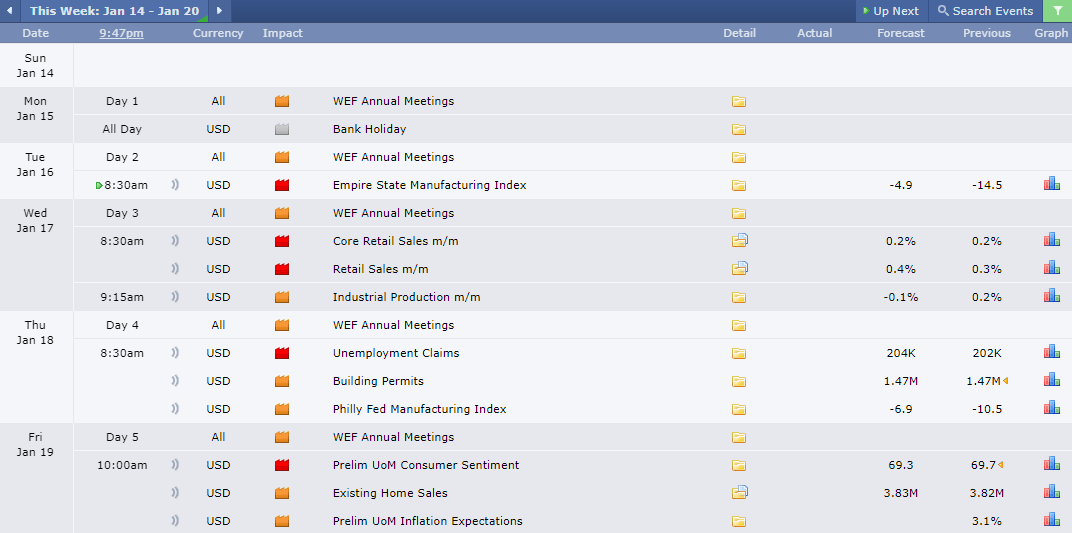

This Week’s Economic Calendar

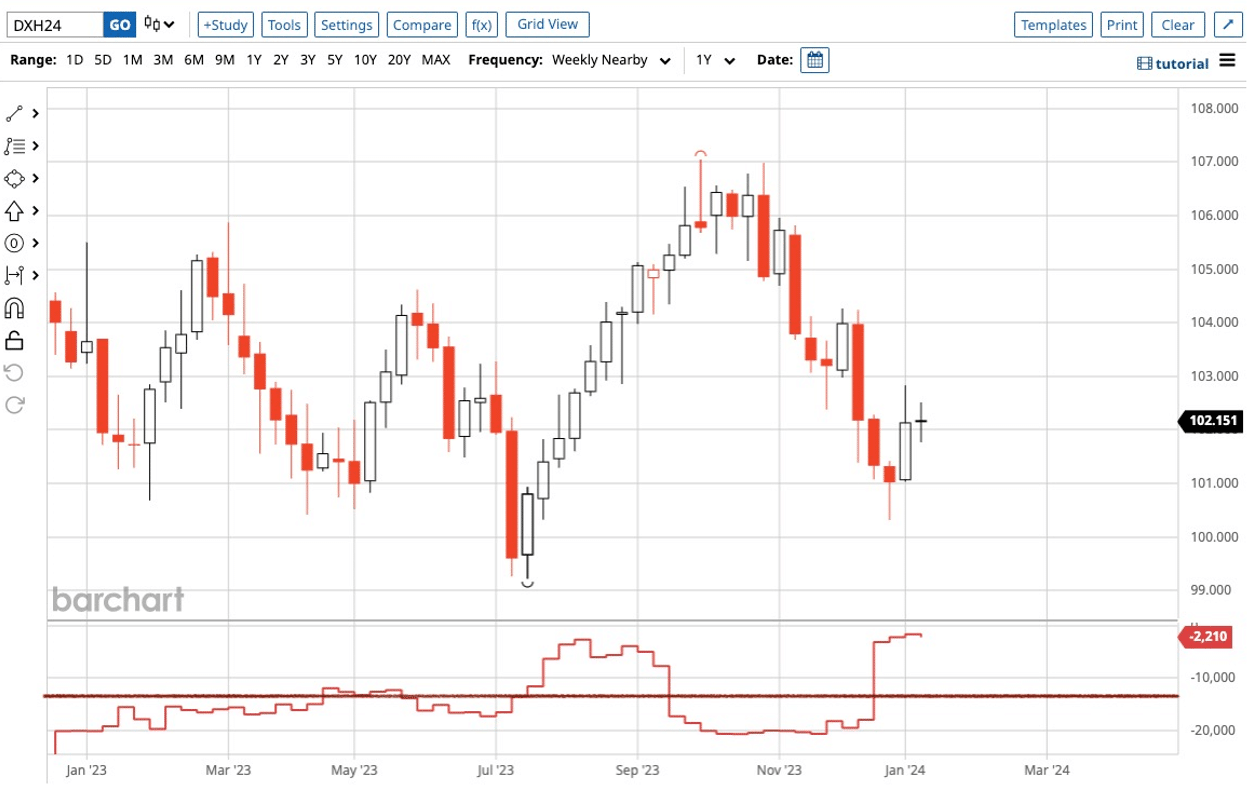

In the Dollar Index, we witnessed sideways price action, characterized as consolidation, throughout

the previous week, primarily attributed to the absence of institutional sponsorship.

As traders, our preference leans towards looking to anticipate one-sided price runs on higher time

frames when considering potential trades. We do not have this clarity at the moment and need to

wait for displacement to confirm new institutional sponsorship. Given the ongoing month of January,

we note that volume is still gradually increasing. Money managers, fund managers, and hedge funds

are exercising caution, refraining from assuming excessive risk early in the year. This cautious

approach is visibly reflected in the price action, which aligns with our anticipation of consolidation

based on our technical analysis as discussed in the previous week’s Youtube livestream. Since we are

trading at the equilibrium of the daily dealing range, we see time and price aligning indicating the

market consolidation profile.

Please note that this is not financial advice.*

Monday:

Bank holiday – Low volatility, avoid trading.

Tuesday:

This day brings red folder news drivers scheduled for 8:30 AM. While there may be a slight volatility

injection at 8:30, navigating the days following a bank holiday can pose challenges. It is advisable to

steer clear of these potentially problematic days unless you’re a scalper who favors low-volatility

conditions. Consider focusing on the afternoon session for a higher probability.

Wednesday:

Multiple news drivers scheduled at 8:30 AM and 9:15 AM, injecting volatility into the markets.

Anticipate optimal trading opportunities throughout the day for both the AM and PM sessions.

Thursday:

This day ushers in medium and red folder news drivers at 8:30 AM, injecting volatility into the

marketplace. Similar to the preceding day, this presents potential opportunities.

Friday:

Introduces red folder news drivers at 10 AM, coinciding with the Silver Bullet hour. If your weekly

profit objectives haven’t been met, redirect your focus to identifying the most probable higher time

frame draw on liquidity during the 10 to 11 AM time window.

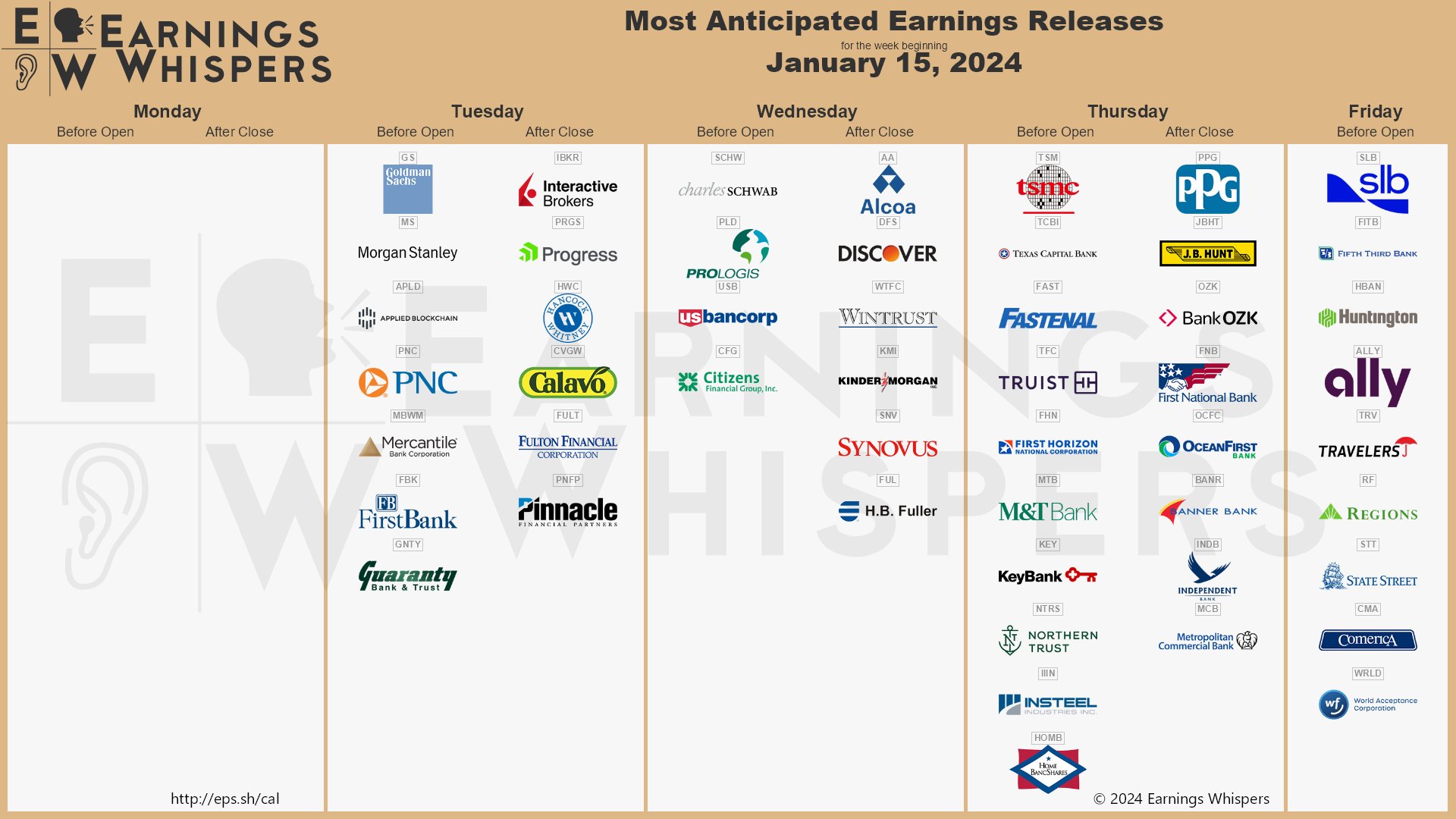

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A Reminder for Traders – Anticipate noteworthy price movements

surrounding earnings reports in large-cap companies. The influx of volatility facilitates smoother

trades with lower resistance. Out of the entire week’s earnings report, Tuesday is in the spotlight with

several large financial institutions taking the stage.

The Cot Report For The US Dollar

The US dollar currently finds itself ensnared in a consolidation phase, positioned at the equilibrium of

the daily dealing range. This week’s release of COTs, with a focus on commercials primarily engaged in

hedging activities, indicates that commercials remain net long. However, a nuanced analysis

incorporating technical aspects presents a contrasting perspective.

What does this signify for us as traders? As traders, the current framework suggests a need for an

expansion from the current range, either upwards or downwards. Although commercials are holding

onto long positions, signaling a potential shift in sentiment, it’s important to note that this change

might take a few weeks to reflect in price delivery. Therefore, exercising caution and waiting for

confirmation from price action before adjusting our bias is advisable. This ensures that any shift in the

big players’ direction is substantiated by observable changes in market behavior and internal

dynamics.

Stay informed for sound decision-making, and always adhere to strict risk management protocols.

Until our next update, trade wisely.

Happy Trading!

Adora Trading Team