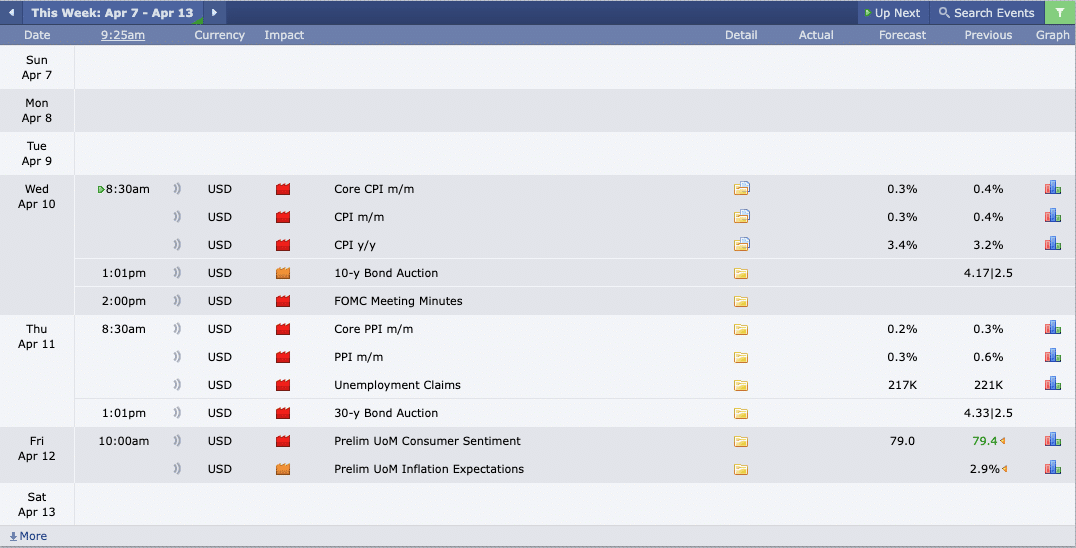

This Week’s Economic Calendar

The recently-concluded week was characterized by continued institutional sponsorship evident since the beginning of March into April, where the US dollar delivered within the context of low resistance liquidity runs and market symmetry, finally returning to symmetrical markets. The indexes, on the other hand, aggressively displaced lower during the week leaving the recent range. Although we will continue to rely on buy models at all-time highs until they prove ineffective, we will also be watching for specific signatures that would constitute a market reversal, while paying attention to order flow and how we trade around certain price delivery arrays in specific contexts.

The new week brings forth important reports, with CPI numbers on Wednesday taking the spotlight, emphasizing the need for meticulous trading and tight risk management.

Please note that this is not financial advice.*

Monday:

This day lacks any significant news drivers, following an expansion on Friday on the US dollar confirmed across all other assets. Coupled with it being a Monday, it’s crucial to exercise patience and manage expectations. The recommendation is to wait for the 9:30 opening and then focus on identifying the most probable higher timeframe draw on liquidity around the 10-11 am silver bullet.

Tuesday:

Highlighted as a day before CPI where we tend to experience high resistance runs and lower probability setups. This is also a day with no news driver. It is important to note that if traders choose to participate on this day ahead of CPI, they should manage expectations accordingly.

Wednesday:

This day brings the anticipation of CPI numbers. Following the news release, we anticipate a surge in market volatility, potentially offering favorable trading opportunities. While we typically avoid trading before high-impact news events, we can assess liquidity and inefficiencies afterward, which present themselves as a draw. Consider focusing on the 10-11 AM Silver Bullet or the PM session after 2 pm for higher probability trades.

Thursday:

With red folder news expected to flood the market throughout the day, starting as early as 8:30 am, traders should anticipate volatility injections that could facilitate smoother trades. Traders are encouraged to prioritize either the 7-8 am Silver bullet, the 10 am Silver bullet, or the PM Session.

Friday:

Red and medium folder news drivers are introduced at 10 AM, coinciding with the Silver Bullet hour. If your weekly profit objectives haven’t been met, redirect your focus to identifying the most probable higher time frame draw on liquidity during the 10 to 11 AM silver bullet window.

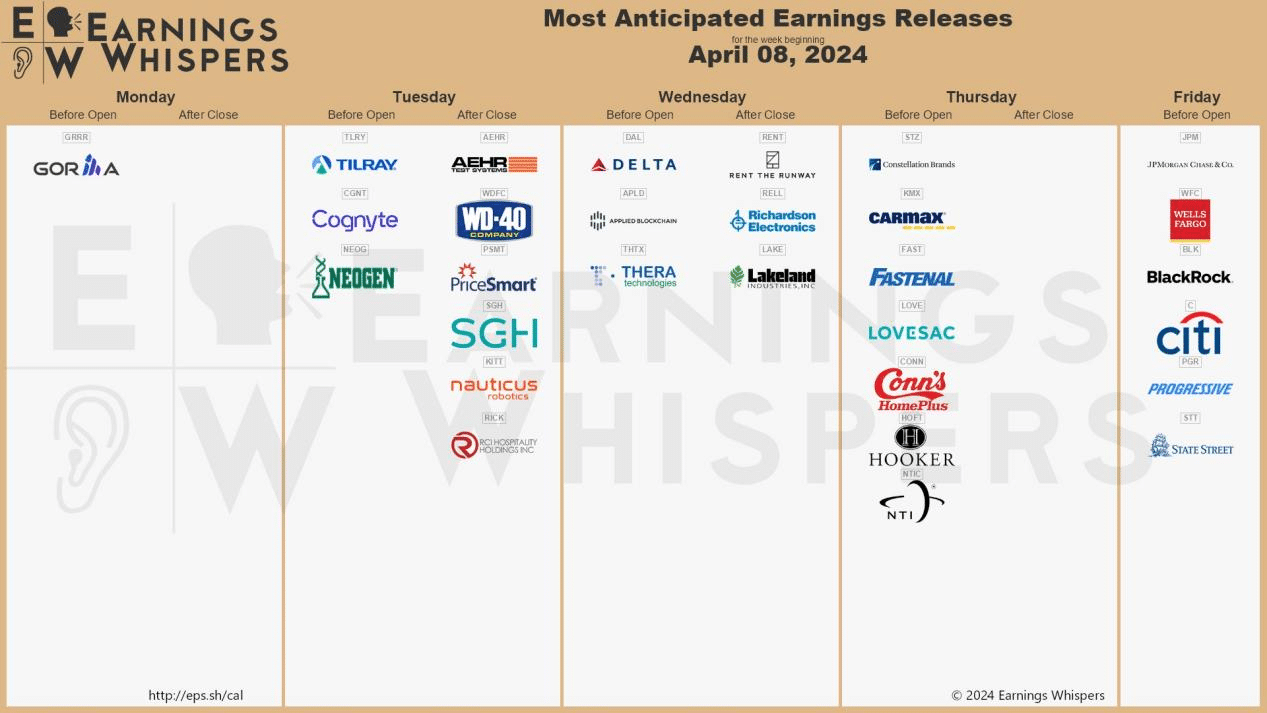

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A gentle reminder to fellow traders, anticipate significant price movements surrounding earnings reports in large-cap companies. This period often presents strategic trading opportunities, capitalizing on heightened volatility for smoother trades.

The upcoming week revolves around earnings reports, with several large-cap institutions scheduled to release theirs. Specifically, Delta, Wells Fargo, BlackRock, and CitiBank are in focus this week, and traders should expect volatility and potential consolidation in the lead-up to these reports.

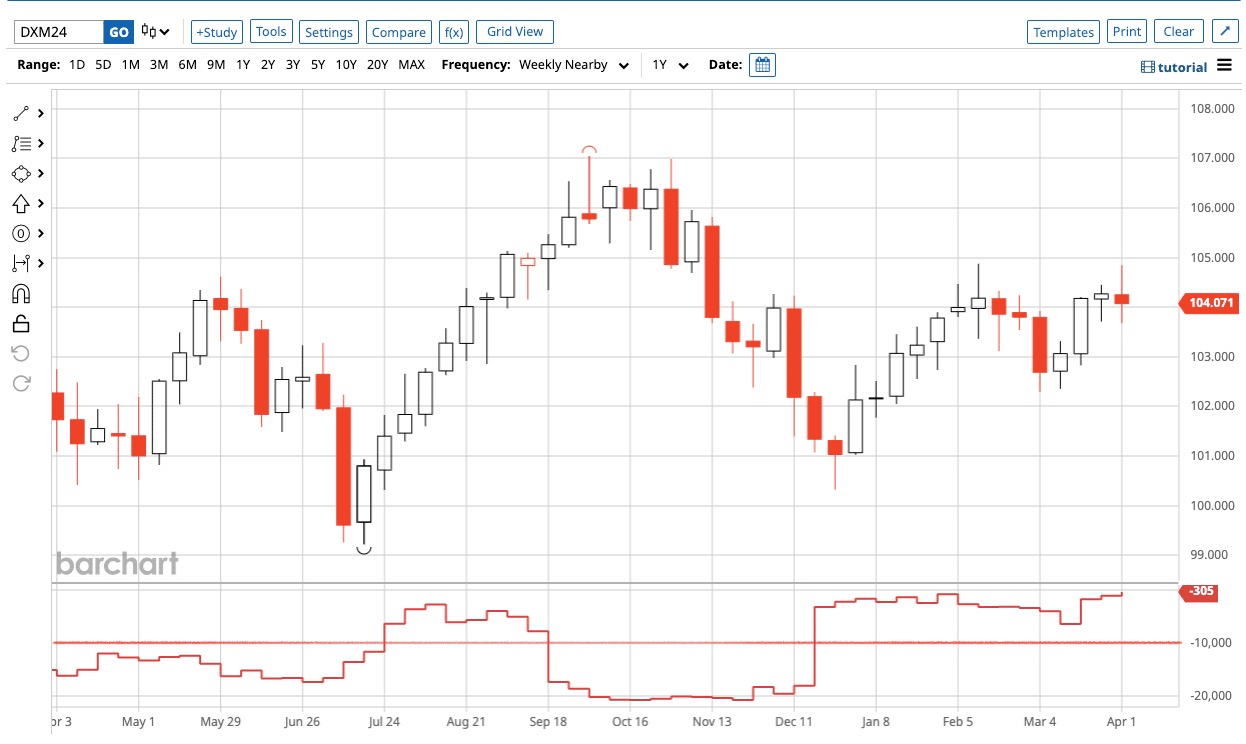

The Cot Report For The US Dollar

The previous week witnessed an expansion on the daily time frame, taking out the external range liquidity, followed by a rejection of the highs into the weekly fair value gap. Analysis of the Commitments of Traders (COT) report, focusing on commercials engaged in hedging activities, reveals that commercials maintain a net long position. The data released on Friday reaffirms once more that commercial entities, including institutions and hedgers, continue to hold more long than short positions in the market, indicating anticipation of higher prices in the longer term.

What does this signify for us as traders? The commercials, whose footprints and actions we track to make informed decisions, still remain net long, with the constant increase in open interest clearly indicating their interest in seeing the US dollar bullish long term. Although this is excellent for long-term macro analysis, we will still pay attention to technical analysis and order flow on the lower time frames to further confirm this particular data and premise. The US dollar will remain bullish until the prevailing price action proves otherwise.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team