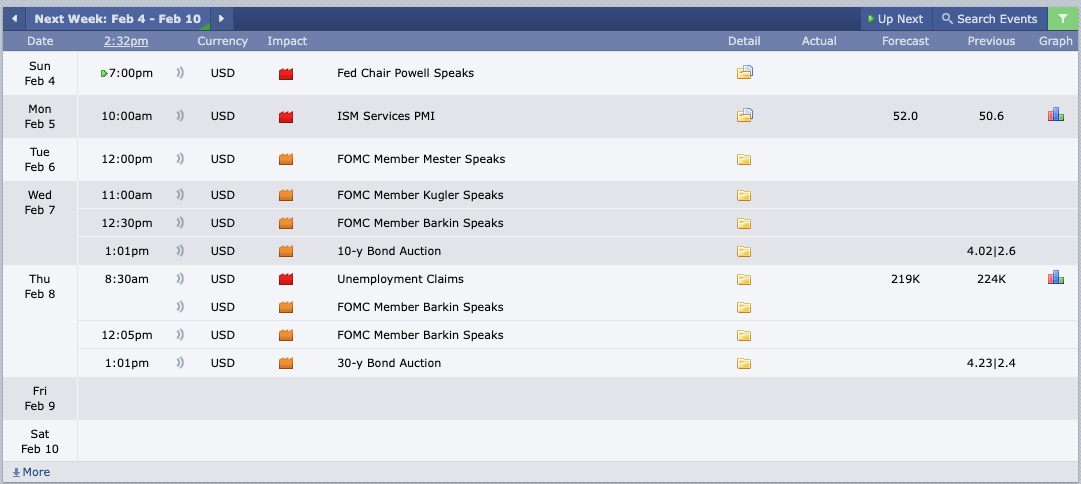

This Week’s Economic Calendar

In the last newsletter, we delved into the consolidation observed in the US dollar and related assets, which provided little to no clarity. The anticipation was set for institutional sponsorship, and this was reflected in the charts with an expansion unfolding across key assets. With the conclusion of January, we are now entering February, and expectations are set for increased market expansion and larger price swings. While this is positive news for traders, the reminder is emphasized to adjust risk management accordingly in response to the changing market conditions.

Please note that this is not financial advice.*

Sunday:

With the FOMC chair speaking, Sunday’s market open is expected to be volatile, with probabilities of a gap. Professional traders are advised to refrain from trading during this period to manage risks effectively.

Monday:

With significant red folder news drivers and considering the larger price run on the indexes and the dollar on the last trading day of the previous week, unlike other Mondays, we expect a volatility injection into the markets, potentially presenting optimal trading opportunities. The recommendation is to wait for the 9:30 opening and then focus on identifying the most probable higher time frame draw on liquidity in the 10 am silver bullet window.

Tuesday:

With an FOMC member speaking at noon and no other significant news drivers before or after, we could expect a relatively calm session. Focus on directing our attention to identifying the higher timeframe direction and expect a continuation in that direction for the 10 am silver bullet and PM Session.

Wednesday:

This day brings multiple medium folder news drivers between 11 AM and 1 PM, injecting volatility into the marketplace. This can present optimal trading opportunities pre-market and in the PM Session after the Fed speaker concludes.

Thursday:

Introduces red folder news drivers at 8:30 AM, and further news later in the day will serve as volatility injections into the markets. Consequently, the day is expected to present optimal trading opportunities. Consider the 10-11 am Silver Bullet or the PM session for higher probability trades.

Friday:

In the absence of significant news drivers on this particular day, traders are encouraged to prioritize either the 7-8 am Silver bullet, the 10 am Silver bullet, or the PM Session.

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: Traders are advised to remain cautious as earnings reports from large-cap companies can trigger significant price movements. This period offers strategic trading opportunities, leveraging heightened volatility for smoother trades.

The spotlight is on the entire week’s earnings reports, featuring several large cap institutions. Anticipate substantial volatility and potential consolidation leading up to these reports. In this particular week, none of the major companies market-moving companies are reporting so this will be less of a factor to consider.

The Cot Report For The US Dollar

Over the past few weeks, a consistent trend has emerged, indicating that commercials maintain a net long position in the markets. Despite facing high resistance, the market has witnessed bullish up-close candles, reflecting underlying strength.

Analysis of the Commitments of Traders (COT) report, with a specific focus on commercials involved in hedging activities, unveils that these entities continue to uphold a net long position. This crucial information implies that institutions and hedgers, constituting commercial entities, currently hold more long positions than short positions in the market.

For traders, the examination of COT reports serves as a valuable tool to understand the positioning of diverse market participants, facilitating informed decisions about prevailing market conditions.

What does this signify for us as traders? Continuous reports of commercials holding a net long position on the dollar are reflected in bullish close candles on the weekly chart. This consistent pattern suggests a potential shift in market structure, solidifying a bullish stance on the charts. The previous week closed on a bullish note, reinforcing this outlook. Moving forward, the focus remains on observing how discount PD arrays support price, we are bullish!

While the commercials maintain a net long position, exercising caution and waiting for confirmation from the market structure before adjusting your bias is advisable. It’s important to observe whether there is a clear displacement away from the consolidation range to validate the continuation of the bullish trend. Monitoring institutional footprints and being patient for a decisive move out of the consolidation can provide more clarity for traders.

Quick announcement! As anticipated, Adora Signals has finally launched. The long wait is over. For all the details, please visit our website. Adora Signals is open now!

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team