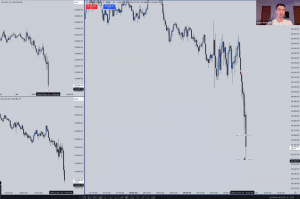

In this video, I guide my private group through a live tape reading session on the NQZ futures, providing a deep dive into institutional order flow and what goes into analyzing price action at a high level. We covered key signatures that traders should look for to confirm or negate a trade, all demonstrated in real time.

How can you trust a trade to keep running in your favor after entering? I explained this by highlighting essential algorithmic signatures, such as breakaway gaps and inversion fair value gaps, which I extended from the other side of the charts to confirm bearish order flow. In this case study, I walked the group through how these elements align to provide measurable insights into price delivery.

When understood it empowers you with renewed confidence in your trades, as you understand how all these factors come together to create a complete price narrative, helping you decide whether to hold a position from the point of entry into a draw on liquidity or to close out at time of day taking profits.

Finally, we observed the market repricing into the sell-side liquidity we anticipated, completing a market maker sell model. As always, the algorithm delivering price references time-based liquidity, including previous session highs and lows, as well as significant daily and weekly levels, reinforcing the underlying structure of price delivery.