Please note that this is not financial advice.*

Monday:

Today brings no major news drivers expected to inject volatility into the marketplace. As it’s Monday and the first trading session after a large range Friday on the Us dollar, exercising patience and managing expectations is crucial. I recommend observing the 9:30 AM equities open, and then focusing on identifying the most probable higher time-frame draw on liquidity, during the 10 AM silver bullet. This approach will help position you for optimal trading opportunities as the market develops.

Tuesday:

Volatility injections are anticipated in the AM session between 9:00 and 10:00 AM, coinciding with the Silver Bullet distribution hour. This is supported by multiple red and medium-impact news drivers expected to inject volatility, creating optimal trading opportunities. Focus on the 10 AM Silver Bullet distribution hour and the PM session for higher probability trade setups.

Wednesday:

Today brings forth the FOMC Meeting Minutes release at 2:00 PM, which is expected to inject volatility into the marketplace. While these minutes are generally less impactful than the main FOMC decisions, we also have several news drivers expected to inject volatility in the AM session, although significantly lower probability for inexperienced traders. Traders are therefore advised to prioritize the 7–8 AM Silver Bullet setup and the last hour of trading for higher probability opportunities.

Thursday:

Bank holiday – Low volatility, avoid trading.

Friday:

The AM session following a bank holiday often presents challenges, typically characterized by consolidation and high-resistance price runs into liquidity and inefficiencies. This is also a day with no significant news drivers expected to inject volatility into the markets. If you haven’t met your weekly profit objectives, allow the opening range to develop, then focus on identifying the most probable higher time frame draw on liquidity during the 10 AM Silver Bullet or the PM session, should a suitable setup present itself.

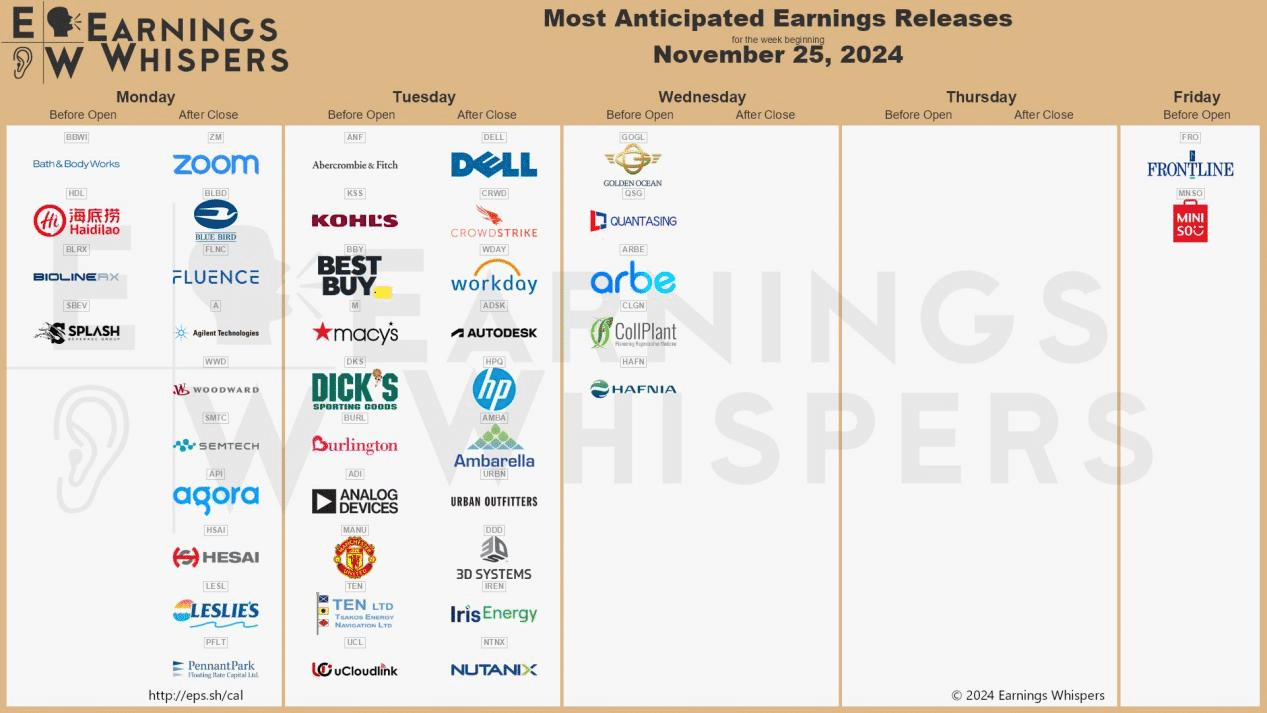

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports from several major large-cap institutions. Key releases to watch include Zoom, Best Buy, Macy’s, CrowdStrike, Dell, HP, Autodesk, and Frontline. These reports are expected to inject significant market volatility, with a likelihood of consolidation leading up to their announcements, especially given the diverse range of sectors represented.

The Cot Report For The US Dollar

For the ninth consecutive week, the U.S. Dollar has closed bullish on the weekly time-frame, continuing its strong upward trajectory. This continuous one-sided buy-side delivery has taken out fund-level stops, delivering the premium targets anticipated and shared in last week’s newsletter.

The just-released COT report on Friday further validates this outlook, highlighting continued accumulation and long hedging by commercial players. Following the retracement into a discount weeks ago, commercials have positioned net long, reinforcing a bullish narrative for both the short and long term. This suggests that the large ranges observed are likely to continue unless proven otherwise by a significant break in market structure within institutional order flow moving forward.

What does this signify for us as traders? Pending any shift within institutional order flow, we maintain a bullish outlook with 109.00 and 110.00 set as intermediate price targets.

Seasonal Tendencies

The US Dollar

November is slowly wrapping up, marked by a strong bullish monthly candle, as anticipated with the use of the seasonal data and other precision element being in correlation. Premium targets have been delivered, with fund-level stops effectively taken out. Based on seasonal tendencies, the latter weeks of November are expected to witness a retracement into the range, potentially closing the last week month with a bearish weekly candle. This can also be anticipated on the technical charts, given how we trade within the weekly fair value gap we are currently at.

While seasonal tendencies suggest a weaker dollar to close the month, confirmation from institutional order flow is essential to validate this shift. Until proven otherwise, the bullish bias remains intact. However, close attention must be paid to newly created highs, which may signal the potential for a reversal if confirmed with a break in structure moving forward.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team