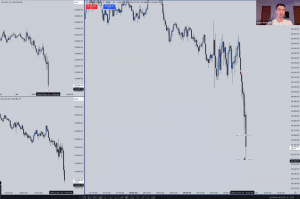

In this session, I demonstrated over live price action on the NQZ futures market to my group, showcasing the accumulation, manipulation, and distribution phases of price delivery in real-time. When the market is bullish, a run against the higher timeframe order flow is expected and designed to trap uninformed traders into short positions before delivering in the intended direction. In this case, the sell-side liquidity at 9:30 AM acted as both the draw and the Judas swing for the day.

Confluences from various institutional reference points around this draw on liquidity made it a high-probability setup, which I demonstrated using new week opening gaps and consequent encroachment of the wick as part of the live teaching.

Understanding price delivery and institutional order flow allowed us to pivot from a bearish to a bullish bias in real time. This further emphasized the importance of taking profits when in a trade, ensuring the trader is paid, regardless of the final outcome, allowing you to leave the session green.

Bullish institutional order flow was then confirmed by an SMT divergence and a change in the state of delivery at the time of day, which positioned us to lock in on the next draw on liquidity, targeting premium levels above the current market price.

The key takeaway is how understanding institutional order flow empowers you to trade with confidence, knowing how these factors work together to create a complete price narrative. This helps you decide whether to hold a position or pivot as necessary.

Additionally, the deep realization that multiple setups consistently present themselves throughout the trading day., the ability to recognize them, without the urge to trade them all, but rather focusing on just one, offers high-probability opportunities.

This approach allows you to capitalize on a run into a draw or inefficiency each day with greater precision and confidence.