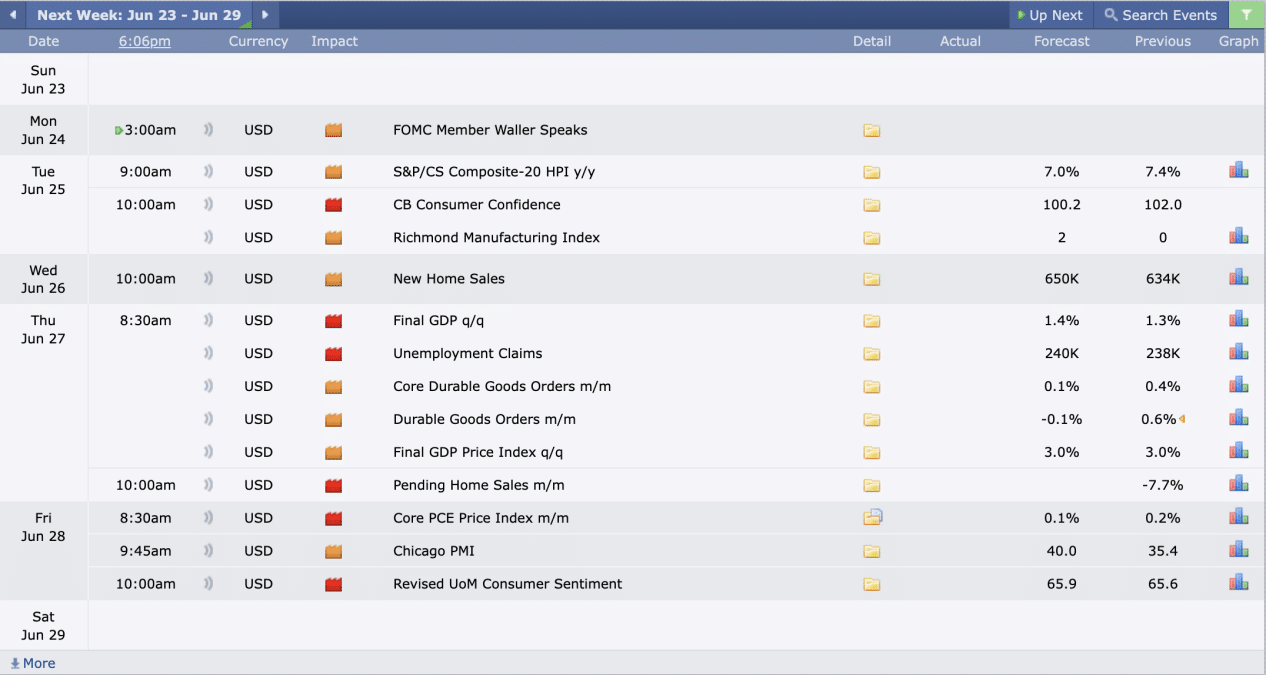

This Week’s Economic Calendar

The just-concluded week was characterized by an expansion into premium targets on the US dollar, as outlined in the Sunday stream and discussed in our weekly newsletter. With sell stops bought by smart money at a discount on the higher time-frame, we will continue to trust institutional order flow to remain bullish in the longer term.

The indices, particularly the NASDAQ and S&P, have retraced into their respective discount fair value gaps. Anticipated displacement to the upside, supported by discount PD arrays, will confirm the resumption of bullish momentum towards new all-time highs. We will continue to trust our buy models until a significant break in structure is observed.

Please note that this is not financial advice.*

Monday:

Given that it’s the last week of June and a Monday, it’s crucial to exercise patience and manage expectations. The medium folder news driver at 3 AM is expected to inject volatility into the market. The recommendation is to wait for the opening range and then focus on identifying the most probable higher time-frame draw on liquidity around the 10 AM silver bullet.

Tuesday:

Medium and red folder drivers are scheduled for 9 AM and 10 AM, respectively, coinciding with the silver bullet hour. This is expected to inject volatility into the markets, presenting optimal trading opportunities. Traders should focus on the 10-11 AM ‘Silver Bullet’ and the PM session for higher probability trades.

Wednesday:

The release of red folder news at 10 AM is poised to inject volatility into the markets shortly thereafter. Identifying the most probable higher time-frame draw on liquidity post-news release is likely to present optimal trading opportunities.

Thursday:

With red folder news expected to flood the market throughout the day, starting as early as 8:30 AM, traders should anticipate volatility injections that could facilitate smoother trades. Traders are encouraged to prioritize either the 7-8 AM Silver Bullet, the 10 AM Silver Bullet, or the PM session.

Friday:

Expect increased market volatility between 8:30 AM and 10 AM due to multiple scheduled news drivers. If your weekly profit objectives haven’t been met, anticipate optimal trading opportunities throughout the day, both in the AM and PM sessions.

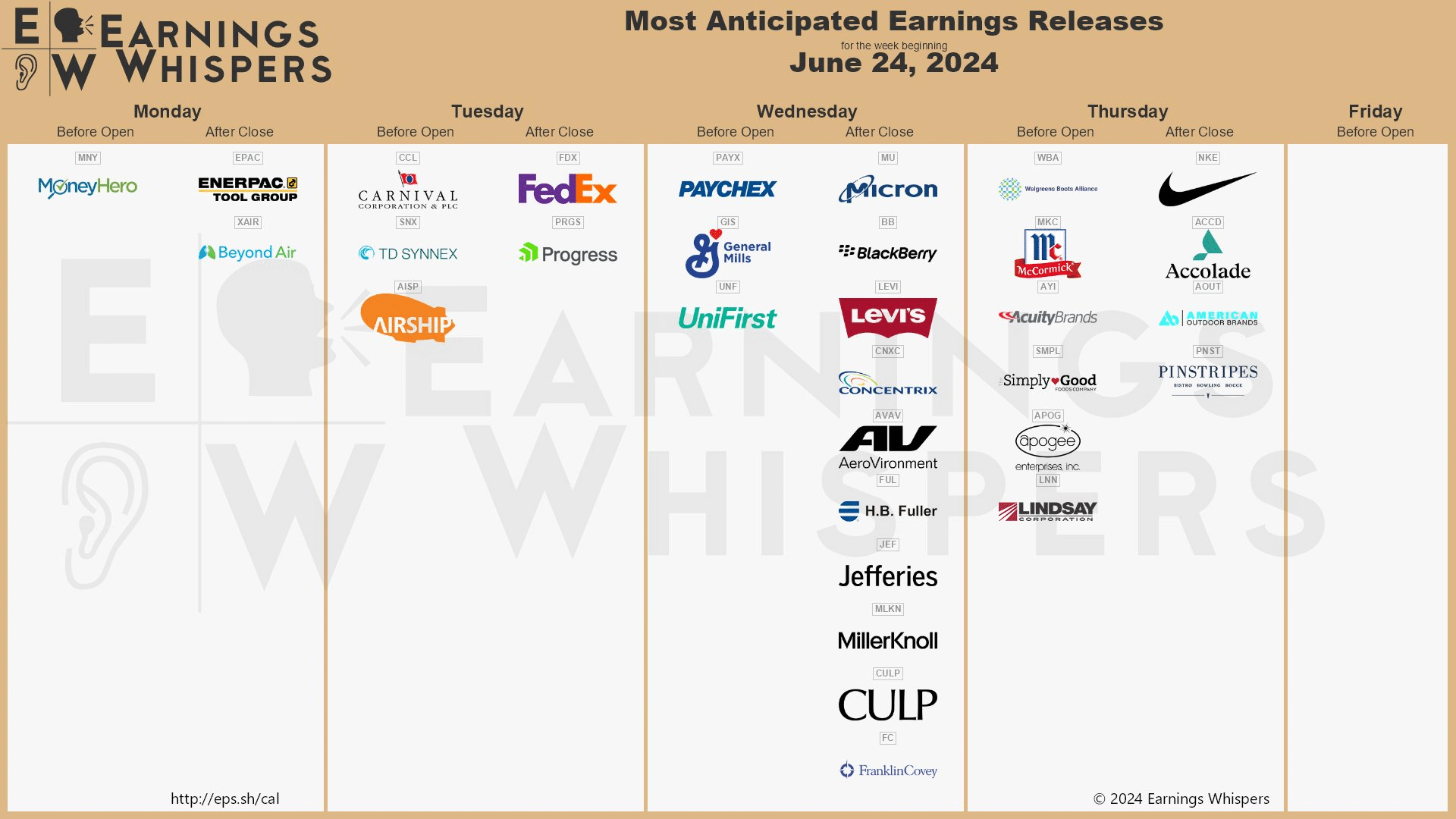

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders, anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports, with several large-cap institutions scheduled to release theirs. Specifically, FedEx, Paychex, and Nike are in focus this week. Traders should expect volatility and potential consolidation in the lead-up to these reports.

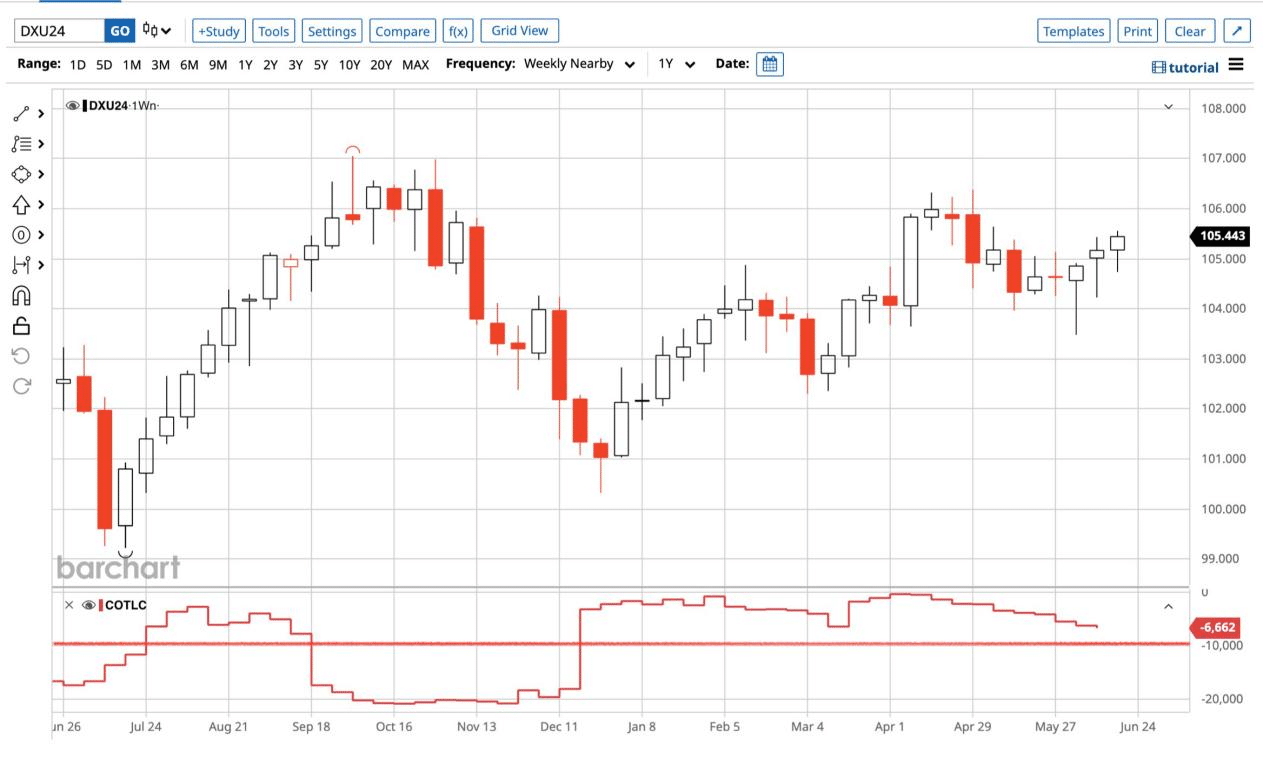

The Cot Report For The US Dollar

At first glance, it is evident that the US dollar remains strongly bullish, confirmed by both technical analysis and fundamental factors.There has recently been an expansion from a discount within the weekly range, where inter-bank traders and smart money bought after clearing out sell-side liquidity of uninformed money.

Analysis of the Commitments of Traders (COT) report, focusing on commercials engaged in hedging activities, reveals that commercials hold more long positions than shorts. This confirms their anticipation of higher prices for the US dollar in the near future.

What does this signify for us as traders? The US dollar remains bullish, confirmed by fundamental factors as we enter the new week. This sentiment is expected to persist until price action on the charts and order flow indicate otherwise. Therefore, our stance remains bullish!

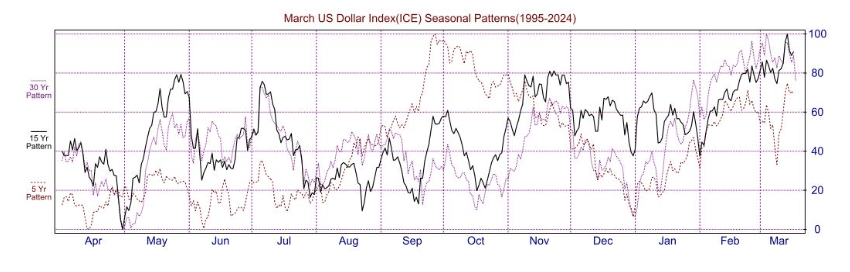

Seasonal Tendencies

Seasonal tendencies refer to the recurring patterns observed in market prices or movements at certain times of the year. These patterns are based on historical data and can provide insights into the potential behavior of prices or market conditions, offering future long-term macro projections.

The US Dollar

The seasonal tendency for the US dollar remains bullish, confirmed by the upward repricing observed throughout the month. This is expected to continue into July, followed by a potential steep decline later in the month. However, relying on the current order flow and market structure, we will continue to look for higher prices for the US dollar. Our bias remains bullish going into the new week .

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wiseley

Happy Trading!

Adora Trading Team