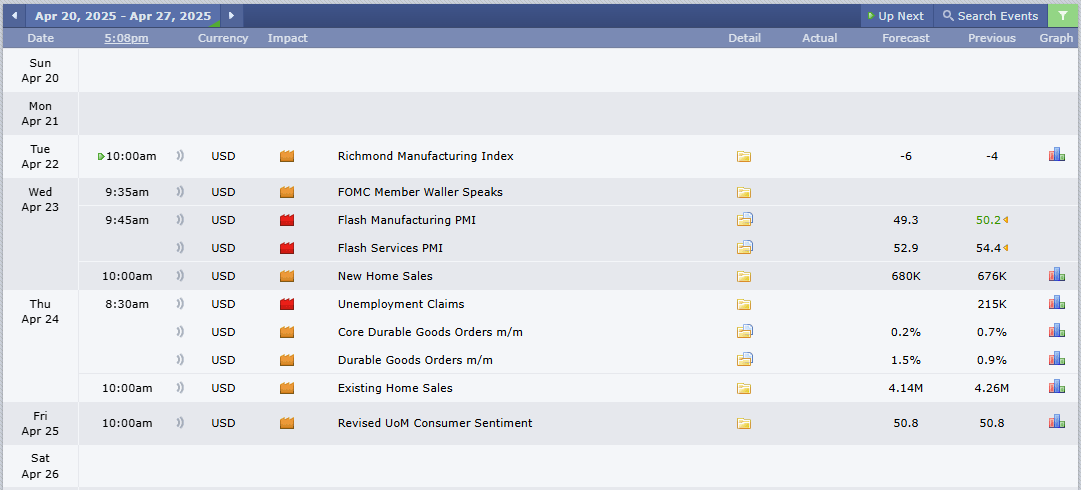

This Week’s Economic Calendar

The previous week closed out as a quiet one, forming an inside week on the NASDAQ and related assets. This was expected, given the Easter holiday, which is widely observed and respected across the U.S. economy and major financial markets.

During weeks like this, liquidity providers, institutional traders, and large funds manage risk rather than take new positions. As a result, we often see:

- Consolidation range

- High-resistance intraday trading conditions

- Tight and small ranges

This was exactly what played out last week.

However, following small-range weeks, we can expect a large range week as the market looks to reprice toward new areas of interest.

Looking Ahead: Key Events This Week

This week is data-heavy, and volatility is expected to pick up around key macroeconomic releases:

- Flash Manufacturing PMI – Wednesday, 9:45 AM EST

- Unemployment Claims – Thursday, 8:30 AM EST

Traders should remain alert and ready to capitalize on high-probability opportunities, especially when they align with:

- Time-of-day & macro windows

- A clear higher-timeframe draw on liquidity

Please note that this is not financial advice.

Monday:

Given that it’s the first trading day following the weekend, and a Monday, patience and managed expectations are key. With no significant economic news driver expected to inject volatility into the markets; I recommend looking for opportunities pre-market, if the market structure suggests its high-probability, or during the Opening Range (9:30-10:00 AM)—focusing on identifying the most probable higher-timeframe draw on liquidity and capitalizing on the volatility near the 9:30 opening bell, if a setup presents itself.

Tuesday:

Volatility injection is anticipated in the AM session at 10:00 AM, facilitated by a medium-impact news driver expected to inject volatility. This will likely provide easy price runs into higher time frame algorithmic reference points, presenting optimal trading opportunities. Traders are advised to focus on the AM session beginning at 9:30 and the PM session for higher probability trade setups.

Wednesday:

Expect heightened market volatility between 9:45 AM and 10 AM due to the impact of Red and medium-folder news drivers expected to flood the market in the AM session. Traders are advised to focus on identifying the most probable higher time-frame draw on liquidity post-news release or alternatively, the 10-11 silver bullet hour, and the PM session for high-probability trade setups.

Thursday:

Heightened market volatility is expected between 8:30 and 10:00 AM, coinciding with the Silver Bullet distribution hour, due to the impact of Red and Medium-folder news drivers scheduled during the AM session. Traders are advised to focus on identifying the most probable higher time-frame draw on liquidity post-news release or alternatively, the AM Session beginning at 9:30 and the PM session for higher probability trade setups.

Friday:

A medium-impact news driver scheduled for 8:30 AM is expected to inject volatility into the market. If you haven’t met your weekly profit objectives, focus on identifying the most probable higher time frame draw on liquidity post-news release, during the 10:00 AM Silver Bullet window, and the PM session, should a suitable setup present itself.

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports from several major large-cap institutions, with key releases to watch including: Berkley (WRB), Comerica (CMA), Verizon (VZ), GE Aerospace, Lockheed Martin (LMT), RTX (Raytheon), Danaher (DHR), Capital One (COF), Enphase (ENPH), SAP,

Intuitive Surgical (ISRG), Tesla (TSLA), Halliburton (HAL), Kimberly-Clark (KMB), Boeing (BA),

AT&T (T), Vertiv (VRT), IBM, Amphenol (APH), Nextera Energy (NEE),

ServiceNow (NOW), Texas Instruments (TXN), Lam Research (LRCX), Chipotle (CMG), Nasdaq (NDAQ), Intel (INTC), Alphabet (GOOGL), T-Mobile (TMUS), Merck (MRK), PepsiCo (PEP),

Vale (VALE), Southwest Airlines (LUV), Union Pacific (UNP), Skechers (SKX), Schlumberger (SLB),

AbbVie (ABBV), Colgate-Palmolive (CL), Phillips 66 (PSX), Charter Communications (CHTR), and LyondellBasell (LYB)

These reports are expected to inject significant volatility into the market, with a high likelihood of consolidation leading up to the announcements—particularly given the diverse range of sectors represented.

The Cot Report For The US Dollar

The Previous Week in Review

The previous week on the U.S. Dollar closed as a small-range week, which is expected given the recent volatility, where targets to the downside have already been met—in this case, taking out key sell-side liquidity on the market maker sell-side of the curve.

Until a break of structure is seen to the upside, the bias remains bearish. However, as noted in previous newsletters, attention should be paid to the new lows being created, as they may price in a potential smart money reversal—especially in line with current commercial positioning.

For yet another week, commercials continue to load heavy long hedges, while simultaneously reducing their previously aggressive short exposure, as reflected in the latest COT report released Friday.

This shift is significant—it reflects a heavy accumulation, and it’s unusual in size compared to the typical transition period we observe when commercials flip positioning. This adds weight to the idea that smart money may be preparing for a longer-term reversal.

The ongoing discrepancy between fundamentals and technicals remains a key factor and will be closely monitored as we move into the new week.

What Does This Signify for Us as Traders?

Until we see a clear break of structure within institutional order flow, the U.S. Dollar remains undeniably bearish. Attempting to call a bottom in a clearly weak market is not advisable.

However, given:

- Commercials positioned long

- Seasonal tendencies

- Interest rate dynamics

Traders should pay close attention to new lows being created going forward—particularly to the possibility of an intermediate-term low being priced in for a smart money reversal.

Seasonal Tendencies

The US Dollar

As the month of April draws to a close, we’ve witnessed large ranges, particularly on the downside—delivering sell-side targets into fund-level stops below market price. This was anticipated by seasonal data and confirmed through institutional order flow.

The final week of April is projected to potentially price in an intermediate-term low, which could set the stage for the next major price swing for the remainder of 2025.

As always, while seasonal tendencies are recurring and informative, they are useless without confirmation through institutional order flow.

Until Then:

Unless we see confirmation via:

- The pricing in of an intermediate-term low

- A clear break in market structure to the upside

We remain bearish on the U.S. Dollar.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team