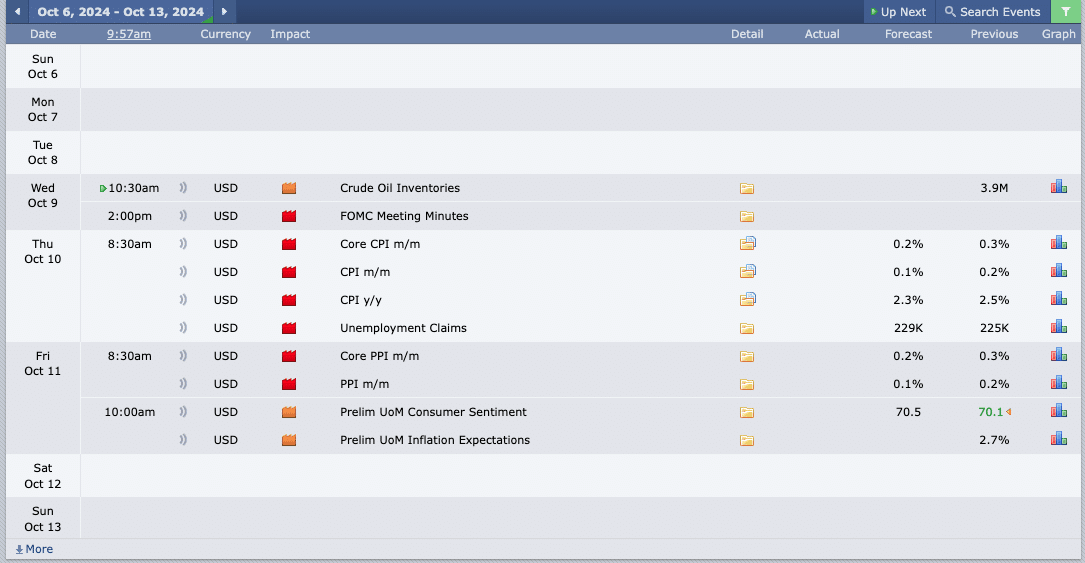

This Week’s Economic Calendar

Escalating tensions, particularly in the Middle East with threats of war, have put the world economy on high alert. This uncertainty has directly impacted the currency market and oil futures, where the demand for oil also drives up the US dollar. As crude oil—often called “black gold”—is traded in US dollars, known as the “petrodollar,” its price strongly correlates with the USD.

While this might sound concerning,it presents great opportunities for traders. The heightened volatility seen in the past week with the US dollar repricing into premium targets creates perfect conditions for smart money to exploit. Market makers use this volatility to swiftly reprice assets toward set targets, allowing for significant distribution by institutional players into the opposing liquidity with speed translating to low-risk high probability trading conditions.

While counter-trend trades can be taken on lower timeframes to reprice to intraday liquidity, the best low-risk high probability setups will continue to appear when trading in line with the higher timeframe weekly and daily institutional order-flow.

Looking ahead, the upcoming week features key data releases, with the CPI numbers announcement on Thursday by 8:30 am as the highlight. While market ranges remain open, we anticipate significant price swings. The priority continues to be effective risk management as we navigate market opportunities moving forward.

Please note that this is not financial advice.*

Monday:

Today brings no major news drivers after Friday’s significant expansion of the us dollar into premium targets. Being Monday and the first trading session post-NFP (a large range day), it’s important to exercise patience and manage expectations. I recommend waiting for the 9:30 AM equities open, then focus on identifying the most probable higher timeframe draw on liquidity, particularly during the 10 AM silver bullet.

Tuesday:

With no significant news drivers expected to inject volatility into the market today, we continue to follow the protocols outlined on Monday, which involve observing the opening range and then directing our attention to identifying the most probable higher time frame draw on liquidity during the 10 AM Silver Bullet and PM Session for higher probability trades.

Wednesday:

Highlighted as the day preceding the CPI numbers, today also brings the FOMC Meeting Minutes release at 2:00 PM, which is expected to inject volatility into the market. While these minutes tend to be less impactful than the main FOMC decisions, traders are advised to manage expectations carefully. It is advised to focus on the 7-8 AM Silver Bullet setup and the 10 AM Silver Bullet, while avoiding the PM session entirely to protect capital in lower probability high resistance price delivery in anticipation of the CPI numbers on Thursday.

Thursday:

This day brings the anticipation of the CPI numbers at 8:30 am, which is expected to inject significant volatility into the market following the news release. While we typically avoid trading ahead of high-impact news driver, the post-news release reveals liquidity and inefficiencies that can be capitalized on as a draw. Focus on the 10 AM Silver Bullet distribution hour and the PM session for higher probability trade setups.

Friday:

Expect heightened market volatility between 8:30 AM and 10:00 AM due to the impact of Red and medium-folder news drivers expected to flood the market throughout the AM session coinciding with the Silver Bullet distribution hour. If you haven’t met your weekly profit objectives, shift your focus to identifying the most probable higher time frame draw on liquidity during the 10 AM Silver Bullet window or the PM session, should a suitable setup present itself.

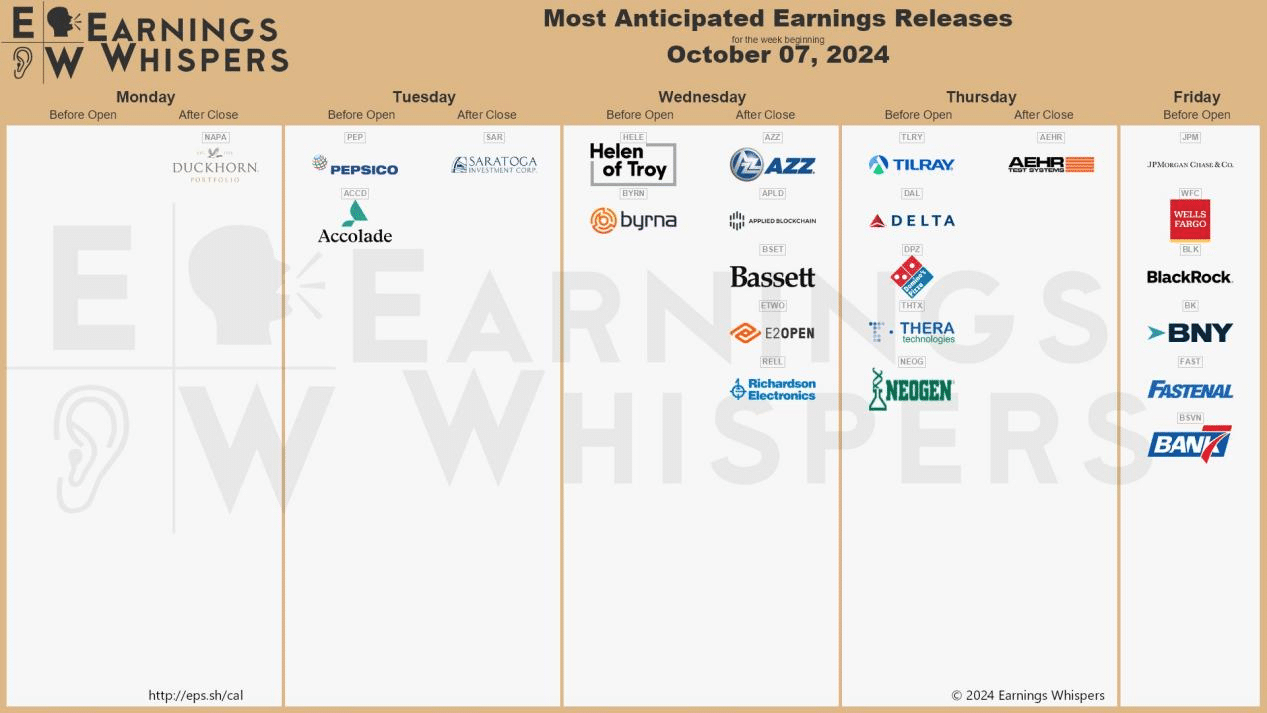

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week will be centered around earnings reports, with several large-cap institutions scheduled to release theirs. Key players to watch include Pepsico, Delta, Domino’s, Wells Fargo, BlackRock, JPMorgan Chase, BNY Mellon, and Bank7. Traders should anticipate heightened volatility and potential consolidation in the lead-up to these report releases.

The Cot Report For The US Dollar

As forecasted, we are currently witnessing an expansion of the US dollar into premium targets, as called out in the recent editions of the newsletter. Discount targets previously highlighted constituted a smart money reversal, distributing into opposing liquidity. The week closed extremely bullish at 102.487, confirming a realignment between technicals and fundamentals once again.

The latest Commitments of Traders (COT) report continues to confirm the anticipation of a higher US dollar in the near term. It reveals that commercials are consistently holding more long hedge positions than shorts, while running down short equity. Friday’s data shows that commercial entities, including institutions and hedgers, are steadily building long positions as we transition into October. This discrepancy between technicals and commercial positioning—marked as smart money accumulation—was confirmed with the rejection of recent discount lows and a change in the state of delivery on higher timeframes, signifying a reversal.

What does this signify for us as traders? An intermediate-term low has been priced in, in line with commercial data, and confirmed by technical charts from the previous week, reinforcing bullish sentiment. This is further supported by strong seasonal tendencies, rising interest rates, and ongoing global economic concerns, including recent escalating tensions. The US dollar remains strongly bullish as we step into the new week, with the expectation that premium targets will continue to be repriced to in the near term.

Seasonal Tendencies

The US Dollar

October, historically a bullish month for the US dollar, is slowly materializing with the large-range bullish weekly candle we just closed with. Supporting macro indicators like the COT report and interest rate trends are also pointing higher, reinforcing the technical analysis that suggests continued bullish momentum for the US dollar. As discussed in the previous newsletter, we expected larger ranges, and they are here—with more still to come.

Prepare for further upside as this strong bullish month unfolds.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team