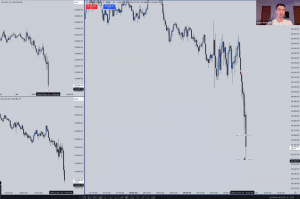

In this video, we’re analyzing real-time price action in NQ (NQU) futures, focusing on teaching my private group how to anticipate price runs and how to manage trades effectively using order flow and algorithmic price delivery. I explained how when the algorithm is going to deliver lower upclose candles will act as true resistance and allow us to trust lower prices will be delivered as seen with the precision stop placement we demonstrate with our live trades every week.

Since price is delivered algorithmically, I also took the opportunity to demonstrate the “sick sister” concept. This involves identifying a leading market that has already hit a new high or low and a lagging market that hasn’t yet reached the same target. The expectation is that the lagging market will follow suit and price in market symmetry.

We put this understanding to the test by applying the Time & Price theory to live price action, observing it unfold exactly as anticipated, reinforcing our models and approach.