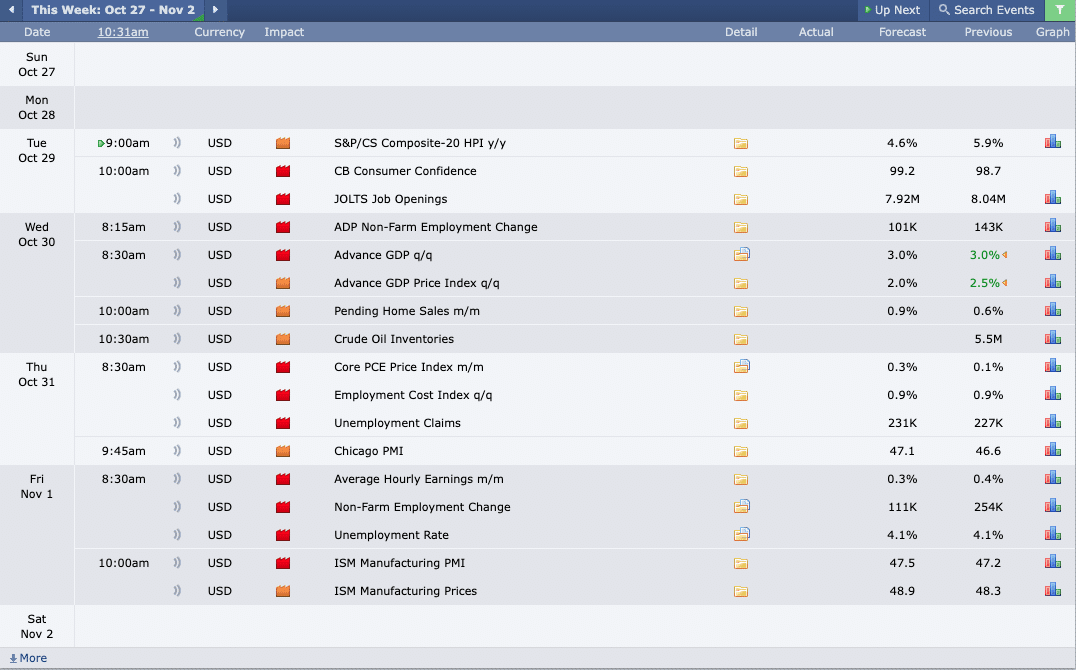

This Week’s Economic Calendar

Over the weekend, a series of significant events unfolded, including escalating tensions in the Middle East, news of extended trading hours, and growing anticipation as the U.S. presidential election approaches—all building up the excitement for the current week ahead. These mutually exclusive events alone are market movers, and in a series of continuous succession, they’re expected to bring heightened volatility in the coming week. This has been particularly evident in the U.S. dollar, rapidly repricing toward premium targets, reaching for Fund level stops above market price and re-balancing inefficiencies closing yet another bullish weekly candle.

While these world events may seem concerning, they present excellent opportunities for traders. Heightened volatility creates ideal conditions for smart money to exploit. Market makers leverage this volatility to reprice assets toward set targets with speed, enabling significant distribution by institutional players into opposing liquidity, which translates into low-risk, high-probability trading setups.

Emphasizing risk management remains crucial as we navigate these market opportunities, especially with the focal point being the NFP numbers set for release on Friday at 8:30 a.m.

Please note that this is not financial advice.*

Monday:

Given that it’s the first day of NFP (Non-Farm Payrolls) week, combined with the last trading week of the month and a Monday, it’s crucial to exercise patience and manage expectations. No major economic news driver is expected to inject volatility into the marketplace today. I recommend observing the 9:30 AM equities open, then focusing on identifying the most probable higher-timeframe draw on liquidity during the 10 AM silver bullet, positioning you for optimal trading opportunities as the market develops

Tuesday:

Expect heightened volatility in the AM session due to multiple key red- and medium-impact news drivers scheduled between 9 and 10 AM, coinciding with the silver bullet hour. This marks the second most probable trading day pre-NFP. Both the AM and PM sessions should offer low-risk, high-probability opportunities.

Wednesday:

Volatility injections are anticipated in the AM session between 8:15 and 10:30 AM, coinciding with the Silver Bullet distribution hour, facilitated by multiple red and medium folder news drivers expected to inject volatility. This will likely provide price runs to algorithmic reference points, presenting optimal trading opportunities. Traders are advised to focus on the 10 AM Silver Bullet and conclude their trading day by 12 noon to protect capital in lower probability high resistance price delivery in anticipation of the NFP numbers on Friday.

Thursday:

Heightened market volatility is expected between 8:30 AM and 9:45 AM, driven by red- and medium-impact news releases flooding the AM session. As the day preceding the Non-Farm Payrolls (NFP) report, price action will likely deliver within the context of high-resistance, low-probability trading conditions. Traders should exercise caution, recognizing it as a lower-probability day—especially for those with less experience.

Friday:

Marked by the anticipation of the Non-Farm Payrolls (NFP) numbers, there is an expectation of heightened volatility in the markets following the release of this high-impact news, potentially offering optimal trading opportunities. However, it’s important to note that trading ahead of such high-impact news is not recommended due to increased uncertainty and risk. Instead, traders are advised to wait and observe the liquidity and inefficiencies that unfold after the news release. For higher probability setups, consideration can be given to trading during the 10-11 AM Silver Bullet window and the PM session.

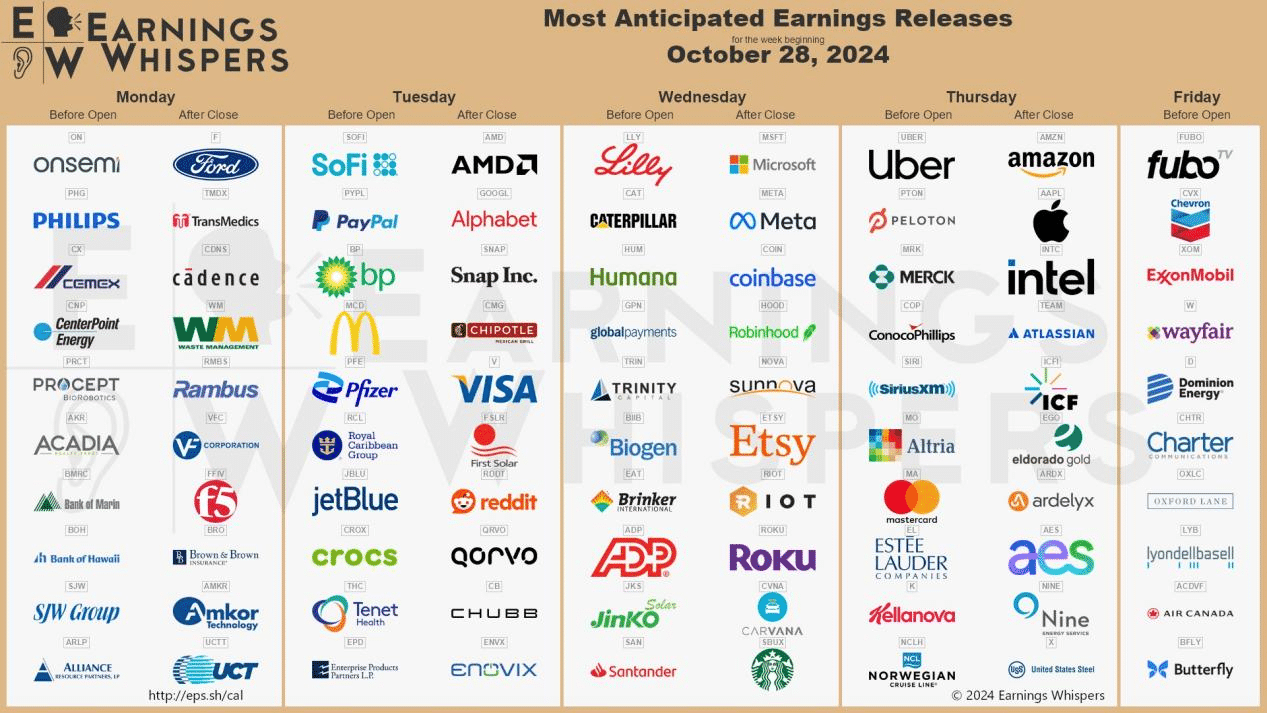

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week centers on earnings reports from major large-cap institutions, including Philips, Ford, AMD, PayPal, BP, JetBlue, Alphabet, McDonald’s, Visa, Microsoft, Meta, Starbucks, Coinbase, Intel, Uber, Amazon, ExxonMobil, Chevron, and Air Canada. These key players are expected to drive heightened market volatility, with potential consolidation likely leading up to their report releases.

The Cot Report For The US Dollar

Given recent global economic events, commercial players we track have been notably active, taking significant risks and increasing hedges—as reflected in the U.S. dollar’s premium repricing and bullish weekly closes over the past five weeks. It must feel like having the “lottery numbers” handed right to you, with our expectations being delivered seamlessly. The U.S. dollar remains bullish in the near term, pending any shift in institutional order flow or fundamental disruptions.

As we head into the new week, the narrative holds. Commercials are still long with existing positions fully intact, underscoring the anticipation of higher prices. While few new positions were added last week, the strong bullish stance persists until proven otherwise. This reinforces expectations of continued upside for the U.S. dollar, both in the short and long term, signaling that larger ranges should remain continually anticipated.

What does this signify for us as traders? We remain bullish on the U.S. dollar until proven otherwise by institutional order flow and price action, with targets at 104.81, 105.30, and 106.10 in sight.

Seasonal Tendencies

The US Dollar

As October draws to a close, it sets the stage for November with seasonal tendencies indicating a strong, bullish October finish—likely a candle with little to no wick, signifying robust strength after the intermediate-term low was confirmed earlier this month. Given the alignment of technical charts and fundamental factors, the U.S. dollar remains positioned for strength, with higher prices anticipated in the coming week, characterized by low-resistance delivery and significant price runs into targeted levels.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team