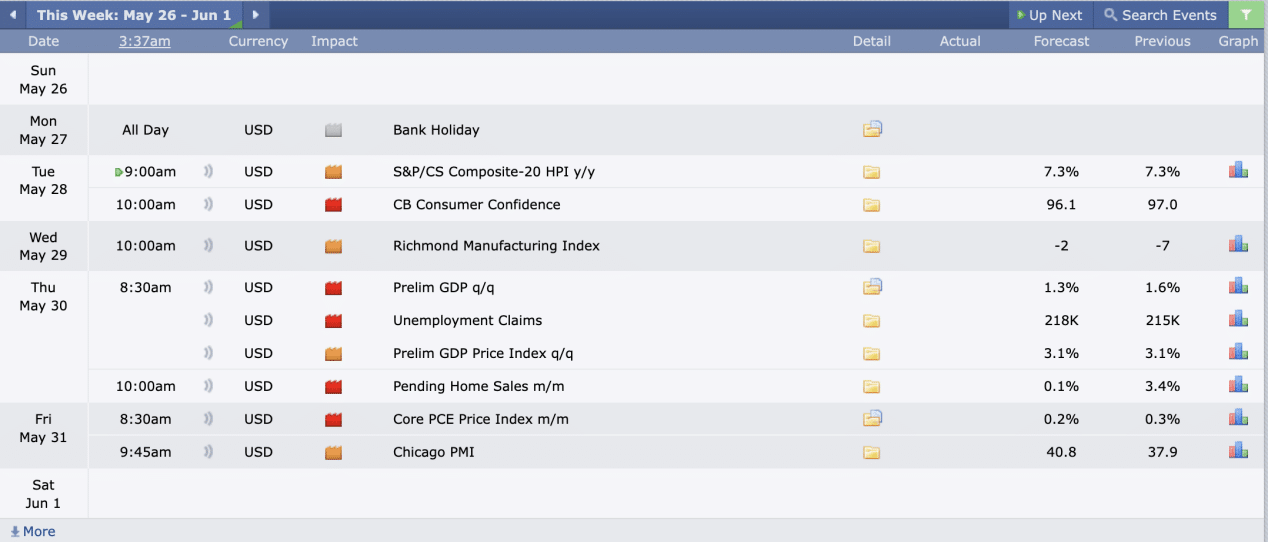

This Week’s Economic Calendar

Last week, the indices, particularly the S&P 500 and NASDAQ, closed once again on a bullish note, creating new all-time highs in consecutive sessions. This signifies that a buy program is actively in play. We shall continue to trust our buy models at all-time highs until a new break in structure is observed, while also trading in line with the higher time frame order flow creating low-resistance, high probability trading conditions.

On the other hand, the DXY closed as an inside week without any significant displacement higher or lower. Seasonal tendencies suggest a bearish month for the dollar. Coupled with the order flow, we will continue to trust this outlook until a significant change is observed.

Please note that this is not financial advice.*

Monday:

Bank holiday – Low volatility, avoid trading.

Tuesday:

Days following a bank holiday can be challenging. This day presents medium and red folder news drivers by 9 AM and 10 AM consecutively. Days like this are treated as a Monday where we wait for the opening range and then direct our attention to identifying the most probable higher time frame draw on liquidity in the 10 AM silver bullet and PM session.

Wednesday:

Wednesday has red folder news drivers scheduled for 10 AM, coinciding with the silver bullet hour, which is expected to inject volatility into the markets. Consequently, the day is anticipated to present optimal trading opportunities. It will be ideal for traders to consider the 10-11 AM Silver Bullet session and the PM session for higher probability trades.

Thursday:

Red and medium folder news drivers are lined up to flood the market during the AM session, starting as early as 8:30 AM. Traders should anticipate volatility injections that could facilitate smoother trades. Traders are encouraged to prioritize either the 7-8 AM Silver Bullet, the 10 AM Silver Bullet, or the PM session.

Friday:

Red and medium folder news drivers are introduced at 8:30 and 9:45 AM consecutively. If your weekly profit objectives haven’t been met, redirect your focus to identifying the most probable higher time frame draw on liquidity during the 10 to 11 AM Silver Bullet window.

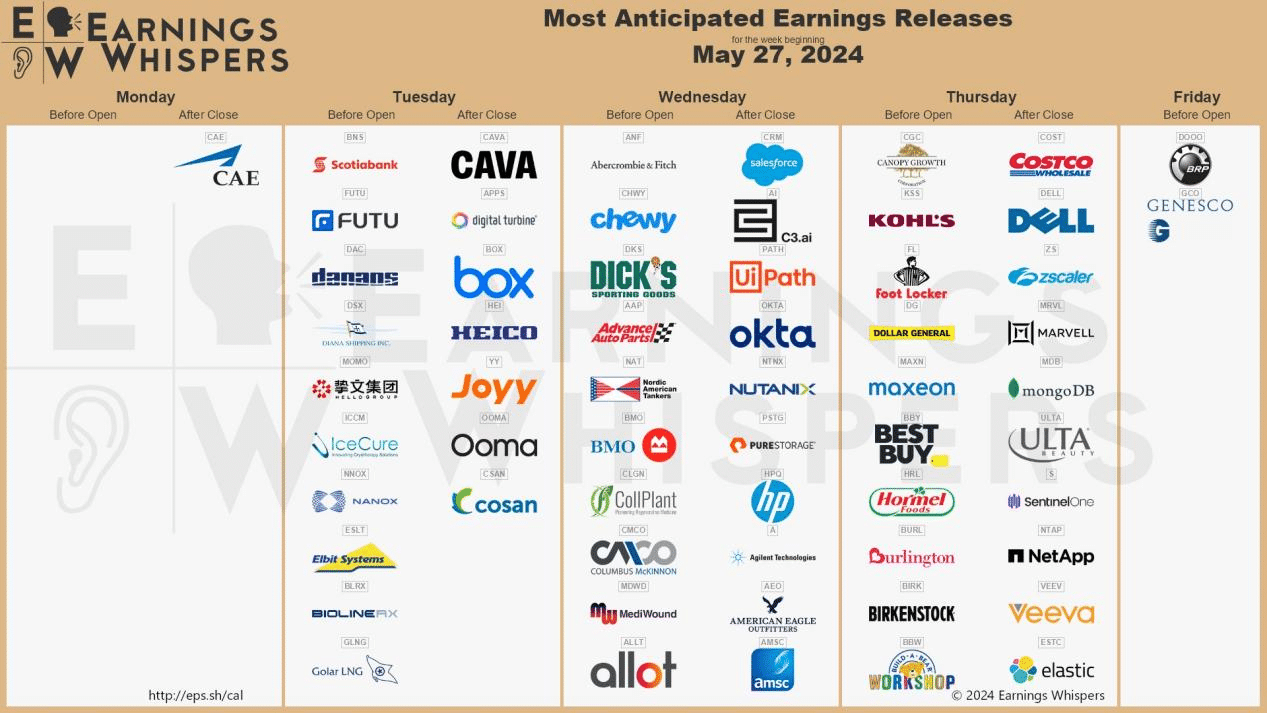

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders, anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports, with several large-cap institutions scheduled to release theirs. Specifically, HP, Dell, Costco, and Dollar General are in focus this week. Traders should expect volatility and potential consolidation in the lead-up to these reports.

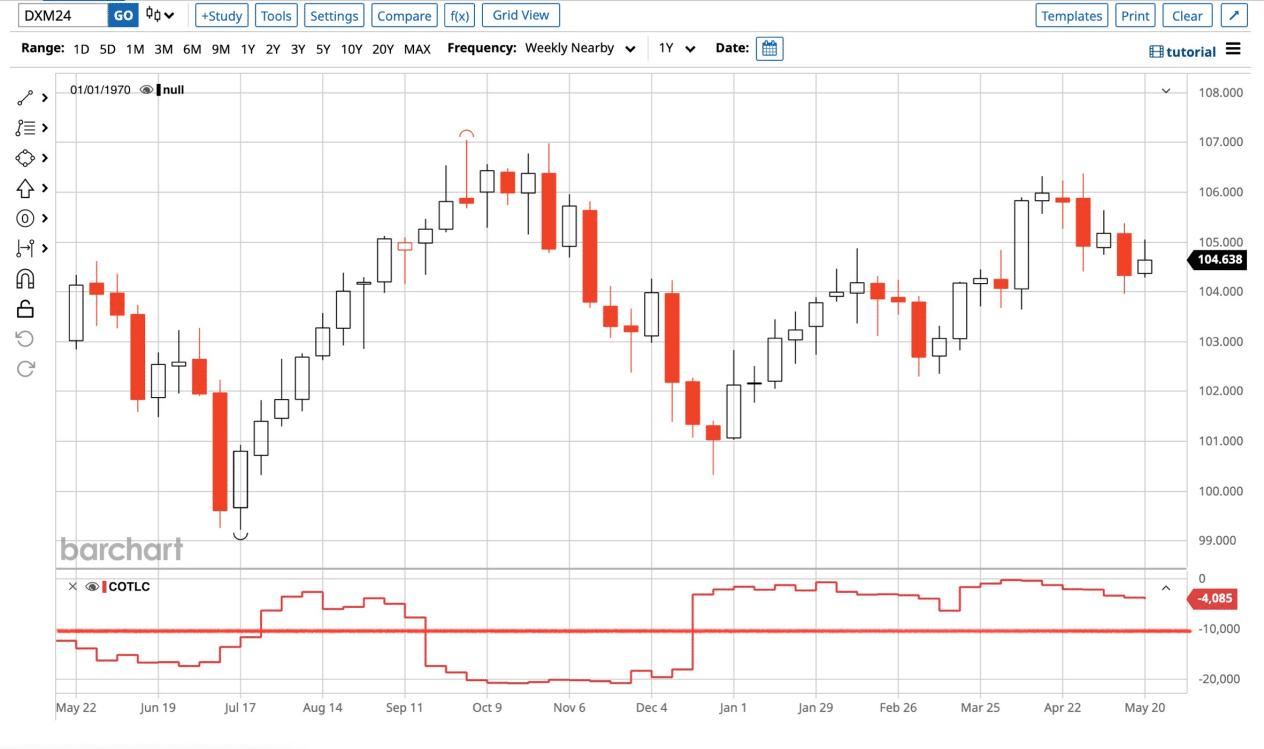

The Cot Report For The US Dollar

The just-concluded week closed with a small range and inside week, finding support at the December 4, 2023 breaker. Seasonal tendencies suggest a bearish month for the US dollar with a recovery in the early months of June. Analysis of the Commitments of Traders (COT) report, focusing on commercials engaged in hedging activities, reveals that commercials maintain a net long position. The data released on Friday reaffirms that commercial entities, including institutions and hedgers, continue to hold more long than short positions in the market, indicating anticipation of higher prices in the longer term.

What does this signify for us as traders? The commercials, whose footprints and actions we track to make informed decisions, still remain net long, clearly indicating their interest in seeing the US dollar bullish long term. Although this is excellent for long-term macro analysis, we will still pay attention to technical analysis and order flow on the lower time frames to further confirm this data and premise. Until we can justify a reason to look for higher prices, the current order flow bearish stance still stands. This also serves as a gentle reminder that discount targets moving forward can constitute a reversal in line with the commercial data.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wiseley

Happy Trading!

Adora Trading Team