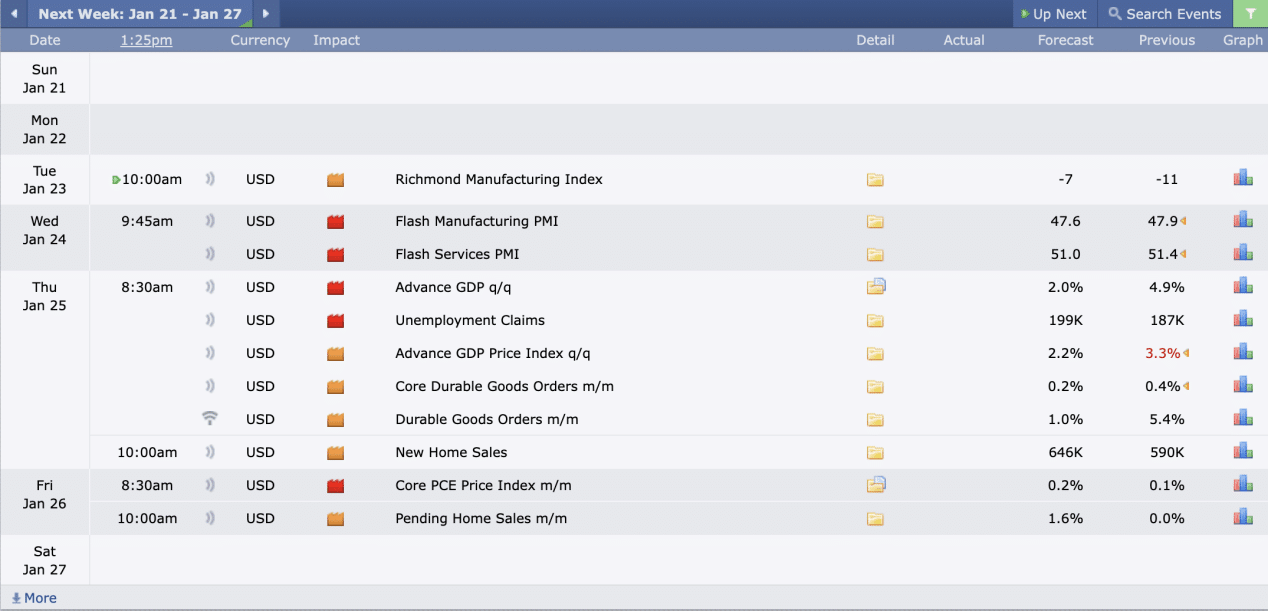

This Week’s Economic Calendar

In the Dollar Index, we have observed an expansion in price action, breaking free from the consolidation that persisted since the beginning of January. This expansion can be attributed to the gradual influx of institutional sponsorship. As traders, our preference leans towards anticipating one-sided price runs on higher time frames when evaluating potential trade setups; the clarity is therefore gradually emerging as January concludes, making way for February, when we anticipate the markets to loosen up, especially considering seasonality. Despite this, it’s worth noting that volume is still gradually increasing.

Money managers, fund managers, and hedge funds are slowly becoming more active, gradually assuming risk as we transition from January to February. This shift is evident in the price action, with ranges opening up and larger price moves becoming more apparent.

In 2024, given the current global events and circumstances, we anticipate larger price swings and increased market expansion. While this is positive news for traders, it also serves as a reminder to adjust risk management accordingly.

Please note that this is not financial advice.*

Monday:

With no significant news drivers and considering the larger price run on the indexes that created new all-time highs on the last trading day of the previous week, coupled with it being a Monday, it underscores the importance of exercising patience and managing expectations. The recommendation is to wait for the 9:30 opening and then focus on identifying the most probable higher time frame draw on liquidity.

Tuesday:

Medium impact news driver at 10 am. We continue to follow the protocols outlined on Monday, which involve waiting for the opening range and then directing our attention to identifying the most probable higher time frame draw on liquidity during the 10 am silver bullet and PM Session.

Wednesday:

Red folder news drivers at 9:45 am will serve as volatility injections into the markets. Consequently, the day is expected to present optimal trading opportunities. Consider the 10-11 am Silver bulllet or the PM session for higher probability trades.

Thursday:

This day brings in red and medium folder news drivers at 8:30 and 10 AM, injecting volatility into the marketplace. Similar to the preceding day, this presents optimal trading opportunities.

Friday:

Multiple news drivers at 8:30 am and 10 am will serve as volatility injections into the markets. If your weekly profit objectives haven’t been met, prioritize the 8:30 news embargo, 10 am silver bullet, or the PM Session for potential opportunities.

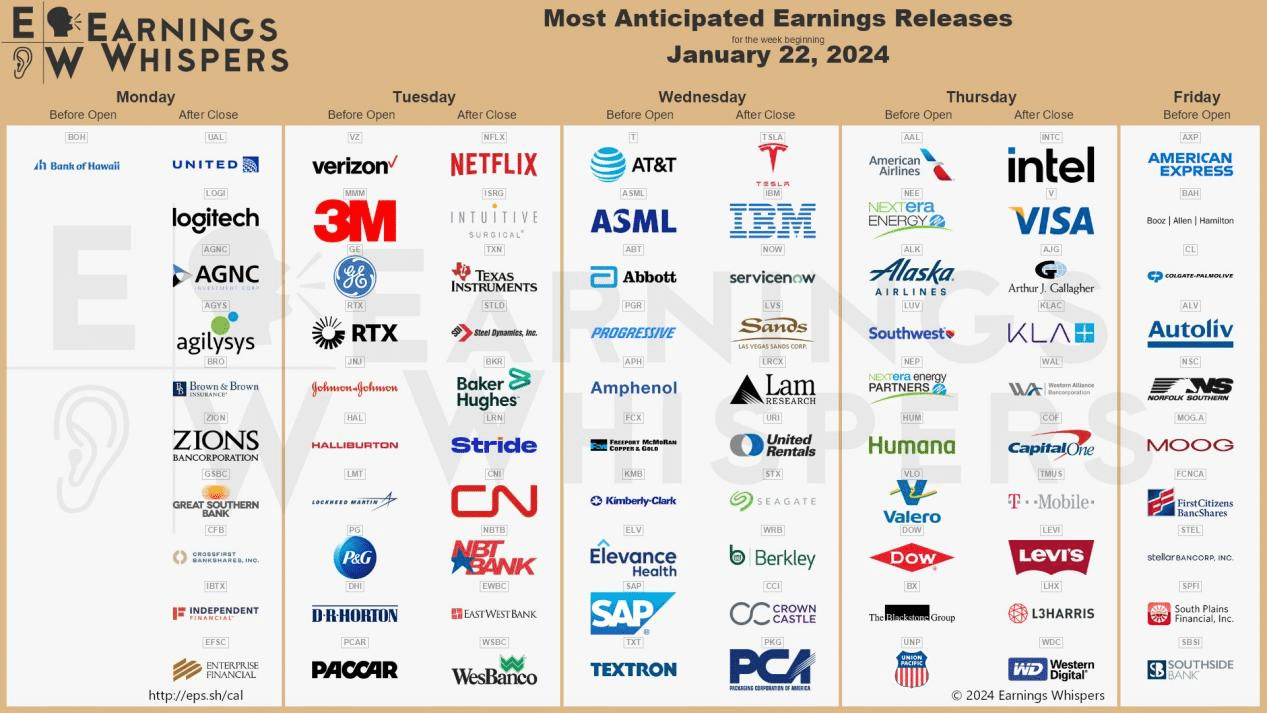

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder for fellow traders – anticipate noteworthy price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, taking advantage of the heightened volatility for smoother trades.

The entire week’s earnings reports are in the spotlight, with several large-cap institutions taking the stage. Expect large surges in volatility around these earnings and potential consolidation ahead of the reports.

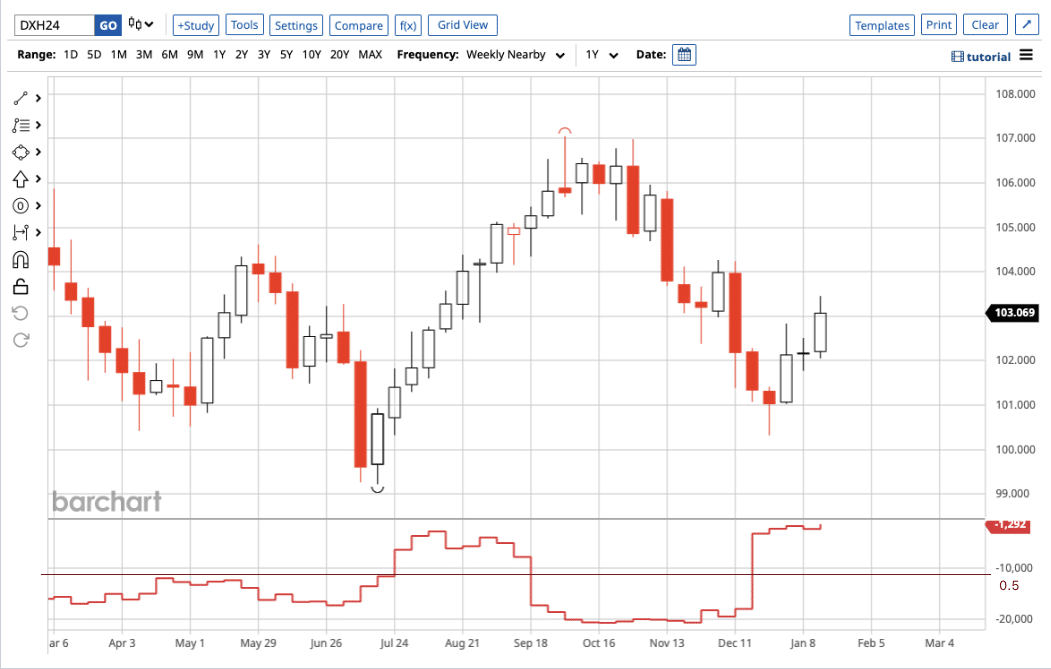

The Cot Report For The US Dollar

The US dollar has finally broken out of the range in which it was held in the last week with an energetic run to the upside. This week’s release of COTs, with a focus on commercials primarily engaged in hedging activities, indicates that commercials remain net long.

What does this signify for us as traders? The repeated indication in the commercials being net long on the dollar is gradually being reflected on the charts by bullish close candles on the weekly time frame, confirming that we may be changing market structure. However, it is still too early to be a long-term bull, but this is a positive indication. The commercials continue to remain net long, strengthening their position, but the displacement and expansion higher must continue for us to have trust that we are finally bullish on the charts. Therefore, exercising caution and waiting for confirmation from market structure before adjusting our bias is still advisable, but the institutional footprints are becoming clearer.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team