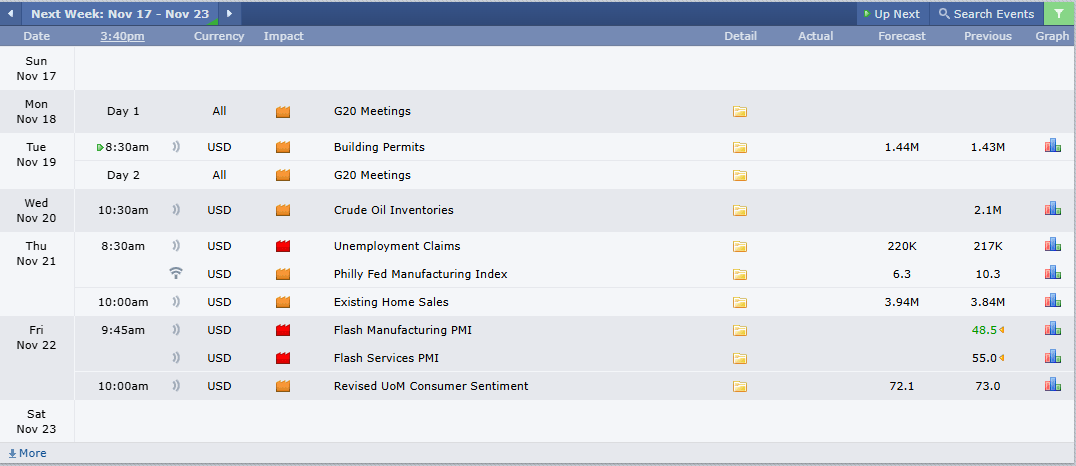

This Week’s Economic Calendar

The previous week was characterized by a fast, one-sided buy-side delivery into targets on the US dollar, confirmed across correlated assets, marked by a repricing into the buy stops of fund-level traders, allowing smart money to offset their already built-up positions into opposing liquidity in a premium.

As smart money continues to buy sell stops at a discount on the higher time-frames, the focus remains on buy models. A buy program is expected to continue until there’s a significant break in structure within institutional order flow, maintaining a bullish outlook for the near term.

Looking ahead, the upcoming week brings key data releases, with unemployment claims at 8:30 AM on Thursday being the highlight. While market ranges remain open, where we can expect significant swings, the emphasis remains on meticulous trading and tight risk management to navigate the evolving markets effectively.

Please note that this is not financial advice.*

Monday:

Today brings no major news drivers expected to inject volatility into the marketplace. As it’s Monday and the first trading session after a large range Friday, exercising patience and managing expectations is crucial. I recommend observing the 9:30 AM equities open, and then focusing on identifying the most probable higher time-frame draw on liquidity, during the 10 AM silver bullet. This approach will help position you for optimal trading opportunities as the market develops.

Tuesday:

A Medium impact news drivers is expected to hit the markets at 8:30 AM, injecting volatility. As a result, today is expected to present optimal trading opportunities. Focus on identifying the most probable higher time-frame draw on liquidity post-news release or, alternatively, wait for the 10 AM Silver Bullet window to frame low risk,high probability setups.

Wednesday:

Expect heightened market volatility at 10:30 AM due to the impact of scheduled crude oil inventory medium-folder news driver, likely providing price runs to key algorithmic reference points at this time especially on the crude oil futures. Optimal trading opportunities are anticipated throughout both the AM and PM sessions.

Thursday:

Volatility injections are anticipated in the AM session between 8:30 and 10:00 AM, coinciding with the Silver Bullet distribution hour. This is supported by red and medium-impact news drivers expected to inject volatility, creating optimal trading opportunities. Traders are encouraged to identify the most probable higher time frame draw on liquidity following the 8:30 news release, or alternatively, wait for the 10 AM Silver Bullet to frame low-risk, high-probability setups.

Friday:

Expect heightened market volatility between 9:45 AM and 10:00 AM due to the impact of Red and medium-folder news drivers expected to flood the market throughout the AM session coinciding with the Silver Bullet distribution hour. If you haven’t met your weekly profit objectives, shift your focus to identifying the most probable higher time frame draw on liquidity during the 10 AM Silver Bullet window or the PM session, should a suitable setup present itself.

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports from several major large-cap institutions. Key releases to watch include Walmart, Lowe’s, Medtronic, Target, NVIDIA, Warner Music Group, Copart, UGI Corporation, and Trip.com. These reports are expected to inject significant market volatility, with a likelihood of consolidation leading up to their announcements, especially given the diverse range of sectors represented.

The Cot Report For The US Dollar

All targets given in the previous week delivered low-resistance, repricing into premium targets with speed, taking out the buy stops of fund-level traders. This allowed smart money to effectively offload their positions, which were built in a discount, at a premium price, closing out. A market top cannot be called just yet until confirmed by a break in structure to the downside—we remain bullish until proven otherwise.

The just-released COT reports, which came out on Friday, continue to confirm further accumulation and building of long hedges by commercial players, following the short retracement into a discount a few weeks back on the commercial hedging program we monitor. With commercials net long, this supports the outlook for continued upside on the U.S. Dollar, both in the short and long term, suggesting that the large ranges we’ve been experiencing are likely to continue.

What does this signify for us as traders? We remain bullish with 107.23, 107.91, and 108.5 set as intermediate-term targets.

Seasonal Tendencies

The US Dollar

Seasonal tendencies for November continue to confirm an expectation of further upward repricing towards premium targets, particularly with a series of up-close weekly bullish candles and unfilled Fair Value Gaps (FVG) seen on the technical charts in correlation. This is a strong indication that the algorithm is in a hurry to reprice into targets. November also kicked off with a strong bullish candle, establishing an intermediate-term low early in the month as anticipated by the seasonal data.

Given the current institutional market structure, bolstered by interest rate dynamics and COT reports, our outlook remains bullish. We maintain our targets at 108.00 for the near to longer term, relying on institutional order flow for optimal positioning. We will only adjust this stance upon clear evidence of a market structure break moving forward.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team