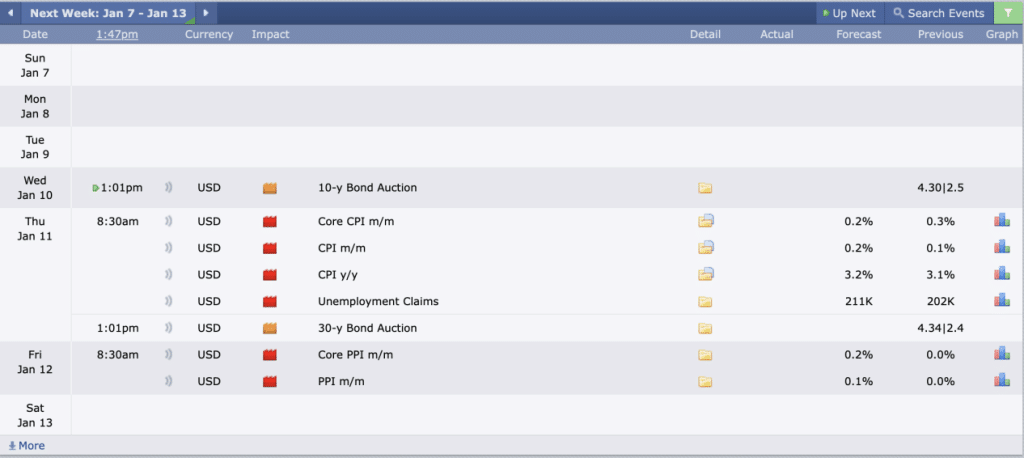

This Week’s Economic Calendar

The holiday season has concluded, marking the end of reduced volume and open interest from speculators due to seasonality. With the beginning of the new year, market ranges are expanding, and liquidity providers (Smart Money) will have more liquidity to turn over. This translates to larger price ranges and low-resistance liquidity runs. To navigate effectively, it’s crucial to stay ahead and be aware of the potential news drivers ahead of us, as well as how to approach them.

Please note that this is not financial advice.*

Monday: There are no significant news drivers, and considering we had NFP on the last trading day of the previous week, coupled with it being a Monday, it emphasizes the importance of exercising patience. The recommendation is to wait for the 9:30 opening and then focus on the most probable higher time frame draw on liquidity.

Tuesday: This day also doesn’t present any significant news drivers. We continue to follow the protocols outlined on Monday, which involve waiting for the opening range and then directing our attention to identifying the most probable higher time frame draw on liquidity in the 10 am silver bullet and PM Session.

Wednesday: This day introduces a medium folder news driver in the PM session, with no news driver in the AM session. However, considering that CPI is scheduled for the next day and might result in consolidations and high resistance liquidity runs, prioritize the 10 am silver bullet or the 7-8 am macro window in the pre-market session with emphasis on being surgical in any executions.

Thursday: This day brings the anticipation of CPI numbers. After the news drops, there will be a volatility injection into the markets, potentially presenting optimal trading opportunities. Although we do not trade ahead of this high-impact news driver, we can after we see what liquidity and inneficiency are in place. Consider focusing on the 10-11 am silver bullet or the PM session for higher probability.

Friday: Introduces red folder news drivers at 8:30 am. Considering we have CPI the day before this can create a large range expansion which can create a consolidation AM Session. If your weekly profit objectives haven’t been met, prioritize the 7-8 am macro, the 10 am silver bullet, or the PM Session.

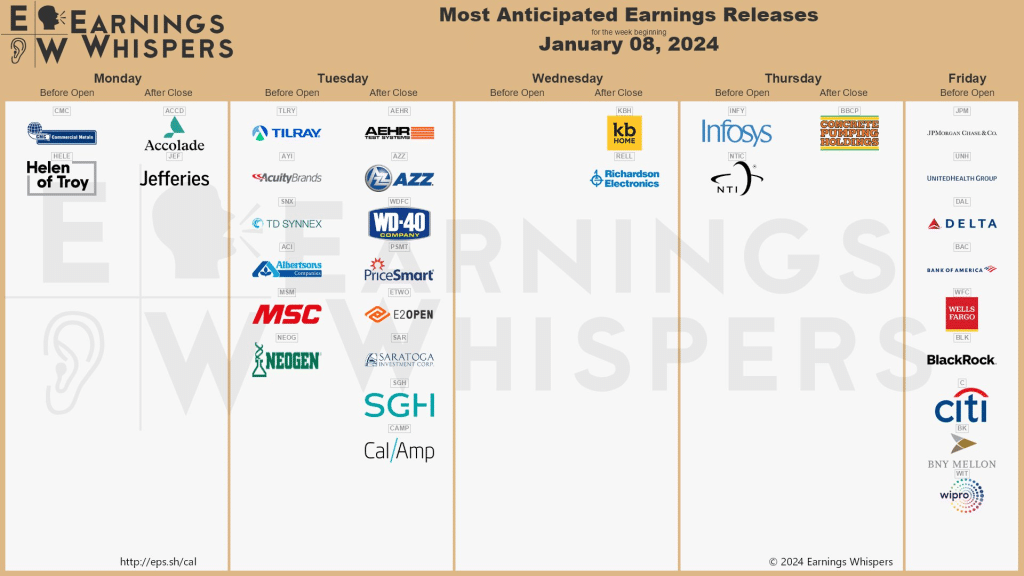

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder for fellow traders – anticipate noteworthy price movements surrounding earnings reports in large cap companies. This period often presents strategic trading opportunities, taking advantage of the heightened volatility for smoother trades.

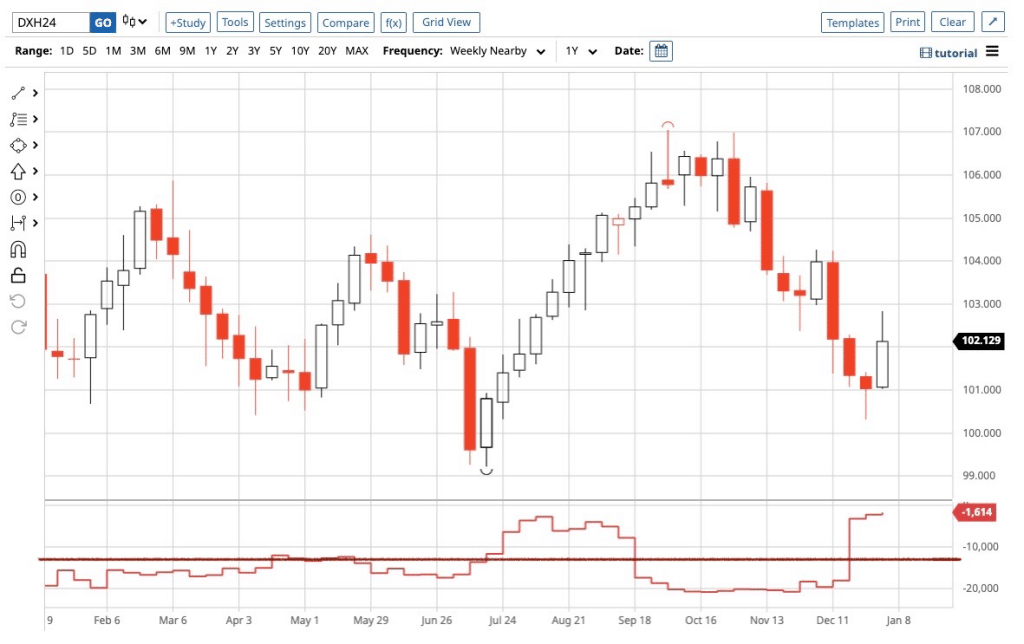

The Cot Report For The US Dollar

The COT report we closely monitor reveals a significant shift in the behavior of commercials, primarily engaged in hedging activities. In recent weeks, these entities transitioned from hedging shorts to establishing long positions. The most recent report, released on Friday, reinforces this change.

What does this signify for us as traders? We should exercise caution regarding potential discount targets moving forward, considering the possibility of a market bottom using this as an early indicator. However, it’s crucial to await confirmation from price action before adjusting our bias, as the large players’ change in direction must be validated by market structure and internal dynamics.

Stay informed for sound decision-making, and always adhere to strict risk management protocols. Until our next update, trade wisely.

Happy Trading!

Adora Trading Team