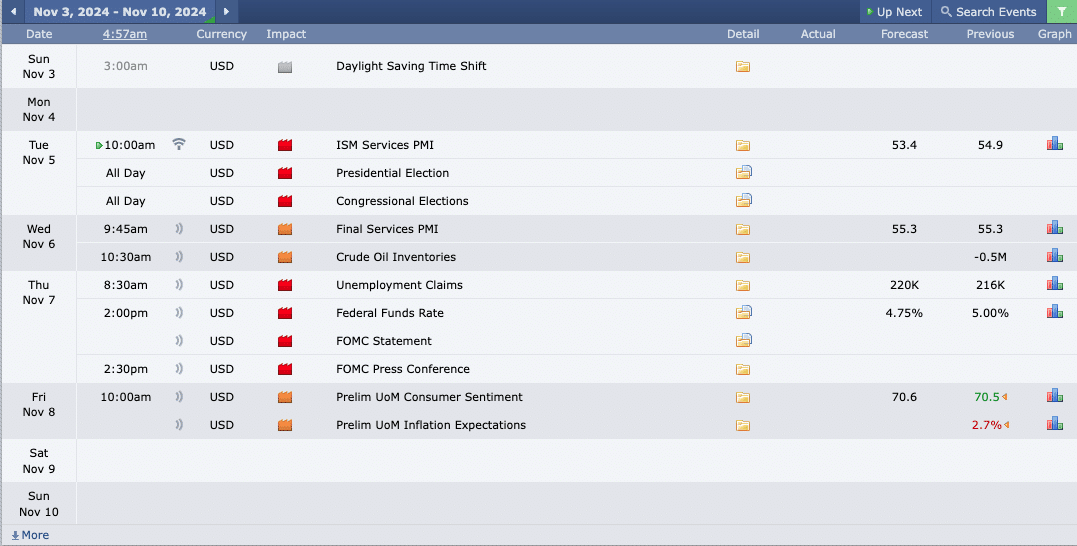

This Week’s Economic Calendar

Over the past week, more than $950 billion was wiped off the U.S. stock market in a single day, with the Nasdaq repricing with speed into discount targets alongside other indices. This underscores the importance of our last three newsletters, which have consistently emphasized risk management and capital preservation in these conditions—especially as the U.S. elections approach.

Fund-level traders and deep-pocketed investors are risk-averse, wary of taking on more exposure amid heightened uncertainty. You should be as well, prioritizing risk management and keeping capital reserved for cleaner days.

Similarly this extends to the U.S. dollar, as the heightened volatility continues to be reflected across correlated assets: playing out as anticipated, allowing smart money to swiftly reprice, targeting fund-level stops above market price to distribute their positions. With discount levels still supporting price and the bullish institutional buy program intact, expectations for higher prices in the near term remain valid unless a significant break in structure occurs within institutional order flow.

Looking ahead, the upcoming week brings critical data releases, with the FOMC rate decision and press conference on Wednesday at 2 PM being the primary focus.

Please note that this is not financial advice.*

Monday:

Given today is the first trading day following a large range week on the indices, marked by a significant repricing into discount targets, patience and managed expectations are key. No major economic news is expected to inject volatility today. I recommend watching the 9:30 AM equities open and then focusing on the 10 AM Silver Bullet to identify the most probable higher-timeframe draw on liquidity for optimal trading opportunities.

Tuesday:

Expect heightened volatility in the AM session due to key red-folder news drivers scheduled for 10 AM, coinciding with the Silver Bullet hour and the upcoming presidential and congressional elections. Avoid taking on risk today; focus on protecting your capital amid anticipated lower probability, high-resistance price delivery and potential violent swings. It’s best to stay out completely.

Wednesday:

Medium-impact drivers are expected to hit the markets between 9:45 and 10:30 AM, injecting volatility. As a result, today is expected to present optimal trading opportunities. Focus on identifying the most probable higher timeframe draw on liquidity post-news release or, alternatively, wait for the 10 AM Silver Bullet window to frame low risk,high probability setups.

Thursday:

Heightened market volatility is expected in the PM session, driven by the FOMC rates and press conference scheduled between 2-2:30 PM, likely leading to consolidation ahead of the event. During the event, there may be periods of heightened volatility and whipsaws in the market.Traders, especially those with less experience, should manage expectations carefully. The recommended focus should be on the 7-8 AM Silver Bullet window, or, for those experienced enough to handle increased volatility, consider setups post-2:30 PM after the FOMC event.

Friday:

Medium-impact news drivers are scheduled for 10 Am. Traders should anticipate volatility injections that could facilitate smoother trades presenting high-probability, low-risk trade setups into a pool of liquidity or re-balancing inefficiencies. If you haven’t met your weekly profit objectives, focus on identifying the most probable higher time frame draw on liquidity during the 10 AM Silver Bullet window or in the PM session, should a suitable setup present itself.

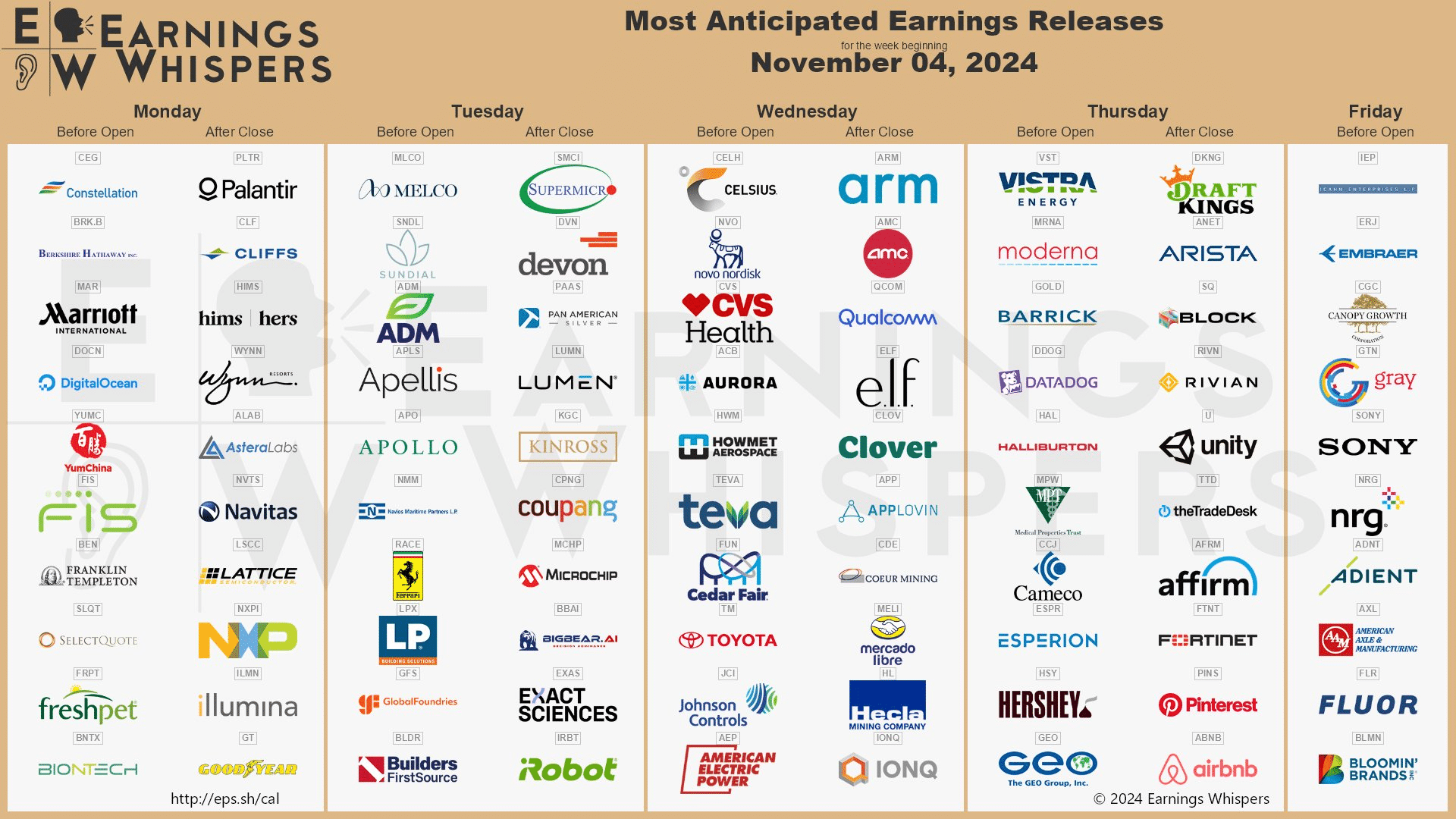

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports from several major large-cap institutions. Notable releases include BioNTech, CVS Health, AMC, Toyota, Unity, Airbnb, Embraer, Sony, and Barrick. These key players are expected to drive heightened market volatility, with potential consolidation likely leading up to their report releases particularly given the diverse sectors represented.

The Cot Report For The US Dollar

The previous week closed strongly bullish on Friday, with the U.S. Dollar closing at 104.31,facilitated by the volatility injected into the market place using the NFP numbers as the catalyst. This confirms a near-term bullish outlook, barring any shifts in institutional order flow or fundamental disruptions.

As we enter the new week, commercial players remain firmly bullish, holding their long positions and hedges tightly. Friday’s data shows a minor reduction in commercial longs, indicating some profit-taking and smart money accumulation at discounted prices. However, they remain net long, reinforcing expectations for continued upside on the U.S. Dollar both in the short and long term. This suggests that larger ranges are likely to continue.

What does this signify for us as traders? For us as traders, this outlook keeps our bias on the U.S. Dollar bullish, supported by both technical and fundamental factors. Intermediate-term targets are set at 104.85, 105.25, and 106.00.

Seasonal Tendencies

The US Dollar

As expected, we’ve seen a bullish monthly close on the U.S. Dollar, with minimal wick-to-body ratio, underscoring its strength and signaling potential for more upside as the year concludes. Seasonally, trends indicate continued strength into the first two weeks of November, with some softening expected in the final stretch of the month, likely closing bearish.

Given the institutional market structure in place, our stance remains bullish until proven otherwise. Forecasts predicting a potential dip will need technical validation to support the data. For now, the focus is on expecting smart money repricing into premium draw on liquidity price levels, targeting traders’ stop-losses above current market price, with near-term targets set at 105.80 and 106.00

We Are Bullish!

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team