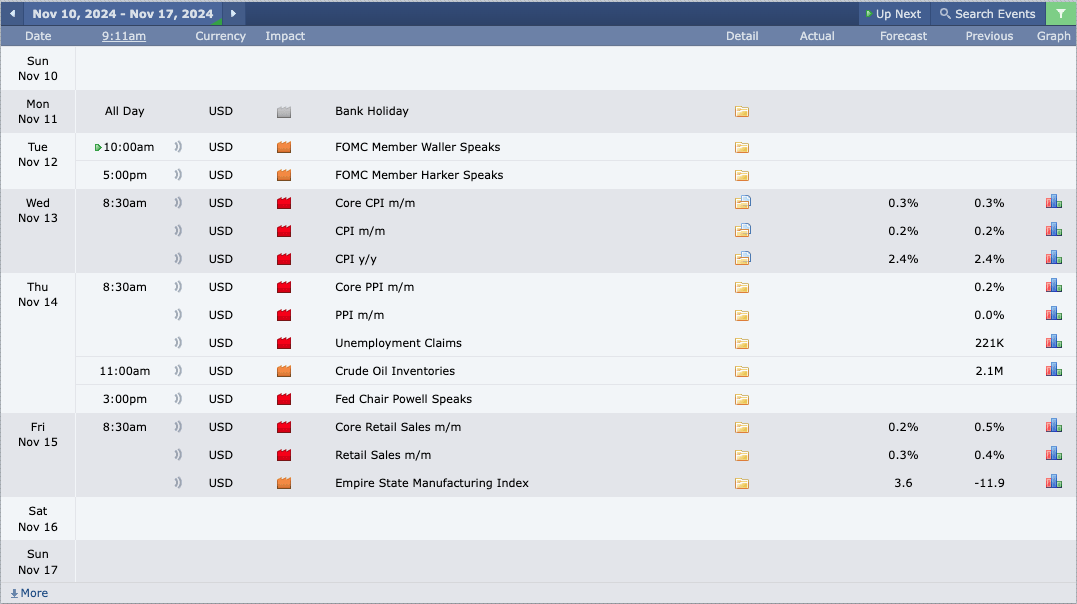

This Week’s Economic Calendar

In a pivotal decision for the U.S. economy, the Federal Reserve recently cut interest rates by 25 basis points in the latest FOMC announcement. This follows the historic 2024 presidential election results earlier this week, which saw Donald Trump return to the White House, injecting significant volatility into the U.S. dollar, indices, and stock markets—all closing bullish on the weekly time frame, reinforcing the alignment between technicals and fundamentals.

With sell stops being bought by smart money at a discount on the higher timeframes, we remain aligned with institutional order flow, maintaining a bullish outlook in the near term. While counter-trend trades can be taken on lower timeframes to reprice to intraday liquidity, the best low-risk, high-probability setups will continue to appear when trading in line with the higher timeframe weekly and daily institutional order flow.

Looking ahead, the upcoming week brings critical data releases, with the CPI inflation numbers on Wednesday at 8:30 AM being the primary focus.

Please note that this is not financial advice.*

Monday:

Bank holiday – Low volatility, avoid trading.

Tuesday:

The AM session following a bank holiday often presents challenges, typically characterized by consolidation and high-resistance price runs into liquidity and inefficiencies. Given that today marks the first trading day of the week (effectively a “Monday”), it’s essential to manage expectations and exercise patience.

Traders should treat it like a regular Monday—allow the opening range to develop, then focus on identifying the most probable higher time frame draw on liquidity, during the 10 AM Silver Bullet, supported by medium-impact news drivers anticipated to inject volatility. The PM session is best avoided to protect capital in lower probability high resistance price delivery in anticipation of the CPI numbers on Wednesday.

Wednesday:

This day brings the anticipation of the CPI numbers at 8:30 am, which is expected to inject significant volatility into the market following the news release. While we typically avoid trading ahead of high-impact news driver, the post-news release reveals liquidity and inefficiencies that can be capitalized on as a draw. Focus on the 10 AM Silver Bullet distribution hour and the PM session for higher probability trade setups.

Thursday:

Expect heightened volatility in the AM session due to multiple key red- and medium-impact news drivers scheduled between 8:30 and 11 AM. Focus on identifying the most probable higher timeframe draw on liquidity post-news release or, alternatively, wait for the 10 AM Silver Bullet window to frame low risk, high probability setups. However, the PM session should be avoided entirely.

Friday:

Red & Medium-impact news drivers are scheduled for 8:30 am. Traders should anticipate volatility injections that could facilitate smoother trades presenting high-probability, low-risk trade setups into a pool of liquidity or re-balancing inefficiencies. If you haven’t met your weekly profit objectives, focus on identifying the most probable higher time frame draw on liquidity during the 10 AM Silver Bullet window or in the PM session, should a suitable setup present itself.

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports from several major large-cap institutions. Notable releases include Shopify, Hertz, Spotify, Home Depot, Sea, Cisco, NICE, Alibaba Group, and Aramark. These key players are expected to drive heightened market volatility, with potential consolidation likely leading up to their report releases particularly given the diverse sectors represented.

The Cot Report For The US Dollar

We’re seeing yet another bullish weekly close, marking the 6th consecutive week of strength as the market continues to reprice into premium targets. This is driven by the volatility surrounding the U.S. presidential elections and the recent FOMC rate cut, further confirming a near-term bullish outlook. Unless we observe any shifts in institutional order flow or major fundamental disruptions, institutional bullish orderflow appears poised to continue.

Commercial players remain firmly bullish, holding onto their long positions and hedges. Friday’s data highlights an expansion in commercial long positions, indicating that smart money is accumulating at discounted levels with expectations of repricing into opposing liquidity—reinforcing a bullish stance. With commercials net long, this supports the outlook for continued upside on the U.S. Dollar, both in the short and long term, suggesting that the large ranges we’ve been experiencing are likely to remain and continue.

What does this signify for us as traders? For us, this outlook solidifies a bullish bias on the U.S. Dollar into the upcoming week, with no clear signs of a reversal. Both technical and fundamental factors support this bias. Intermediate-term targets are set at 105.25, 106.00, and 106.50, giving us clear objectives to aim for as we remain align with the ongoing institutional order flow.

Seasonal Tendencies

The US Dollar

We’ve closed the first week of November with a bullish up-close weekly candle, in line with anticipated seasonal tendencies. Historically, the first two weeks of November tend to show continued strength, followed by a potential softening and an intermediate-term high as we approach the latter part of the month, which could close bearish.

Given the current institutional market structure, supported by interest rate triads and COT reports, our stance remains bullish until there are clear signs to the contrary. Our targets remain set at 106.00 in the near to longer term, with a focus on aligning with institutional order flow for optimal positioning.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team