This Week’s Economic Calendar

Continued repricing into premium targets was witnessed in the previous week, as outlined in the newsletter and during the Sunday pre-market live stream, confirming bullish institutional order flow. Additionally, escalating tensions, particularly in the Middle East, with the looming threat of war, continue to put the global economy on high alert. This has translated into heightened volatility for the US dollar and correlated assets, playing out as anticipated and facilitating the swift repricing for smart money to exploit, targeting fund-level stops above market price to distribute their positions.

With discount levels still supporting price and the bullish institutional buy program intact, the expectation of higher prices in the near term remains valid until a significant break in structure is observed within institutional order flow.

Please note that this is not financial advice.*

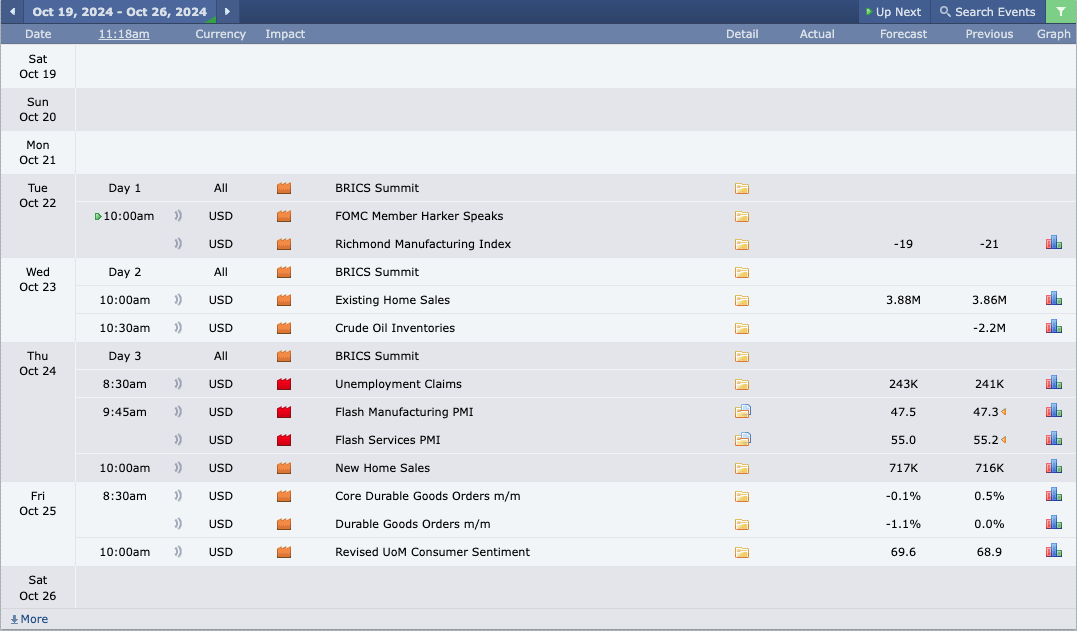

Monday:

Today brings no major news drivers expected to inject volatility into the marketplace. As it’s Monday and the first trading session after the weekend, exercising patience and managing expectations is crucial. I recommend observing the 9:30 AM equities open, and then focusing on identifying the most probable higher timeframe draw on liquidity, during the 10 AM silver bullet. This approach will help position you for optimal trading opportunities as the market develops.

Tuesday:

Expect heightened volatility in the AM session due to multiple key medium-impact news drivers slated for 10 AM, coinciding with the silver bullet hour. Both the AM session and PM should create low-risk, high-probability opportunities.

Wednesday:

Expect heightened market volatility between 10 and 10:30 AM due to the impact of scheduled medium-folder news drivers, likely providing price runs to key algorithmic reference points at this time. Optimal trading opportunities are anticipated throughout both the AM and PM sessions.

Thursday:

Volatility injections are anticipated in the AM session between 8:30 and 10:00 AM, coinciding with the Silver Bullet distribution hour. This is supported by red and medium-impact news drivers expected to inject volatility, creating optimal trading opportunities. Traders are encouraged to identify the most probable higher time frame draw on liquidity following the 9:45 news release, or alternatively, wait for the 10 AM Silver Bullet to frame low-risk, high-probability setups.

Friday:

Medium-impact news drivers are scheduled for 8:30 and 10 AM, respectively. Traders should anticipate volatility injections that could facilitate smoother trades presenting high-probability, low-risk trade setups into a pool of liquidity or re-balancing inefficiencies. If you haven’t met your weekly profit objectives, focus on identifying the most probable higher time frame draw on liquidity during the 10 AM Silver Bullet window or in the PM session, should a suitable setup present itself.

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week is centered around earnings reports, with several large-cap institutions scheduled to release theirs, including Verizon, Tesla, Coca-Cola, AT&T, IBM, UPS, Nasdaq Inc., 3M, Aon, CN, and Carrier. Traders should anticipate increased volatility and potential consolidation in the lead-up to these reports.

The Cot Report For The US Dollar

Once again, the targets outlined in this newsletter, based on insights from the Commitment of Traders (COT) report, seasonal tendencies, technical analysis, and other tools, have been delivered. The low-hanging fruit target at 103.8, highlighted last week, has been met, closing with another bullish weekly candle at 103.463. Premium targets remain the draw above market price until proven otherwise.

Furthermore, massive hedge long positions continue to be added to the already large long hedge positions by the commercials over the past week. Friday’s data release further confirms the strong expectation of higher prices for the U.S. dollar in the near term, suggesting larger ranges are to be continually anticipated.

What does this signify for us as traders? n simple terms, the US dollar remains bullish until institutional order flow and market structure indicate otherwise.

Seasonal Tendencies

The US Dollar

The seasonal tendencies continue to anticipate higher prices for the US dollar in October, supported by the convergence of 5, 15, and 30-year data trends. This aligns with technical analysis and escalating geopolitical risks, including the threat of war and the upcoming presidential election, reinforcing expectations of higher prices in the near term. As previously mentioned in this newsletter, the live charts over the past weeks have visually confirmed this data, with smart money targeting fund level stops in a premium as a draw. Expect continued upward repricing towards further premium targets into the new week.

We remain bullish!

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team