This Week’s Economic Calendar

Last week the price action, as a result of the economic calendar, unfolded precisely as anticipated marked by numerous consolidations and high-resistance liquidity runs. As we enter the current week, a notable shift will occur. There will be a decline in volume and open interest from speculators due to seasonality. During the holiday season, large pockets, banks, and smart money are offloading their balance sheets and squaring positions ahead of the new year which is attributed to this decline in volume.

Given that these entities are adopting a more reserved approach, market movements are expected to undergo a significant reduction. Because these entities encompass a significant portion of the volume in the marketplace, the liquidity providers (Smart Money) will have less liquidity to turn over. This translates to smaller price ranges and tighter consolidations. To navigate effectively, it’s crucial to adjust strategies accordingly and maintain nimbleness in response to the evolving market dynamics.

Monday:

No significant news drivers coupled with the seasonality and it being a Monday emphasizes the importance of exercising patience. Wait for the 9:30 opening, then focus on the most probable higher time frame draw on liquidity.

Tuesday:

FOMC Meeting Minutes at 2 pm and medium-tier news at 10 am. FOMC Minutes are less impactful than the main FOMC decisions. Prioritize either the 10 am Silver Bullet or the last hour of trading.

Wednesday:

Multiple news drivers at 8:30 am and 10 am will serve as volatility injections into the markets. As a result, the day will likely present optimal trading opportunities. Consider the 7-8:30 am or 10-11 am Silver Bullet for higher probability.

Thursday:

Bank holiday – No trading.

Friday:

Red folder news drivers at 9:45 am. Days following a bank holiday can be challenging, it’s best to avoid these problematic days unless you are a scalper and prefer low-volatility conditions.

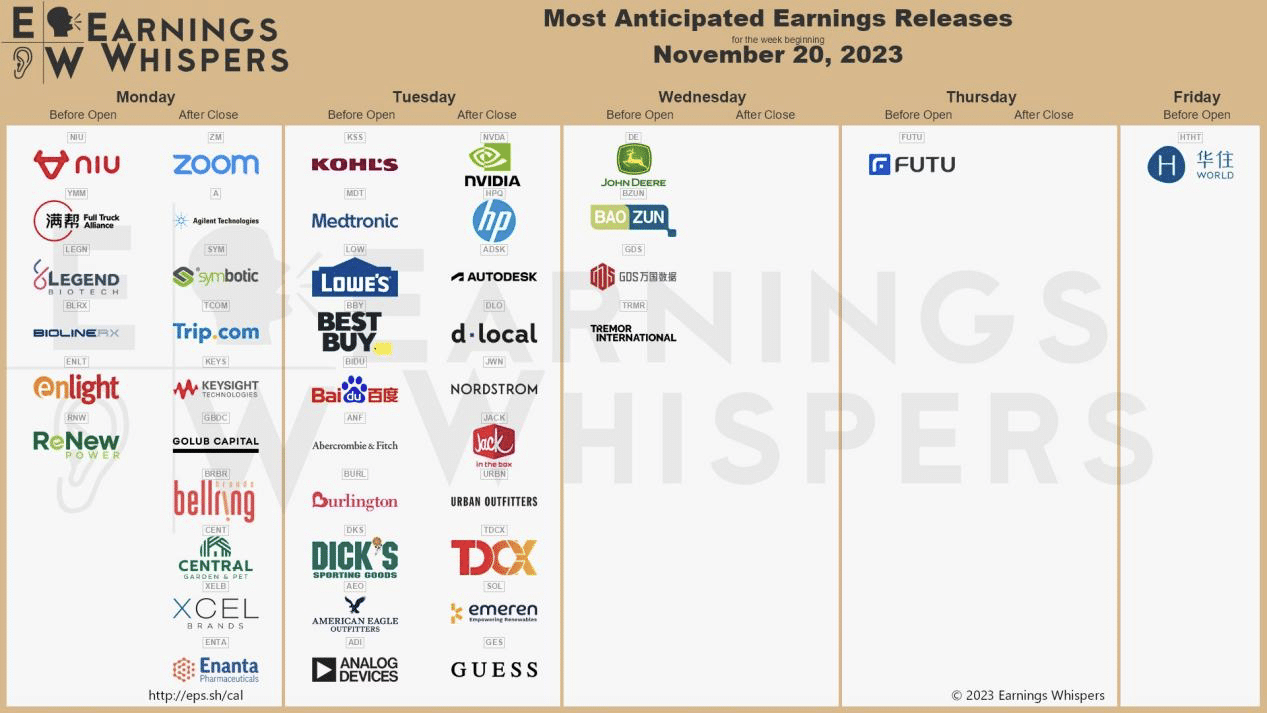

Earnings Spotlight: Major Corporate Reports Unveiling This Week – Key Insights for Investors

Earnings Reports Impact: A Reminder for Traders –

Expect significant price runs around the earnings reports. Potential trading opportunities for strategic positioning. The influx of volatility facilitates smoother trades with lower resistance.

Wrap-up:

Stay informed for sound decision-making, and always adhere to strict risk management protocols. Until our next update, trade wisely.

Happy Trading!

Adora Trading Team