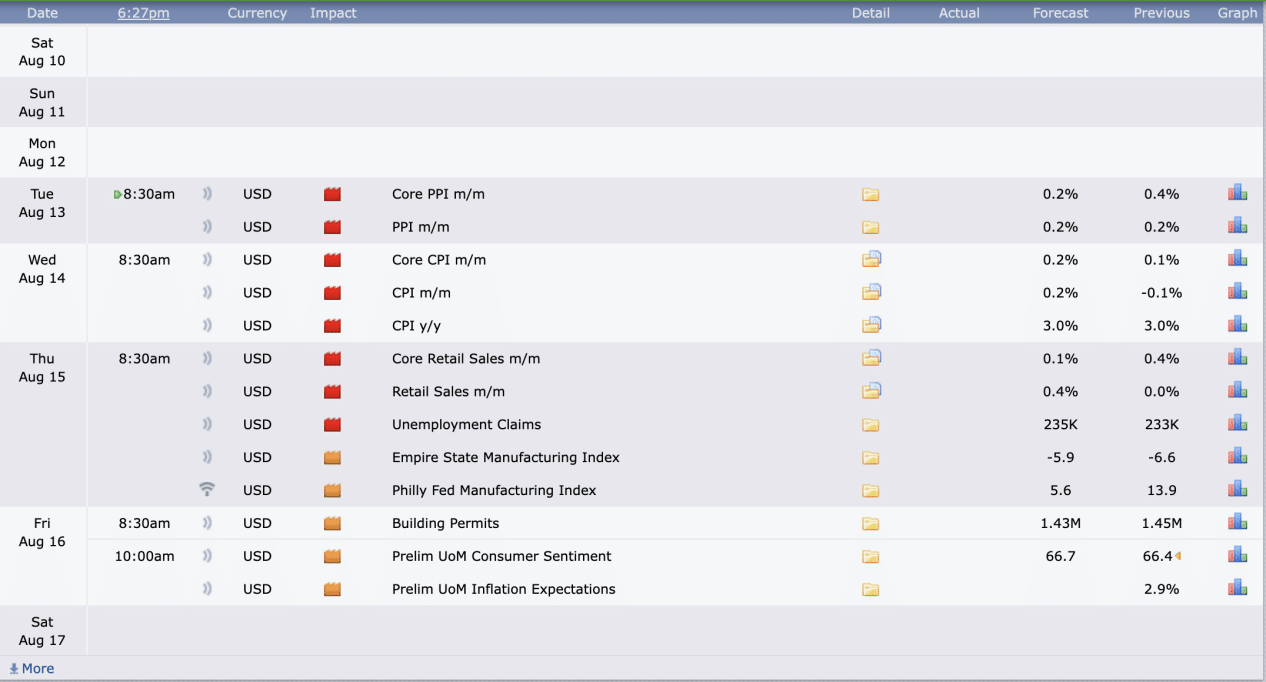

This Week’s Economic Calendar

In a sell program, after an expansion, we expect a retracement back into inefficiencies left open during the expansion phase of price delivery, with the draw on liquidity being above equilibrium inside a premium of the dealing range. This retracement is then expected to be followed by another expansion into set targets below market price, completing a market maker sell model after smart money accumulation of shorts in fair value.

The Nasdaq, although in a premium, still has a discount draw on liquidity yet to be delivered, which will be monitored moving forward, with institutional order flow following a large-range week.

As for the dollar, the consolidation profile on the monthly time frames remains intact as we continue to trade within the 99-107 weekly dealing range, focusing on the quadrants of the consolidation ranges until an expansion out of the consolidation occurs. This, coupled with seasonal tendencies, accounts for the bearish price delivery seen in the charts over the previous week, accelerating towards discount targets.

Looking ahead, the new week brings forth significant reports, with CPI numbers on Wednesday at 8:30 AM taking the spotlight. This emphasizes the need for meticulous trading and tight risk management.

Please note that this is not financial advice.*

Monday:

Today, there are no significant news drivers expected to inject volatility into the market. Given that it’s Monday, patience and managing expectations are crucial. It’s recommended to wait for the 9:30 opening and then focus on identifying the most probable higher timeframe draw on liquidity around the 10 AM silver bullet.

Tuesday:

Red folder news drivers in the AM session at 8:30 AM are expected to inject volatility into the market. However, as the day precedes CPI, traders are advised to heavily manage their expectations. This day is likely to present high-resistance runs and lower probability setups, with liquidity building in anticipation of the following day’s events. If traders choose to participate, they should be aware that this is a lower probability day and should only engage if they have the experience to navigate it professionally.

Wednesday:

This day brings the anticipation of CPI numbers. Following the news release, we expect a surge in market volatility, potentially offering favorable trading opportunities. While we typically avoid trading before high-impact news events, we’ll assess liquidity and inefficiencies afterward, which present themselves as a draw. Consider focusing on the 10 AM Silver Bullet distribution hour and the PM session for higher probability trades.

Thursday:

With red and medium-impact news expected to flood the market in the AM session, starting as early as 8:30 AM, traders should anticipate volatility that could facilitate smoother trades. Identifying the most probable higher time frame draw on liquidity post-news release, or waiting for the 10 AM Silver Bullet, is likely to present optimal trading opportunities.

Friday:

Red and medium-impact news drivers are scheduled for 8:30 and 10 AM, aligning with the Silver Bullet distribution hour. If your weekly profit objectives haven’t been met, redirect your focus to identifying the most probable higher time frame draw on liquidity during the 10 AM Silver Bullet window or in the PM session, if your setup presents itself.

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders: anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week centers on earnings reports, with several large-cap institutions set to release theirs. Notably, Sea, Home Depot, Cisco, Walmart, Alibaba, and John Deere are in focus. Traders should anticipate volatility and potential consolidation in the lead-up to these reports.

The Cot Report For The US Dollar

The previous week for the US dollar was characterized by a swift repricing from the 104.6 premium into discount targets, hitting our live callouts at 102.68 and 102.32, effectively delivering on our objectives. This move was driven by the weakening US economy and falling interest rates, key macro indicators signaling a fragile currency index. However, this was followed by a retracement into the 103.5 premium, with the week closing at 103.15.

An analysis of the COT report, particularly focusing on commercials engaged in hedging activities, reveals that commercials continue to hold more short positions than longs. This stance confirms their anticipation of lower prices for the US dollar in the near future, aligning with the series of bearish closing weeks we’ve observed.

What does this signify for us as traders? Intermediate-term targets forecasted in the previous edition of the newsletter have been delivered. Emphasis remains on understanding that we are still trading within the weekly and monthly consolidation and tight ranges, specifically within the 99-107 key dealing range. This calls for managed expectations moving forward.

Although commercials remain heavily short, close attention will be paid to how we trade at the 103.7 premium level. This will require further information from price action(Technical analysis) to gain clarity as we head into the new week.

Seasonal Tendencies

The US Dollar

As expected, seasonal tendencies continue to forecast a range-bound market for the month of August for the US dollar, delivering to intermediate-term targets before returning back into the range. However, this year is proving to be different given the unique market climate and open ranges we are navigating. Fundamentals will continue to play a significant role in price delivery, serving as a perfect excuse for deep pockets and central banks to strategically provide liquidity to the marketplace, capitalizing on the current excitement and repricing at lightning speed into set targets.

Once again, the tight weekly range of 99.5-107.38 emphasizes one key course of action: managing expectations and targeting delivery into intermediate-term price objectives moving forward, until proven otherwise.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team