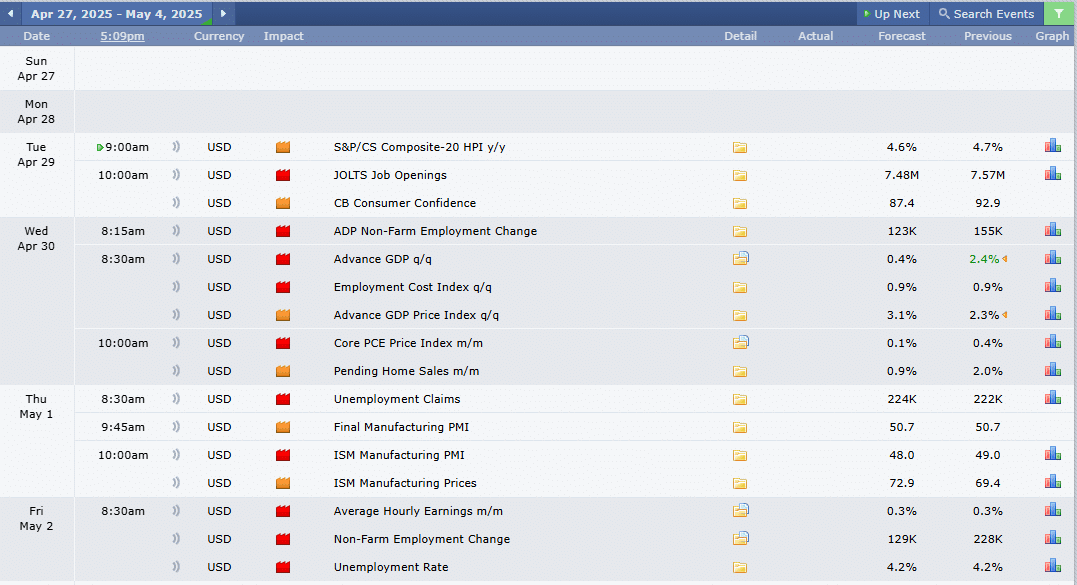

This Week’s Economic Calendar

After a small range week, a large range week was expected—and this played out on the NASDAQ and correlated assets, with an explosive price run to the upside, closing the weekly candle bullish.

Given the current bullish institutional order flow and market structure, higher prices and premium targets remain the active draw until proven otherwise. The best intraday opportunities at the moment will come from trading in alignment with the weekly, daily and hourly order flow.

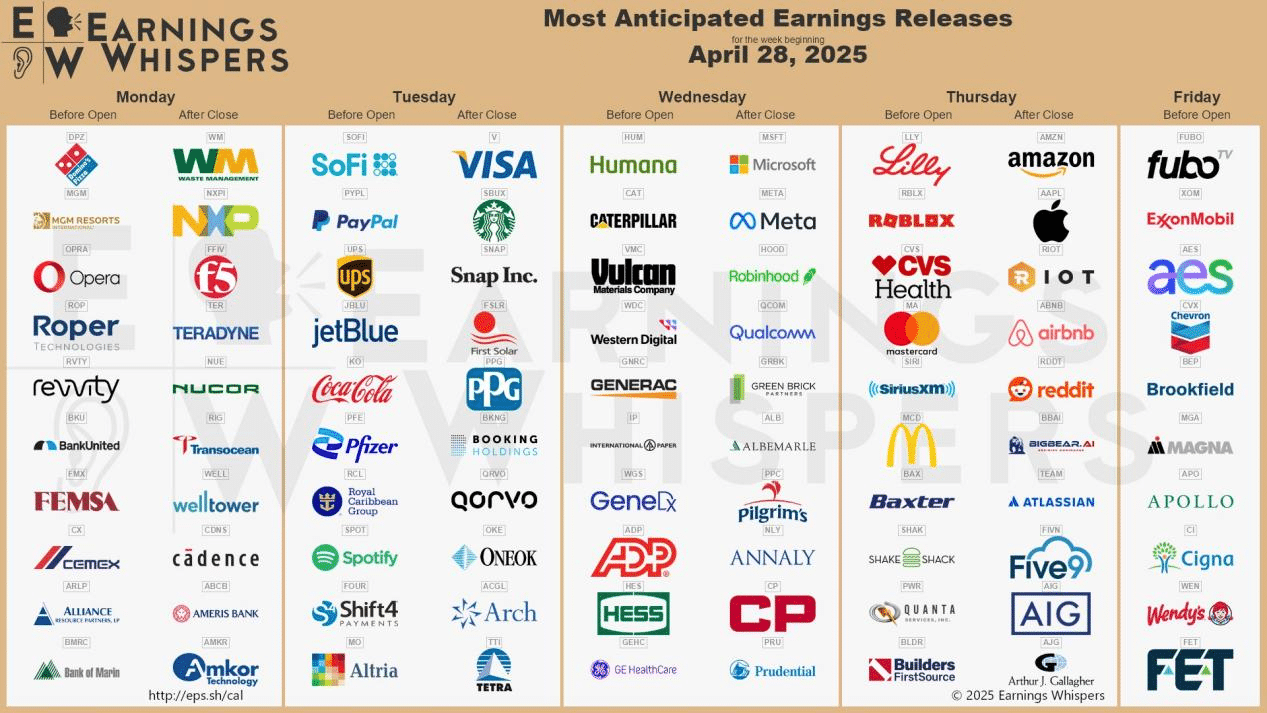

Earnings Week Reminder

This is a major earnings week, with large-cap companies set to report results, bringing heightened volatility both before the market open and into the close. Manage Risk accordingly.

Looking Ahead: Key Events This Week

This week is data-heavy, with volatility expected to pick up around important macroeconomic releases:

- Advance GDP q/q – Wednesday, 8:30 AM EST

- Non-Farm Payroll (NFP) – Friday, 8:30 AM EST

Traders should stay alert and prepared to capitalize on high-probability opportunities, especially when they align with:

- Time-of-day and macro windows

- A clear higher-timeframe draw on liquidity

Please note that this is not financial advice.

Monday:

Given that it’s the first day of NFP (Non-Farm Payrolls) week, and a Monday, patience and managed expectations are key. With no significant economic news driver expected to inject volatility into the markets; I recommend looking for opportunities pre-market, if the market structure suggests its high-probability, or during the Opening Range (9:30-10:00 AM)—focusing on identifying the most probable higher-timeframe draw on liquidity and capitalizing on the volatility near the 9:30 opening bell, if a setup presents itself.

Tuesday:

Expect heightened volatility in the AM session due to key medium & high impact news drivers scheduled between 9:00 and 10 AM, coinciding with the silver bullet hour. This marks the second most probable trading day pre-NFP. Both the AM and PM session should offer low-risk, high-probability opportunities.

Wednesday:

Volatility injections are anticipated in the AM session at 8:15 & 10AM, facilitated by medium & high impact news drivers. This will likely provide easy price runs to algorithmic reference points, presenting optimal trading opportunities. Traders are advised to focus on the AM session beginning at 9:30 AM and look to conclude their trading day by 12 noon to protect capital, as price delivery beyond that point may shift into lower-probability, high-resistance conditions ahead of Friday’s NFP release.

Thursday:

Highlighted as the day before the Non-Farm Payrolls (NFP) report, where we can expect price to deliver within the context of high resistance and low probability trading conditions. Traders are advised to exercise caution and recognize that it’s a lower probability trading day, particularly if they lack experience.

Friday:

Marked by the anticipation of the Non-Farm Payrolls (NFP) numbers, there is an expectation of heightened volatility in the markets following the release of this high-impact news, potentially offering optimal trading opportunities. However, it’s important to note that trading ahead of such high-impact news is not recommended due to increased uncertainty and risk. Instead, traders are advised to wait and observe the liquidity and inefficiencies that unfold after the news release. The AM session beginning at 9:30 AM & PM session should offer low-risk, high-probability opportunities.

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports from several major large-cap institutions, with key releases to watch including:

- Apple (AAPL)

- Microsoft (MSFT)

- Amazon (AMZN)

- Meta Platforms (META)

- Visa (V)

- ExxonMobil (XOM)

- Eli Lilly (LLY)

- Mastercard (MA)

- Chevron (CVX)

- Pfizer (PFE)

These reports are expected to inject significant volatility into the market, with a high likelihood of consolidation leading up to the announcements—particularly given the diverse range of sectors represented.

The Cot Report For The US Dollar

The Previous Week in Review

The previous week delivered a small range with a range bound, choppy intra-day delivery.

This was expected, given the lack of major high impact drivers expected to inject volatility, combined with the fact that targets had already been met on the higher time frames following a significant price run. After an expansion leg, a consolidation profile is to be seen before the next expansion—and that’s exactly what we observed.

Going into the new week, top-down analysis shows that the U.S. dollar is likely to be bullish.How the market trade within the weekly gap in a premium will set the stage for the next expansion leg.

Commercials remain heavily invested on the buyside of the curve—Week after week, they’ve been aggressively loading long hedges. Another significant increase in positions was added recently, further confirmed by the surge in open interest. Buzz and expectation are beginning to build on the institutional side, signaling the early stages of a smart money reversal potentially being priced in. That said, as always, while fundamentals and macro drivers support the bias,→ Confirmation must come through institutional order flow for it to hold weight.

What Does This Signify for Us as Traders?

Following an expansion profile, a retracement to the weekly FVG is underway. In the short term, the U.S. dollar remains bullish based on fundamental backing. However, how we trade inside that weekly FVG will be critical: If institutional order flow flips bullish, it may signal that a smart money reversal (i.e., the pricing in of an intermediate-term low) is finally in. If not, we continue treating it as short-term bullish retracement for the next expansion leg of price to the downside. This will be something to closely monitor moving forward into the new week.

Seasonal Tendencies

The US Dollar

As the month of April officially comes to a close, we now welcome in the month of May.

Historically, May tends to be a bullish month for the U.S. dollar, according to seasonal data available.

Following the pricing in of an anticipated intermediate-term low, the stage is set for the later expansion leg of the year 2025.

This is further supported by other fundamental factors such as:

- Interest rate traids

- COT report positioning

- Macroeconomic indicators

Once confirmed by institutional order flow, it becomes a high-probability price swing that can be capitalized on, particularly for swing trading opportunities.

Looking into the New Week:

- Short-term, the U.S. dollar is expected to be bullish

- However, if we begin to find a discount within PD arrays on the sell side of the curve,→ Longer-term bullish order flow becomes even more likely.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team