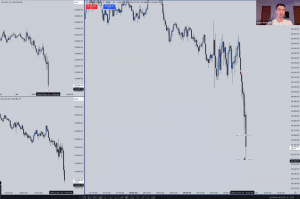

In this video, I guide my private group through a live setup on the NQ (NQZ) futures, using real-time institutional order flow to frame a high-probability trade. This is more than just trade execution—it’s a teaching moment, showcasing how to manage trades effectively while pyramiding positions using logical PD arrays. The goal was to demonstrate how to frame a monster trade into retail buy stops above market price, leveraging order flow and algorithmic price delivery.

As we navigated through price action, I highlighted the importance of taking partials at key levels following a smart money reversal. The trader’s job isn’t just to execute but to ensure they’re rewarded at strategic intervals and paid—a point I emphasize in our weekly live trading calls.

Using the macro window, where we expect price to spool and deliver low risk and high probability, I broke down the market maker buy model (MMBM) in real time, explaining how the algorithm that delivers price will pair up previous ranges of sell-side delivery with the new accumulation leg, matching it with the prior distribution leg. This creates the opportunity to reprice into premium targets after manipulating uninformed money. We look to pair our orders, going long on the buy side of the curve with fair value, which occurs where the distribution took place on the sell side of the curve.

Ultimately, we saw a repricing of over 150 points, with the position closed out for a substantial gain, as the higher time frame narrative and bias I was trading in line with played out exactly as anticipated. This trade, and the way it unfolded, reinforced our models and approach, proving once again that trading with discipline, logic, and clear strategies leads to success.