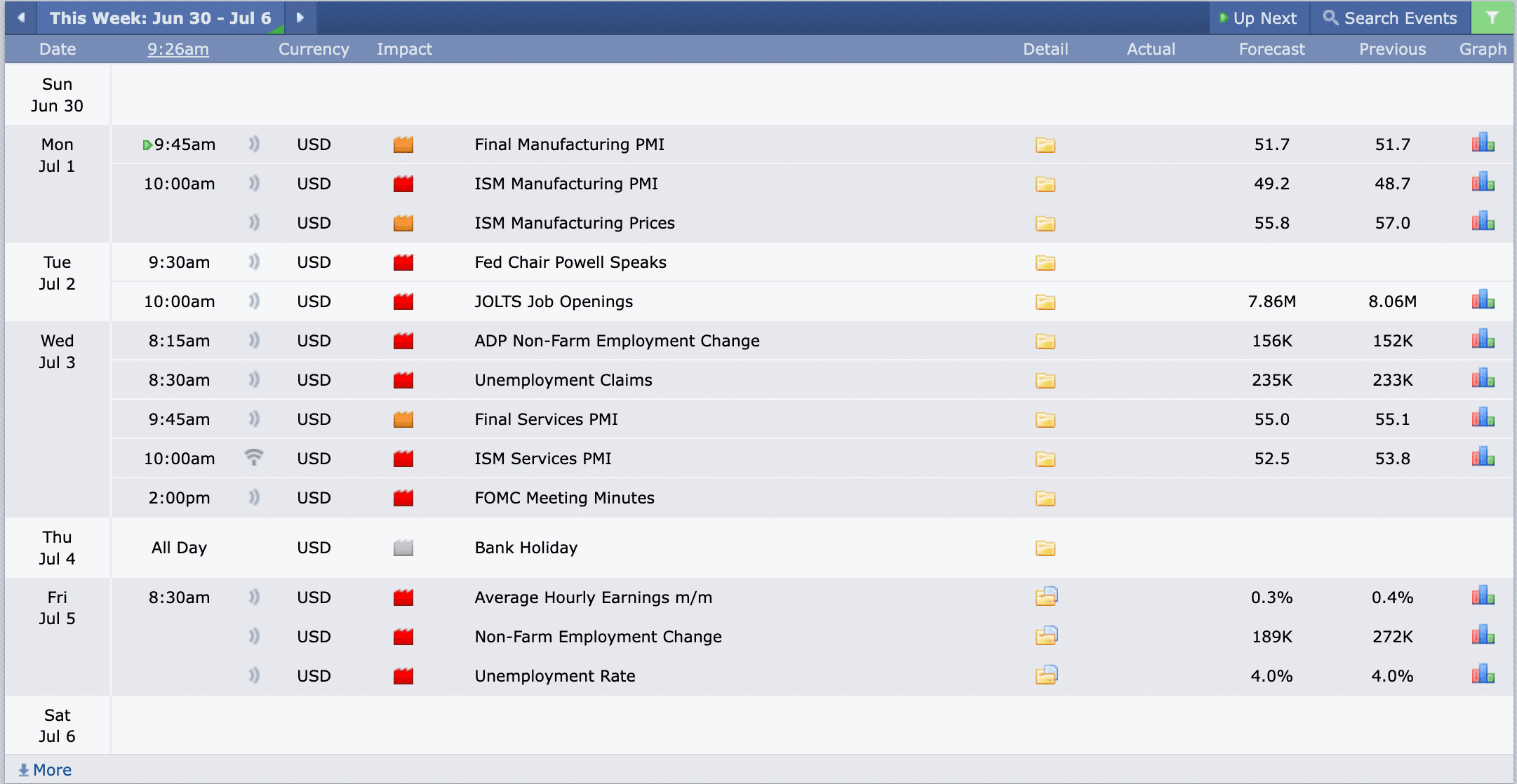

This Week’s Economic Calendar

Recent escalating tensions among global powers, combined with mounting threats of conflict and the imminent U.S. presidential election, have significantly influenced the marketplace. These factors have led to rapid repricing and volatile swings around news releases, creating a dynamic environment for traders. Such conditions are often exploited by market makers to swiftly reprice the market towards set targets, facilitating smart money distribution.

In particular, indices like the NASDAQ, which have retraced to their weekly fair value gap and found support, continue to remain bullish. This is confirmed by institutional order flow, emphasizing the focus on buy models, especially at all-time highs, until a significant break in market structure is observed.

As we enter the new week, key reports will come into focus, with the Non-Farm Payroll (NFP) numbers announcement on Friday being particularly significant. The emphasis remains on meticulous trading and tight risk management to navigate the evolving markets effectively.

Please note that this is not financial advice.*

Monday:

Given that it’s the first day of the NFP (Non-Farm Payrolls) week, combined with the start of a new month and a Monday, it’s crucial to exercise patience and manage expectations. Red and medium-folder news drivers at 9:45 and 10:00 AM are expected to inject volatility. The recommendation is to wait for the opening range and then focus on identifying the most probable higher time-frame draw on liquidity around the 10:00 AM silver bullet.

Tuesday:

Red folder news drivers are expected in the AM session, likely injecting volatility into the markets. However, it’s important to note that Fed Chair Powell will be speaking at 9:30 AM, which could lead to consolidations leading up to his speech. During his speech, there may be increased volatility and erratic whipsaws. Traders are advised to manage their expectations heavily and focus on the PM session instead.

Wednesday:

Red and medium-folder news drivers are expected to flood the market throughout the AM session, starting as early as 8:30 AM. Traders should anticipate volatility injections that could facilitate smoother trades during the 10:00 AM silver bullet if their setup aligns. The FOMC Meeting Minutes will also be released at 2:00 PM. While these minutes are less impactful than the main FOMC decisions, traders are advised to prioritize the last hour of trading for higher probability opportunities.

Thursday:

Bank holiday – Low volatility, avoid trading.

Friday:

Marked by the anticipation of the Non-Farm Payrolls (NFP) numbers, there is an expectation of heightened volatility in the markets following the release of this high-impact news, potentially offering optimal trading opportunities. However, it’s important to note that trading ahead of such high-impact news is not recommended due to increased uncertainty and risk. Instead, traders are advised to wait and observe the liquidity and inefficiencies that unfold after the news release. For higher probability setups, consideration can be given to trading during the 10-11 AM Silver Bullet or the PM session.

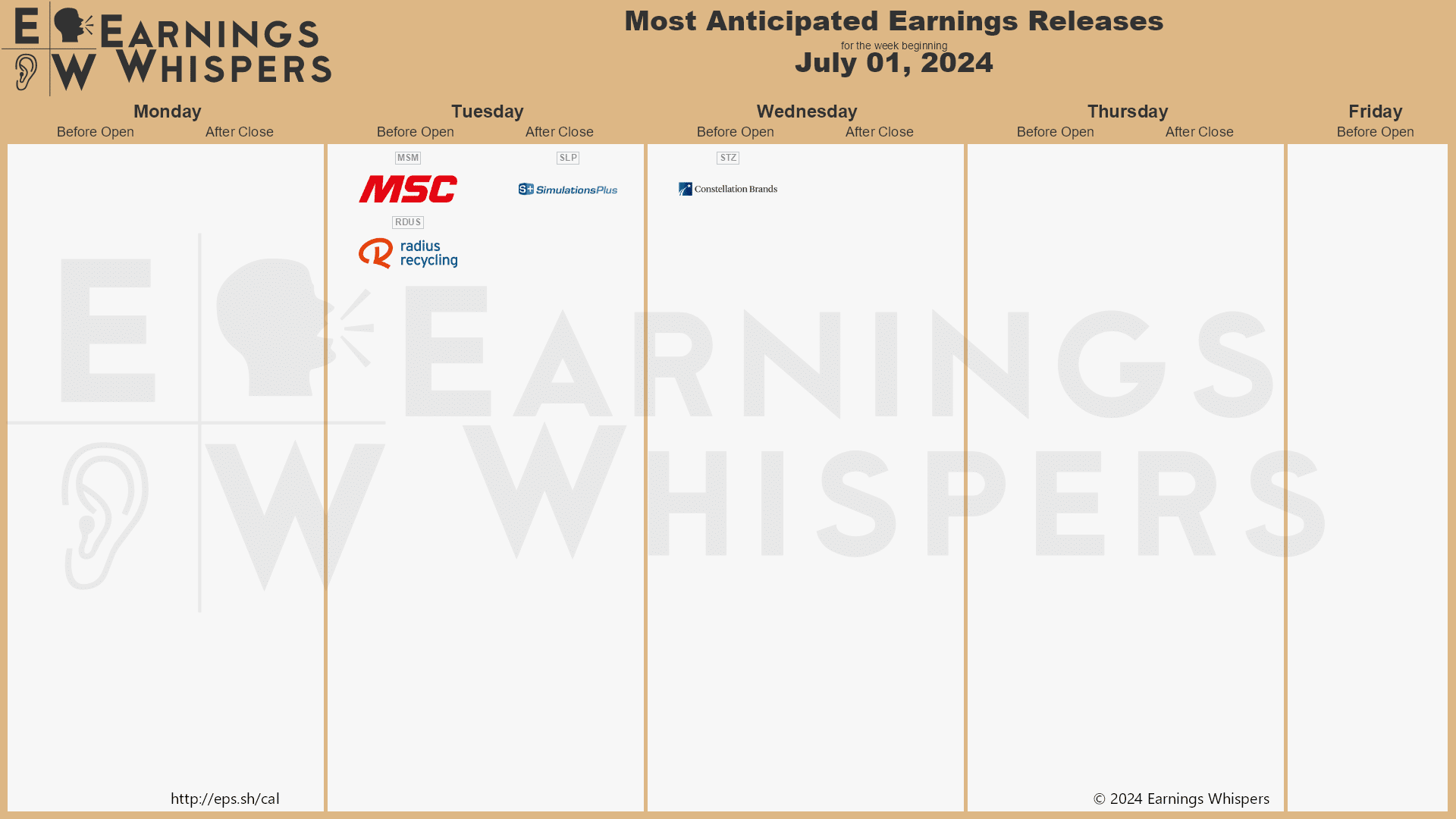

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

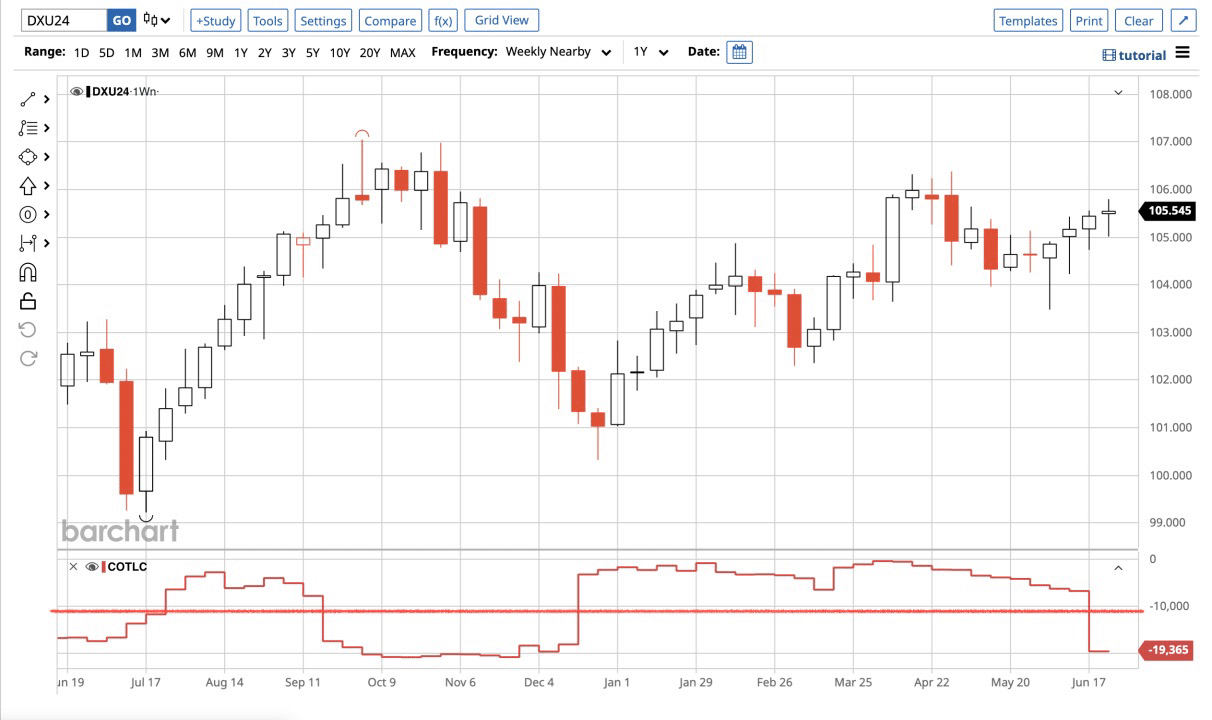

The Cot Report For The US Dollar

The just-concluded week experienced a narrow trading range with significant back-and-forth price runs, marked by notable high resistance trading on the daily timeframe. Seasonal tendency indicate an initial bullish phase for the U.S. dollar in July, followed by a substantial decline.

An analysis of the Commitments of Traders (COT) report shows a notable shift in commercial hedging activities. Previously long positions are now transitioning to short hedges. Data released on Friday confirms that commercial entities, including institutions and hedgers, have begun to hold short positions as we enter July. This shift serves as an early signal of smart money accumulation.

What does this signify for us as traders? The commercials, whose activities and positions we closely monitor, have begun to hedge short. This shift, evidenced by an increase in open interest, suggests their expectation for a bearish U.S. dollar in the near term. While this insight is valuable for long-term macro analysis, we will continue to monitor technical analysis and order flow on lower time frames to validate this data. The U.S. dollar will remain bullish until the prevailing price action indicates otherwise.

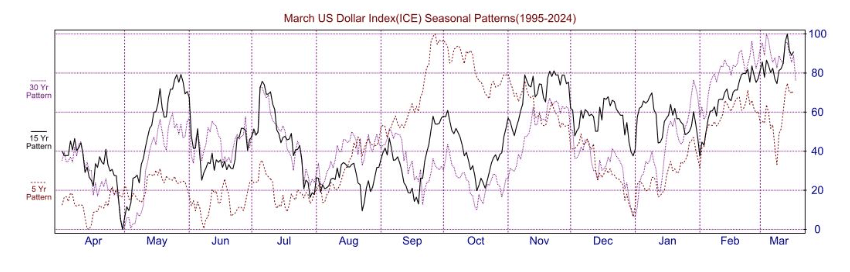

Seasonal Tendencies

Seasonal tendencies refer to the recurring patterns observed in market prices or movements at certain times of the year. These patterns are based on historical data and can provide insights into the potential behavior of prices or market conditions, offering future long-term macro projections

The US Dollar

The seasonal tendency for the U.S. dollar remains bullish in early July, supported by recent upward repricing and a bullish order flow. This is anticipated to continue into mid-July. However, a potential steep decline could follow later in the month, at key institutional reference points.

Given the current order flow and market structure, we will continue to target higher prices for the U.S. dollar until we identify a significant break in structure. Our bias remains bullish as we enter the new week, while we stay vigilant for any structural shifts that may impact our outlook.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wiseley

Happy Trading!

Adora Trading Team